Are you equity-rich but cash-poor? You’re not alone! “Modern-Day Reverse Mortgages: The Senior’s Guide to Leveraging Your Home’s Value” is your go-to resource for transforming your home equity into a powerful tool for financial freedom. This essential guide empowers seniors to unlock the hidden potential of their homes, ensuring a secure and fulfilling retirement. Whether you’re looking to maintain your independence, fund lifelong dreams, or protect your legacy, this book equips you with the knowledge to make informed decisions about your financial future.

Discover how to create a steady income stream from your home without the need to sell or move, and learn innovative ways to use reverse mortgage funds for investments, long-term care, and even travel. With practical insights and actionable strategies, “Modern-Day Reverse Mortgages” is more than just a book—it’s your roadmap to a brighter, more secure future. Don’t let your equity sit idle; unlock it today and take control of your retirement!

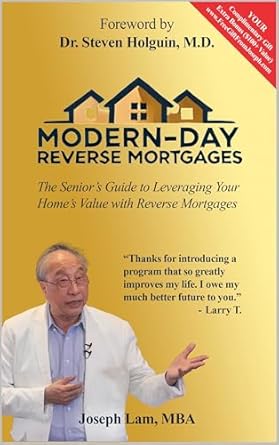

Modern-Day Reverse Mortgages: The Senior’s Guide to Leveraging Your Home’s Value with Reverse Mortgages

Why This Book Stands Out?

- Empowering Knowledge: ‘Modern-Day Reverse Mortgages’ demystifies the complexities of reverse mortgages, giving you the confidence to leverage your home’s equity effectively.

- Financial Freedom: Learn how to transform your home equity into a steady income stream, ensuring you can maintain your lifestyle without the need to sell or move.

- Investment Insights: Discover strategies for investing reverse mortgage funds in annuities, providing you with higher and more predictable returns.

- Legacy Planning: Gain insights on using reverse mortgage funds to create a lasting legacy, support charitable causes, or leave an inheritance for your loved ones.

- Health Security: Understand how to use reverse mortgage proceeds to cover long-term care insurance, safeguarding your health and financial needs in the future.

- Flexible Financial Solutions: Explore how reverse mortgages can serve as a safety net, offering peace of mind and financial flexibility for unexpected needs.

- Future Growth: Learn about the growth rate factor of unused funds, ensuring you have access to more money when you need it later.

- Personalized Enjoyment: Use your reverse mortgage funds to finance travel, hobbies, or other passions, enriching your retirement experience.

- Innovative Housing Solutions: Discover how to utilize funds for adding an ADU (Accessory Dwelling Unit), creating additional income streams or accommodating family needs.

Personal Experience

As I flipped through the pages of Modern-Day Reverse Mortgages, I couldn’t help but reflect on the many conversations I’ve had with friends and family about financial security in retirement. It’s a topic that weighs heavily on the minds of so many, especially those of us who find ourselves equity-rich yet financially strained. This book feels like a warm conversation with a wise friend, offering insights that resonate deeply with the challenges we face.

Throughout my reading journey, I found myself nodding in agreement with the author’s observations. The idea that our homes hold untapped potential is both comforting and empowering. Many of us have poured our hearts into our homes, yet we often overlook their value as a financial asset. This book opened my eyes to the possibilities of transforming that equity into a steady income stream—a concept that felt both revolutionary and practical.

- Imagine the freedom of using reverse mortgage funds to finally take that dream trip you’ve always talked about.

- The thought of establishing a “just-in-case” fund brought me a sense of relief, knowing that unexpected financial needs could be met with confidence.

- Understanding how to protect my heirs and create a legacy resonates on a personal level, as I think about the values I want to pass down.

What struck me most was the flexibility that reverse mortgages can offer. The ability to fund long-term care insurance or even enhance my home with an ADU (Accessory Dwelling Unit) for family or rental income felt like a game-changer. It’s not just about accessing funds; it’s about using them to enrich our lives and those of our loved ones.

