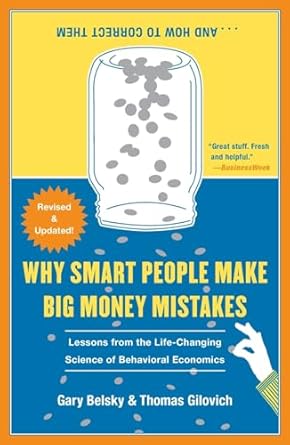

Unlock the secrets to smarter financial decisions with “Why Smart People Make Big Money Mistakes and How to Correct Them.” This essential guide, revised to reflect today’s economic realities, dives deep into the fascinating world of behavioral economics. Authors Gary Belsky and Thomas Gilovich explore the psychological patterns that lead even the most astute individuals to make costly financial blunders.

Discover why investors often cling to losing stocks, why homeowners miss out on potential profits, and how our spending habits can derail financial goals. With practical advice, engaging anecdotes, and fresh insights, this book equips you with the tools to make informed choices and protect your financial future. Transform your approach to money management and ensure you’re not leaving money on the table!

Why Smart People Make Big Money Mistakes and How to Correct Them: Lessons from the Life-Changing Science of Behavioral Economics

Why This Book Stands Out?

- Expert Insights: Authored by Gary Belsky and Thomas Gilovich, leading figures in behavioral economics, offering authoritative perspectives on financial decision-making.

- Behavioral Economics Focus: Delves into the psychological factors influencing financial choices, providing a deeper understanding of why smart individuals often make poor money decisions.

- Practical Guidance: Provides actionable strategies to avoid common financial pitfalls, helping readers to protect and grow their finances effectively.

- Real-World Applications: Addresses everyday financial situations, such as investing, home buying, and credit management, making the content relatable and applicable.

- Updated Content: Revised to reflect current economic realities, ensuring relevance in today’s financial landscape.

- Engaging Anecdotes: Features lively stories and illustrative examples that make complex concepts accessible and memorable.

- Cost-Saving Potential: Equips readers with the knowledge to avoid costly errors, potentially saving thousands of dollars annually.

Personal Experience

Reading “Why Smart People Make Big Money Mistakes and How to Correct Them” can be an enlightening journey into understanding our own financial behaviors. As you delve into the pages of this book, you may find yourself reflecting on your personal experiences with money and the decisions you’ve made over the years. Here are some relatable insights and potential experiences that many readers might resonate with:

- Recognizing Patterns: You might recall times when you sold a stock too early, only to watch it soar later, or perhaps you hesitated to sell a losing investment, hoping it would rebound.

- Home Buying and Selling: The book’s insights on real estate can strike a chord if you’ve ever felt overwhelmed during the buying or selling process, realizing later that you could have negotiated better.

- Credit Card Debt: Many readers will relate to the struggle of managing credit card balances, understanding why it can be so easy to accumulate debt while attempting to save.

- Impulse Spending: Reflecting on moments of impulse purchases, you may find yourself questioning why you bought that expensive gadget or outfit, knowing you didn’t need it.

- Financial Faux Pas: You might recognize past mistakes, such as not taking advantage of employer-matching retirement contributions, feeling the weight of missed opportunities.

As you engage with the text, you’ll likely discover practical advice that resonates with your own financial journey. The anecdotes and real-life examples shared by Belsky and Gilovich are not just theoretical; they mirror situations many of us encounter, making the lessons feel applicable and actionable. This book invites you to not only reflect on your past but also to take proactive steps towards better financial decision-making in the future.

Who Should Read This Book?

This book is ideal for anyone looking to improve their financial decision-making skills and understand the psychological influences behind their money management behaviors. Specifically, it caters to:

- Investors: Those who want to make smarter investment choices and avoid common pitfalls in buying and selling assets.

- Home Buyers and Sellers: Individuals seeking to navigate the real estate market more effectively and maximize their financial outcomes.

- Credit Card Users: Borrowers looking to reduce interest payments and manage credit effectively.

- Savers: Anyone wanting to enhance their saving habits and find strategies to increase their savings.

- Financial Professionals: Advisors and planners aiming to better understand client behaviors and improve their guidance.

By exploring behavioral economics, this book offers valuable insights and practical advice that can help readers recognize and correct their financial mistakes, ultimately leading to better financial outcomes.

Why Smart People Make Big Money Mistakes and How to Correct Them: Lessons from the Life-Changing Science of Behavioral Economics

Key Takeaways

Readers of “Why Smart People Make Big Money Mistakes and How to Correct Them” can expect to gain valuable insights into the psychological factors that influence financial decision-making. Here are the key takeaways from the book:

- Understanding Behavioral Economics: Learn the fundamental principles of behavioral economics that explain why people make irrational financial choices.

- Common Money Mistakes: Identify typical financial pitfalls, such as selling winning stocks too quickly and holding onto losing investments for too long.

- Negotiation Strategies: Discover techniques for getting the best deals in real estate transactions, both as buyers and sellers.

- Smart Borrowing and Saving: Understand how to manage credit card debt effectively and enhance savings strategies to achieve financial stability.

- Spending Control: Gain insights on how to curb impulsive spending and make more deliberate financial choices.

- Practical Guidance: Benefit from actionable advice that can help you avoid costly financial mistakes and improve your financial well-being.

- Real-Life Examples: Engage with illustrative anecdotes that highlight the consequences of common financial errors and the benefits of informed decision-making.

Final Thoughts

“Why Smart People Make Big Money Mistakes and How to Correct Them” is an enlightening exploration into the psychological factors that often lead to poor financial decisions, even among the most astute individuals. Gary Belsky and Thomas Gilovich expertly weave together the principles of behavioral economics with practical advice, making this book not just informative but also actionable.

The key takeaways from the book include:

- Understanding the common cognitive biases that influence financial choices.

- Recognizing the patterns of irrational behavior in investing, spending, and saving.

- Learning strategies to mitigate these biases and make better financial decisions.

- Gaining insights through engaging anecdotes that illustrate the impact of behavioral economics on everyday life.

This book is an invaluable resource for anyone looking to enhance their financial literacy and protect their wealth. Whether you’re a seasoned investor or just starting to take control of your finances, the lessons contained within these pages can help you avoid costly mistakes.

Don’t miss out on the opportunity to transform your financial decision-making. Buy the book today and equip yourself with the knowledge to navigate your financial future with confidence!