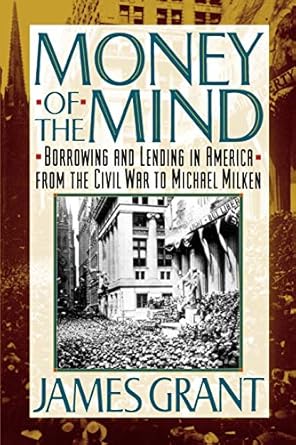

Discover the intricate tapestry of American finance in the 1980s with James Grant’s compelling work, Money of the Mind: How the 1980s Got That Way. This insightful exploration delves into the era’s unprecedented credit expansion, revealing how the convergence of democratized credit and socialized risk led to a debt frenzy that reshaped the financial landscape. Grant’s clear-eyed analysis sheds light on the origins of our contemporary financial habits, making this book essential reading for anyone seeking to understand the roots of today’s economic climate.

With a blend of original scholarship and sharp observations, Grant presents a wickedly entertaining narrative that highlights the consequences of a culture increasingly enamored with debt. Recognized for its unique perspective and engaging style, Money of the Mind invites readers to reflect on the ghoulish humor of our credit lunacy while challenging conventional wisdom. Don’t miss your chance to grasp the lessons of a pivotal decade in finance that continue to resonate today.

Money of the Mind: How the 1980s Got That Way

Why This Book Stands Out?

- In-depth Historical Analysis: James Grant provides a thorough examination of the evolution of American finance leading up to the 1980s, offering readers a deep understanding of the financial landscape.

- Unique Perspective on Debt: The book explores the paradox of democratized credit and socialized risk, revealing how these trends culminated in a speculative frenzy that defined the era.

- Engaging and Entertaining: Grant’s witty and often humorous writing style makes complex financial concepts accessible and enjoyable for a broad audience.

- Original Scholarship: Based on extensive research and firsthand observations, the book presents fresh insights that challenge conventional narratives about the 1980s financial boom.

- Critical Commentary: The author’s iconoclastic analysis invites readers to rethink their understanding of credit and its implications for society, making it a thought-provoking read.

- Accolades from Experts: Endorsed by influential figures like Ron Chernow, the book is recognized for its brilliant storytelling and critical insights into America’s relationship with debt.

Personal Experience

As readers dive into James Grant’s “Money of the Mind: How the 1980s Got That Way,” they may find themselves reflecting on their own encounters with credit and debt. The book’s exploration of the 1980s financial landscape resonates deeply, particularly for those who have navigated the complexities of modern borrowing and lending.

Here are some relatable insights and potential experiences that may emerge while reading:

- Recognizing the Shift in Credit Culture: Readers might recall their own experiences with loans, whether as students, homeowners, or consumers, and how the accessibility of credit has evolved over time.

- Understanding Financial Decisions: The book encourages readers to think critically about their financial choices, prompting reflections on moments when they felt pressured to take on debt, mirroring the societal trends discussed in the 1980s.

- Contemplating Risk and Responsibility: Grant’s analysis of the socialization of risk may resonate with those who have felt the implications of financial decisions made by institutions, leading to a personal sense of responsibility for their own financial health.

- Engaging in Conversations about Money: The provocative nature of the book can spark discussions among friends or family, allowing readers to share their stories and perspectives on debt, credit, and financial stability.

- Finding Humor in Financial Absurdities: Grant’s wickedly entertaining style might lead readers to laugh at the often absurd nature of credit culture, allowing them to find camaraderie in shared experiences of financial folly.

Overall, “Money of the Mind” serves as a mirror reflecting not just the economic history of an era, but also the personal journeys of readers as they navigate their own financial landscapes. It invites introspection and discussion, making it a truly engaging read.

Who Should Read This Book?

This book is ideal for a diverse audience interested in understanding the intricacies of American finance and the socio-economic trends of the 1980s. It offers valuable insights for various groups:

- Economics Students and Professionals: The book provides a detailed analysis of credit practices and financial history, making it a significant resource for those studying economics or finance.

- Historians and Researchers: With its original scholarship and firsthand observations, this book serves as a critical reference for anyone exploring the economic landscape of the late 20th century.

- Policy Makers and Financial Regulators: Understanding the convergence of credit democratization and risk socialization is crucial for those involved in shaping financial policies and regulations.

- General Readers Interested in Finance: For those curious about how credit systems affect everyday life, this book offers an engaging narrative that highlights the broader implications of the financial practices of the 1980s.

- Anyone Seeking Insight into Modern Debt Culture: Readers looking to comprehend the roots of contemporary debt issues will find this book’s analysis relevant and enlightening.

Money of the Mind: How the 1980s Got That Way

Key Takeaways

Readers of “Money of the Mind: How the 1980s Got That Way” can expect to gain valuable insights into the financial landscape of the 1980s and its lasting implications. Here are the key points that highlight the book’s main lessons:

- Understanding Debt Dynamics: Explore how the rush into debt during the 1980s was not an isolated phenomenon but the result of long-term trends in credit practices.

- Democratization of Credit: Learn how access to credit transformed from being a privilege to a widespread norm, making loans accessible to the average American worker.

- Socialization of Risk: Examine the shift in responsibility for creditors’ risks from private lenders to the government, highlighting the potential dangers of such policies.

- Historical Context: Gain insight into how historical events and policies from the Progressive era set the stage for the financial behaviors observed in the 1980s.

- Critical Analysis of Economic Policies: Engage with Grant’s iconoclastic views on the economic policies of the Reagan administration and their implications for American finance.

- Humorous yet Chilling Perspective: Enjoy a unique blend of humor and serious analysis that makes the complex topic of credit and debt both entertaining and thought-provoking.

- Lessons for the Future: Reflect on the consequences of the credit binge and consider the lessons it imparts for contemporary financial practices and policies.

Final Thoughts

James Grant’s “Money of the Mind: How the 1980s Got That Way” offers a compelling exploration of the financial landscape of the 1980s, painting a vivid picture of a period marked by rampant credit expansion and the profound implications it had for American society. Through meticulous research and insightful commentary, Grant reveals how the convergence of democratized credit and socialized risk led to a speculative frenzy that shaped the economic realities we face today.

This book is not just a historical account; it is an essential analysis for anyone looking to understand the roots of contemporary financial behaviors and policies. Grant’s engaging writing style makes complex ideas accessible, ensuring that readers will find themselves both informed and entertained.

- Insightful analysis of the 1980s credit boom.

- Engaging narrative that combines history and humor.

- Essential reading for anyone interested in finance and economics.

- Offers a fresh perspective on debt and risk in modern society.

Don’t miss the chance to delve into this enlightening and entertaining examination of our financial past. If you’re ready to gain a deeper understanding of how our world of credit came to be, purchase “Money of the Mind” today!