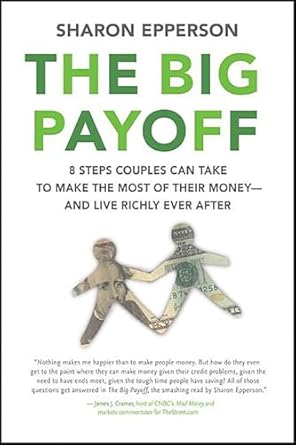

Are you a middle-class couple feeling overwhelmed by financial pressures? Look no further than *The Big Payoff: 8 Steps Couples Can Take to Make the Most of Their Money—and Live Richly Ever After* by Sharon Epperson. This essential guide offers a practical roadmap for couples of all ages, empowering you to take control of your finances and enjoy a secure future together. With relatable anecdotes and actionable advice, Epperson helps you strengthen your financial communication and build a wealth plan tailored to your unique needs.

In just eight easy-to-follow steps, *The Big Payoff* covers everything from budgeting and saving for college to investing in your home and preparing for retirement. This book not only provides valuable insights but also encourages meaningful conversations about money—ensuring that your relationship stays vibrant and healthy while navigating the complexities of financial planning. It’s time to transform your financial worries into a shared journey of growth and success!

The Big Payoff: 8 Steps Couples Can Take to Make the Most of Their Money—and Live Richly Ever After

Why This Book Stands Out?

- Practical Approach: The Big Payoff offers a step-by-step plan that goes beyond typical personal finance advice, making it accessible and actionable for couples at any stage of their financial journey.

- Couples-Centric Communication: Sharon Epperson emphasizes the importance of open dialogue about finances, equipping couples with the tools to foster understanding, compromise, and patience in their discussions.

- Humor and Real-Life Experience: With relatable anecdotes and down-to-earth language, Epperson brings a refreshing perspective that makes financial planning feel less daunting and more engaging.

- Comprehensive Coverage: The book addresses essential topics such as budgeting, investing, insurance, and estate planning, ensuring couples have a well-rounded understanding of their financial landscape.

- Customizable Tools: Readers will find helpful worksheets and exercises designed to tailor a financial plan that suits their unique circumstances, empowering them to take charge of their financial future.

- Timeless Relevance: Whether you’re newlyweds or nearing retirement, this book provides valuable insights that are relevant at any life stage, making it a lasting resource for financial wellness.

Personal Experience

As I delved into The Big Payoff, I found myself reflecting on my own journey with finances alongside my partner. Like many couples, we often found ourselves tangled in the complexities of budgeting, saving, and planning for the future. It’s easy to get caught up in the daily grind, focusing on immediate expenses while the bigger picture looms in the background. This book felt like a breath of fresh air, giving us not just a roadmap, but also the encouragement we needed to tackle our financial life together.

One of the most relatable aspects of the book was the emphasis on communication. I could almost hear the echo of our own conversations about money—those moments of hesitation and uncertainty. Sharon Epperson’s approach reminded me that just as we navigate our relationship with understanding and patience, we must also apply those same qualities to our financial discussions. It was a revelation to realize that we could transform our financial talks from potential conflict zones into opportunities for collaboration and growth.

- Realizing the importance of teamwork: Each chapter challenged us to work together, reinforcing the idea that financial planning isn’t a solo journey.

- Finding humor in finance: Epperson’s anecdotes about her own experiences made us laugh and feel less alone in our struggles, reminding us that we are all navigating similar waters.

- Creating a customized plan: The worksheets and exercises prompted us to lay bare our financial goals, which sparked some deep conversations about our dreams for the future.

- Feeling empowered: The practical steps outlined in the book made financial wellness feel attainable, encouraging us to take control rather than feeling overwhelmed.

As we flipped through the pages, it became clearer that the journey to financial health is not just about numbers; it’s about building a life together that reflects our shared values and aspirations. The insights from The Big Payoff resonated deeply with us, igniting a renewed sense of purpose in our partnership. I believe that whether you’re navigating the early years of marriage or approaching retirement, this book offers something invaluable for every couple on their financial journey.

Who Should Read This Book?

If you’re part of a couple navigating the complexities of finances, then The Big Payoff is tailor-made for you! Whether you’re newlyweds just starting your journey together, parents juggling education expenses, or even empty-nesters looking to secure your financial future, this book offers invaluable insights that can transform how you manage money as a team.

Here’s why this book is perfect for you:

- Newlyweds: Learn how to start your financial life on the right foot, setting goals together that align with your dreams.

- Young Families: Discover practical strategies for budgeting, saving for your children’s education, and planning for life’s unexpected turns.

- Middle-Aged Couples: Find out how to balance raising kids, paying off a mortgage, and preparing for retirement—all while keeping your relationship strong.

- Empty Nesters: Explore how to maximize savings and investments now that your financial priorities are shifting.

What sets The Big Payoff apart is its emphasis on communication and collaboration. Sharon Epperson understands that financial discussions can be tense, and she equips you with the tools to tackle money matters with understanding and patience. With relatable anecdotes and practical exercises, this book not only guides you through financial planning but also strengthens your partnership.

So, if you’re ready to take control of your finances and bring peace of mind to your marriage, grab a copy of The Big Payoff and start your journey towards financial wellness together!

The Big Payoff: 8 Steps Couples Can Take to Make the Most of Their Money—and Live Richly Ever After

Key Takeaways

In “The Big Payoff,” Sharon Epperson provides invaluable insights for couples looking to take charge of their finances and strengthen their relationship. Here are the key points that make this book a must-read:

- Effective Communication: Learn how to discuss money matters openly and honestly, fostering understanding and compromise between partners.

- Actionable Financial Plan: Follow an eight-step program that simplifies financial planning, making it accessible and manageable for couples of all ages.

- Customizable Worksheets: Utilize practical worksheets and exercises to create a personalized financial plan tailored to your unique situation.

- Comprehensive Coverage: Discover strategies for budgeting, saving for emergencies, retirement, and college, as well as investing in a home and choosing the right insurance.

- Real-Life Anecdotes: Benefit from Epperson’s humorous stories and relatable experiences that illustrate common financial pitfalls and solutions.

- Empowerment: Gain the confidence to take control of your finances, allowing you to focus on what truly matters in life—your marriage and family.

- Timeless Guidance: Whether you’re newlyweds or nearing retirement, the principles in this book are relevant for every stage of financial planning.

Final Thoughts

If you’re part of a couple navigating the financial landscape, “The Big Payoff: 8 Steps Couples Can Take to Make the Most of Their Money—and Live Richly Ever After” by Sharon Epperson is an invaluable resource tailored just for you. This insightful guide not only addresses the common financial struggles faced by middle-class couples but also offers a practical, step-by-step approach to achieving financial wellness together.

Through engaging anecdotes and relatable advice, Epperson emphasizes the importance of communication and teamwork in managing finances. Here are some of the key benefits you’ll discover in this book:

- Effective strategies for budgeting and saving money.

- Guidance on creating emergency, retirement, and college savings plans.

- Tips for investing wisely in your home and choosing the right insurance.

- Tools to foster meaningful discussions about money with your partner.

- Customizable worksheets and exercises to tailor a plan that fits your unique situation.

Whether you’re newlyweds, starting a family, or approaching retirement, “The Big Payoff” equips you with the knowledge and confidence to take control of your financial future, ensuring you can focus on what truly matters—enjoying your life together. Don’t miss the opportunity to transform your financial journey.

Ready to embark on a path to financial empowerment? Purchase your copy of The Big Payoff today and start building the future you deserve!