For anyone who has ever felt uncertain about their financial future, this book serves as a much-needed guide. It’s not just about the numbers; it’s about the dreams we hold close to our hearts and the legacy we aspire to leave behind. I found a sense of camaraderie in the shared struggles and triumphs of those navigating similar paths. Modern-Day Reverse Mortgages isn’t just a book; it’s a conversation starter, a source of hope, and a practical toolkit for a more secure and fulfilling retirement.

Who Should Read This Book?

Are you a senior homeowner feeling the pinch of financial uncertainty? Perhaps you’re equity-rich but cash-poor, wondering how to leverage your home’s value for a more secure retirement. If so, Modern-Day Reverse Mortgages is the perfect guide for you!

This book is specifically designed for:

- Seniors Planning for Retirement: If you’re looking to maintain your independence and enjoy your golden years without financial worry, this book provides essential strategies to transform your home equity into a steady income stream.

- Homeowners Seeking Financial Freedom: If you want to unlock the hidden treasure of your home, this guide will show you how to tap into your equity and use it wisely to fund your dreams, travel, or hobbies.

- Family Caregivers and Heirs: Understanding reverse mortgages can help you protect your loved ones’ financial future, ensuring a legacy while providing peace of mind for unexpected expenses.

- Individuals Interested in Investment Opportunities: Learn how to invest reverse mortgage funds in annuities for higher, more predictable returns, turning your home into a powerful financial asset.

- Those Considering Long-Term Care Options: If you’re worried about future health needs, discover how to use reverse mortgage proceeds to pay for long-term care insurance and safeguard your financial future.

With its friendly and accessible approach, Modern-Day Reverse Mortgages empowers you to take charge of your financial destiny. It’s not just a book—it’s your roadmap to unlocking the potential of your home and enjoying a secure, fulfilling retirement!

Modern-Day Reverse Mortgages: The Senior’s Guide to Leveraging Your Home’s Value with Reverse Mortgages

Key Takeaways

In ‘Modern-Day Reverse Mortgages,’ readers will gain invaluable insights into how to effectively leverage their home equity for a more secure financial future. Here are the key points that highlight why this book is a must-read:

- Transform home equity into a steady income stream without the need to sell or move.

- Learn how to invest reverse mortgage funds in annuities for higher and more predictable returns.

- Gain insights on using reverse mortgage funds to establish a legacy, support charitable causes, or leave an inheritance.

- Discover strategies to protect your heirs and ensure a lasting legacy through reverse mortgages.

- Utilize reverse mortgage funds to pay for long-term care insurance, securing coverage for future health needs.

- Understand the growth rate factor of your unused funds, giving you access to more money later.

- Create a “just-in-case” fund with reverse mortgages, providing peace of mind for unexpected financial needs.

- Explore how unlocking home equity can serve as a safety net for comfortable living without financial worries.

- Learn about the benefits of using reverse mortgage funds to add an ADU for extended family or rental income.

- Discover how to use reverse mortgage proceeds to fund travel, hobbies, or other personal passions in retirement.

Final Thoughts

In “Modern-Day Reverse Mortgages: The Senior’s Guide to Leveraging Your Home’s Value with Reverse Mortgages,” you will find an invaluable resource designed specifically for homeowners who are looking to enhance their financial well-being in retirement. This book is not just about reverse mortgages; it’s about transforming the way you think about your home and the equity it holds. With the insightful strategies and practical tips provided, you’ll gain the confidence to take control of your financial future and make informed decisions that align with your dreams and aspirations.

Key takeaways from the book include:

- Transforming home equity into a steady income stream.

- Investing in annuities for higher, predictable returns.

- Establishing a legacy or supporting charitable causes with reverse mortgage funds.

- Using reverse mortgages to cover long-term care insurance and unexpected expenses.

- Funding personal passions and hobbies during retirement.

Whether you wish to maintain your independence, support your family, or simply enjoy life without financial stress, this guide offers a roadmap to achieving those goals. Don’t let your home’s equity sit idle—unlock its potential and secure your financial future.

If you’re ready to take the next step towards a more secure retirement, we encourage you to purchase “Modern-Day Reverse Mortgages” today. Embrace the opportunity to transform your life and make the most of your hard-earned equity!