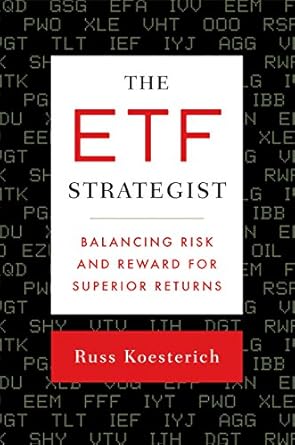

If you’re looking to elevate your investment strategy, The ETF Strategist: Balancing Risk and Reward for Superior Returns is the essential guide you’ve been waiting for. Designed for investment advisers and savvy retail investors, this book dives deep into the world of exchange traded funds (ETFs), revealing how they can provide superior diversification, targeted exposure to specific sectors, and a tailored asset allocation. Unlike other resources that skim the surface, this guide offers advanced insights into leveraging ETFs effectively, ensuring you maximize your investment potential.

What sets The ETF Strategist apart is its focus on sophisticated concepts like alphabeta separation, helping you distinguish between skill and risk in your investment decisions. By understanding how to combine different ETFs, you can create a balanced portfolio that aligns with your financial goals, whether you’re interested in real estate, commodities, or beyond. This book is not just informative; it’s a game-changer for anyone serious about navigating today’s dynamic investment landscape.

The ETF Strategist: Balancing Risk and Reward for Superior Returns

Why This Book Stands Out?

- Advanced Insights: Unlike other ETF guides that focus on basics, this book delves into sophisticated strategies, helping you navigate the complexities of ETF investing.

- Practical Applications: It doesn’t just explain concepts; it shows you how to apply them effectively to enhance your investment strategy.

- Alpha-Beta Separation: Explore the groundbreaking concept of separating skill from risk, which can transform your approach to investing.

- Diverse Portfolio Strategies: Learn how to combine different ETFs to achieve the ideal balance of risk and reward across various asset classes.

- Targeted Advice for Professionals: Tailored specifically for investment advisers and sophisticated retail investors, making it a must-have resource for serious investors.

Personal Experience

As I delved into The ETF Strategist, I found myself reflecting on my own journey through the world of investing. Like many readers, I started with the basics, grappling with the complexities of mutual funds and the overwhelming sea of investment options. I remember the confusion that often clouded my decision-making, particularly when it came to balancing risk and reward. This book spoke to those very struggles, offering a guiding light through the often murky waters of investment strategies.

One of the aspects that resonated deeply with me was the emphasis on understanding the nuances of exchange traded funds (ETFs). The concept of alphabeta separation struck a chord; it reminded me of the times I mistook market volatility for my own investing skills. The clarity with which the authors present this idea helped me recognize that skill in investing is about making informed decisions rather than simply reacting to market fluctuations.

Throughout the book, I found relatable insights that echoed my own experiences:

- Diversifying Risk: I often felt tethered to the performance of a few stocks. Learning how ETFs can provide a broader safety net made me reconsider my approach to risk management.

- Targeting Specific Sectors: There have been moments when I wished I could invest specifically in sectors I was passionate about, like renewable energy. This book opened my eyes to how ETFs could facilitate that dream.

- Avoiding Style Drift: The struggle of staying true to an investment strategy amidst changing market conditions is real. The strategies outlined in the book helped me solidify my asset allocation and stay the course.

- Combining ETFs for Balance: The idea of mixing different ETFs to achieve my desired risk-reward ratio was a revelation. It made investing feel like a personalized journey rather than a one-size-fits-all approach.

Reading The ETF Strategist felt like having a conversation with a knowledgeable friend who genuinely wanted to help me succeed in my investment endeavors. It’s a resource that I believe many will find not just informative, but also personally empowering, as it fosters a deeper understanding of how to navigate the investment landscape with confidence.

Who Should Read This Book?

If you’re navigating the complex world of investments, then The ETF Strategist: Balancing Risk and Reward for Superior Returns is a must-read for you! This book is tailored specifically for:

- Investment Advisers: If you’re a professional helping clients grow their wealth, this book will equip you with advanced strategies to leverage ETFs effectively. You’ll learn how to enhance your clients’ portfolios by balancing risk and reward.

- Sophisticated Retail Investors: For those who have some experience in investing and are looking to deepen their understanding, this guide offers valuable insights that can take your investment strategy to the next level.

- Financial Planners: If you’re involved in crafting comprehensive financial plans, the book’s focus on asset allocation and diversification through ETFs will be invaluable in delivering tailored solutions for your clients.

- Anyone Interested in ETFs: Whether you’re a novice wanting to explore the world of exchange-traded funds or someone who’s already familiar but seeking to optimize your approach, this book has something for you.

What makes this book unique is its focus on advanced concepts like alphabeta separation, which helps you distinguish between skill and risk in investing. It goes beyond the basic mechanics of ETFs and dives into how you can use them strategically to improve your investment outcomes. With practical examples and actionable insights, The ETF Strategist is your guide to mastering the art of ETF investing.

The ETF Strategist: Balancing Risk and Reward for Superior Returns

Key Takeaways

The ETF Strategist offers valuable insights for both investment advisers and retail investors looking to enhance their investment strategies through the effective use of exchange-traded funds (ETFs). Here are the essential lessons and benefits you can expect to gain from this book:

- Advanced Investment Strategies: Learn how to leverage ETFs to create sophisticated investment strategies that go beyond basic knowledge.

- Diversification Benefits: Discover how ETFs can help diversify risk across various sectors and countries, providing a more balanced investment portfolio.

- Precision in Asset Allocation: Understand how to maintain a specific asset allocation, including exposure to real estate or commodities, while avoiding style drift.

- Alpha-Beta Separation: Gain insight into the concept of distinguishing between skill and risk, ensuring that your investment decisions are informed and strategic.

- Combining ETFs Effectively: Explore methods for combining different ETFs to achieve an ideal balance of risk and potential reward tailored to your investment goals.

- Enhanced Understanding of ETFs: Move beyond the basics of ETF mechanics and regulations to grasp their potential in improving overall investment performance.

Final Thoughts

If you’re seeking to deepen your understanding of exchange traded funds and enhance your investment strategy, The ETF Strategist: Balancing Risk and Reward for Superior Returns is an essential read. This book transcends the basics, offering sophisticated insights that cater to both investment advisers and savvy retail investors alike. It demystifies advanced concepts such as alphabeta separation, empowering you to differentiate between skill and risk, and teaches you how to craft a well-balanced portfolio that aligns with your financial goals.

- Learn how to effectively diversify risk with ETFs.

- Understand the nuances of targeting specific sectors or countries.

- Avoid style drift while maintaining your desired asset allocation.

- Explore advanced strategies to optimize your investment returns.

This book is not just for beginners; it’s a treasure trove of knowledge for those looking to refine their investment strategies and achieve superior returns. Don’t miss out on the opportunity to elevate your investment game—purchase your copy of The ETF Strategist today!