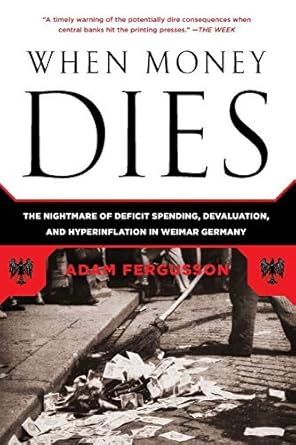

Discover the harrowing tale of economic collapse in “When Money Dies: The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar Germany.” This compelling historical account delves into the devastating effects of hyperinflation in 1923, where the German mark plummeted to an unimaginable exchange rate of 4.2 trillion marks per dollar. As currency lost its value, the nation was plunged into chaos, transforming everyday transactions into desperate exchanges of goods, with people trading luxuries for basic necessities.

More than just a historical narrative, this book serves as a cautionary tale for our times. It draws parallels between past and present monetary policies, including modern practices like quantitative easing. With striking insights into the consequences of reckless fiscal decisions, “When Money Dies” is essential reading for anyone seeking to understand the fragility of economic systems and the potential for societal upheaval when monetary discipline is compromised.

When Money Dies: The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar Germany

Why This Book Stands Out?

- Timely Historical Insight: “When Money Dies” presents a detailed account of the Weimar Republic’s catastrophic hyperinflation, offering a historical perspective that resonates with contemporary economic concerns.

- Powerful Narrative: The book vividly illustrates the personal experiences of individuals during the crisis, transforming abstract economic concepts into relatable human stories of loss and desperation.

- Relevance to Modern Economics: The author draws parallels between past and present economic strategies, such as quantitative easing, highlighting the potential consequences of deficit spending in today’s digital economy.

- Comprehensive Analysis: It delves into the social and political ramifications of monetary collapse, providing a holistic view of how economic policies can lead to societal breakdown.

- Moral and Cautionary Tale: The book serves as a sobering reminder of the dangers of monetary irresponsibility and the fragility of economic systems, urging readers to consider the long-term implications of fiscal decisions.

Personal Experience

Reading “When Money Dies” is not just an academic exercise; it can evoke deep, personal reflections about our relationship with money, stability, and the economy. As you delve into the harrowing experiences of those in Weimar Germany, you may find parallels in your own life, prompting you to consider the fragility of financial security in today’s world. Here are some relatable insights and potential experiences you may have while engaging with this powerful narrative:

- Understanding Financial Anxiety: Many readers can relate to the anxiety that comes with financial instability. The stories of individuals in 1923 who watched their savings evaporate resonate deeply, reminding us of our own fears regarding job loss or unexpected expenses.

- Value of Essentials: The barter economy described in the book highlights a shift in values—where material wealth becomes irrelevant compared to the essentials of life. This can lead readers to reflect on what truly matters in their lives, such as family, health, and community support.

- Lessons on Spending and Saving: The downfall of the German currency serves as a stark warning about the consequences of reckless spending and deficit financing. Readers might reassess their own financial habits and consider the importance of budgeting and saving for the future.

- Awareness of Economic Policies: As the book draws parallels to modern economic practices like quantitative easing, readers may find themselves more engaged in discussions about current financial policies and their potential impacts on personal finances.

- Empathy for Historical Struggles: The personal stories of suffering and resilience in times of hyperinflation can evoke empathy, encouraging readers to appreciate their own circumstances while also fostering a sense of responsibility towards those facing economic hardships today.

Ultimately, “When Money Dies” is more than a historical account; it is a mirror reflecting our own vulnerabilities and the importance of understanding the economic systems that govern our lives. The emotional journey through the pages can inspire readers to take proactive steps in safeguarding their financial well-being.

Who Should Read This Book?

“When Money Dies” is an essential read for a diverse audience, particularly those interested in the intricacies of economic crises and their societal implications. The book is suitable for:

- Economists and Financial Analysts: Gain insights into the historical context of hyperinflation and its effects on economies, providing a framework for analyzing current monetary policies.

- History Enthusiasts: Explore a critical period in German history, understanding how economic mismanagement can lead to social upheaval.

- Students of Political Science: Learn about the intersection of economics and politics, particularly how government decisions impact societal stability.

- Policy Makers and Advisors: Understand the dangers of deficit spending and monetary policy mismanagement, aiding in the formulation of sound fiscal strategies.

- General Readers: Anyone seeking a compelling narrative on the consequences of financial irresponsibility and the fragility of economic systems will find this book enlightening.

This book offers valuable lessons from history that resonate with current economic challenges, making it a critical read for anyone invested in understanding the limits of monetary policy and the potential for crisis.

When Money Dies: The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar Germany

Key Takeaways

When Money Dies offers critical insights into the dire consequences of monetary mismanagement, particularly as seen during the hyperinflation in Weimar Germany. Readers can expect to gain the following key lessons:

- Understanding Hyperinflation: A thorough exploration of how hyperinflation occurs and its devastating impact on a nation’s economy and society.

- Historical Context: Insight into the historical events of 1923 that led to the collapse of the German mark, illustrating the real-life effects of economic policies gone awry.

- Lessons on Currency Management: Valuable lessons on the importance of maintaining monetary discipline and the risks associated with excessive deficit spending and devaluation.

- Modern Parallels: Discussion on contemporary economic practices, such as quantitative easing, and their potential consequences mirrored in past events.

- Social Consequences: An examination of the social unrest and human suffering that can arise from economic instability, emphasizing the human cost of financial crises.

- Moral and Ethical Considerations: A sobering reminder of the ethical responsibilities of policymakers in managing a nation’s economy to avoid repeating historical mistakes.

Final Thoughts

When Money Dies is an eye-opening exploration of the catastrophic effects of hyperinflation as seen in Weimar Germany. The book serves as a powerful reminder of the fragility of currency and the potential consequences of unchecked fiscal policies. Through vivid historical accounts, it offers valuable insights into economic principles that remain relevant today.

- Historical Insight: Understand the real-life impact of hyperinflation on everyday citizens.

- Economic Lessons: Learn about the dangers of deficit spending and the importance of monetary discipline.

- Timely Relevance: Draw parallels between past and present economic policies, including modern quantitative easing.

- Compelling Narrative: Engage with a narrative that combines history with critical economic analysis.

Investing in this book is essential for anyone looking to grasp the intricacies of economic stability and the dire consequences of its absence. Don’t miss out on this opportunity to deepen your understanding of economic history and its implications for the future. Purchase When Money Dies today!