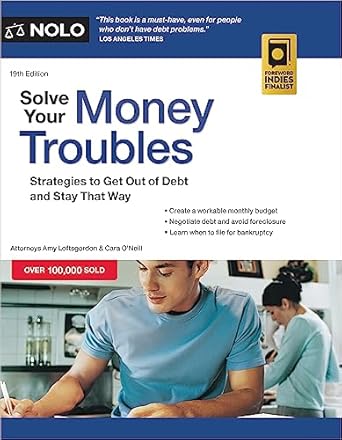

Are you overwhelmed by debt and searching for effective solutions? Look no further than “Solve Your Money Troubles: Strategies to Get Out of Debt and Stay That Way.” This essential guide equips you with the knowledge and tools to regain control of your finances. With practical strategies to stop debt collector harassment, negotiate with creditors, and reduce your student loan payments, you’ll learn how to create a sustainable financial plan tailored to your needs.

Not only does this book tackle everyday financial challenges, but it also provides expert guidance on more complex issues such as stopping wage garnishments, recovering your car after repossession, and preventing foreclosure. With up-to-date legal information and practical resources like sample creditor letters and budgeting worksheets, “Solve Your Money Troubles” is your comprehensive companion for navigating the path to financial freedom.

Solve Your Money Troubles: Strategies to Get Out of Debt and Stay That Way

Why This Book Stands Out?

- Comprehensive Solutions: Offers a wide range of strategies for tackling various debt issues, from negotiation to long-term financial planning.

- Up-to-Date Legal Information: Provides the latest legal insights to empower readers in understanding their rights and options.

- Practical Tools: Includes sample creditor letters and budgeting worksheets that facilitate actionable steps toward financial recovery.

- Focus on Real-Life Scenarios: Addresses significant challenges like wage garnishment, repossession, and foreclosure, equipping readers with the knowledge to navigate tough situations.

- Empowering Guidance: Teaches readers how to confidently stop debt collector harassment and negotiate effectively with creditors.

- Holistic Approach: Combines immediate crisis management with long-term financial strategies, helping readers not only to get out of debt but also to stay debt-free.

Personal Experience

Many readers can relate to the feeling of being overwhelmed by debt, whether it’s from credit cards, student loans, or unexpected medical bills. “Solve Your Money Troubles” offers a lifeline for those grappling with financial stress. As you delve into the pages of this book, you may find echoes of your own struggles and triumphs in its advice and strategies.

Think about a time when a bill arrived in the mail, and your heart raced as you realized you simply couldn’t pay it. Or the anxiety that set in when the phone rang, and you wondered if it was a debt collector on the other end. These scenarios are all too familiar for many, and the insights shared in this book can provide a sense of relief and empowerment.

Here are some relatable experiences that readers may encounter while engaging with “Solve Your Money Troubles”:

- Discovering practical ways to stop harassment from debt collectors, giving you back your peace of mind.

- Learning negotiation techniques that can help lower your debts, allowing you to breathe easier and regain control.

- Finding strategies to manage student loan payments, particularly if you’re feeling overwhelmed by the burden of educational debt.

- Creating a personalized financial plan that reflects your life, goals, and values, making budgeting less daunting.

- Gaining insight into legal protections against wage garnishments and other actions that can leave you financially vulnerable.

- Feeling empowered to take action after reading how to respond to legal notices, transforming fear into proactive steps.

- Considering the option of bankruptcy, and realizing that it might not be the end, but rather a new beginning.

As you navigate through the book, you will likely resonate with its compassionate approach and the clear, actionable advice it offers. Each chapter serves as both a guide and a source of encouragement, reminding you that you’re not alone in your financial journey.

Who Should Read This Book?

“Solve Your Money Troubles” is an essential resource for anyone facing financial challenges. Whether you’re grappling with debt or simply looking to improve your financial literacy, this book offers tailored strategies and practical tools to help you regain control of your finances.

- Individuals in Debt: If you’re struggling with accumulating debt, this book provides actionable steps to negotiate with creditors and reduce your financial burden.

- Students with Loans: Recent graduates or current students can benefit from guidance on managing and reducing student loan payments, making financial planning more achievable.

- People Facing Financial Hardships: Those experiencing wage garnishments, repossessions, or foreclosure can find valuable advice on how to navigate these difficult situations.

- Anyone Interested in Financial Planning: Readers looking to create a sustainable and healthy financial plan will find useful budgeting worksheets and strategies for long-term stability.

- Individuals Considering Bankruptcy: This book offers insights into the bankruptcy process, helping readers make informed decisions about their financial future.

Solve Your Money Troubles: Strategies to Get Out of Debt and Stay That Way

Key Takeaways

Readers of Solve Your Money Troubles: Strategies to Get Out of Debt and Stay That Way can expect to gain valuable insights and practical tools to manage their debt effectively. Here are the most important points:

- Understanding Your Options: Learn about the various strategies available for tackling debt.

- Debt Collector Harassment: Discover methods to stop aggressive debt collection practices.

- Negotiating with Creditors: Gain techniques to negotiate lower debt amounts with creditors.

- Student Loan Management: Find ways to reduce your student loan payments significantly.

- Financial Planning: Create a sustainable financial plan tailored to your lifestyle.

- Dealing with Wage Garnishment: Understand how to prevent wage garnishment from affecting your income.

- Recovering Repossessions: Get guidance on how to recover your car after repossession.

- Foreclosure Prevention: Learn about loss mitigation programs to avoid foreclosure.

- Legal Responses: Know how to respond if you are sued regarding your debts.

- Bankruptcy Considerations: Assess whether filing for bankruptcy is the right choice for your situation.

- Practical Tools: Access sample creditor letters and budgeting worksheets to assist in your financial journey.

Final Thoughts

“Solve Your Money Troubles: Strategies to Get Out of Debt and Stay That Way” is an invaluable resource for anyone struggling with debt. This book equips readers with essential tools and knowledge to take control of their financial situation and build a healthier future. With its practical advice, up-to-date legal information, and helpful resources like sample letters and budgeting worksheets, this guide empowers individuals to navigate the complexities of debt management effectively.

Key benefits include:

- Strategies to stop debt collector harassment.

- Negotiation techniques to lower your debt.

- Ways to manage student loan payments.

- Steps to prevent foreclosure and wage garnishment.

- Guidance on filing for bankruptcy if necessary.

Investing in this book is a step towards financial freedom and peace of mind. Don’t let debt control your life any longer—take charge today! Buy “Solve Your Money Troubles” now!