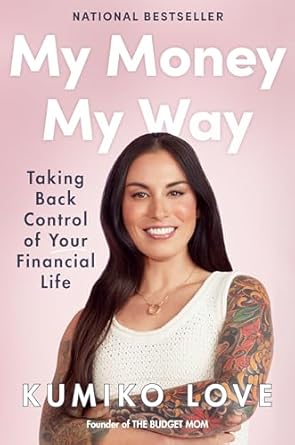

Unlock the secrets to financial freedom with “My Money My Way: Taking Back Control of Your Financial Life” by Kumiko Love, a standout title on Barnes and Noble’s 2022 List of “Best Books that Help!” If financial anxiety is holding you back from achieving your dreams, this empowering guide is your solution. Love, a single mom who transformed her life from $77,000 in debt to living in her dream home debt-free, shares her step-by-step plan to reclaim control over your financial destiny.

In this enlightening book, you’ll discover how to harness your emotions to your financial advantage, create a realistic budget that aligns with your values, and develop an exciting debt pay-off plan. With relatable stories and practical tools, “My Money My Way” equips you to merge emotional and financial health, allowing you to let go of shame and embrace a fulfilling financial future. It’s time to stop worrying about money and start living the life you deserve!

My Money My Way: Taking Back Control of Your Financial Life

Why This Book Stands Out?

- Transformative Personal Journey: Kumiko Love shares her compelling story of overcoming financial despair, making her teachings relatable and inspiring for readers facing similar struggles.

- Emotional & Financial Alignment: The book emphasizes the connection between emotional health and financial well-being, offering a holistic approach to managing money.

- Step-by-Step Framework: Readers receive a clear, actionable plan that can be customized to their individual circumstances, regardless of income or debt level.

- Empowerment Through Self-Discovery: Love encourages readers to confront self-doubt and societal expectations, positioning them as the solution to their financial challenges.

- Practical Tools & Techniques: The book provides foundational practices, including budgeting based on real life and creating motivating debt pay-off plans that foster excitement for the future.

- Community Impact: As the founder of The Budget Mom, Love’s teachings have already empowered millions, showcasing the book’s potential for wider societal benefit.

- Recognized Excellence: Featured on Barnes and Nobles’ 2022 List of “Best Books that Help,” highlighting its credibility and value in the self-help genre.

Personal Experience

Kumiko Love’s journey in “My Money My Way” offers relatable insights that many readers may find resonate with their own experiences. Whether you are navigating financial difficulties, feeling overwhelmed by debt, or simply seeking a more fulfilling relationship with money, her story serves as a powerful reminder that change is possible. Here are some potential experiences and reflections that may arise as you delve into the book:

- Confronting Financial Anxiety: Many readers may relate to the fear and insecurity that comes with checking bank accounts or dealing with bills. Love’s candid discussions about her own struggles offer a comforting acknowledgment that you are not alone.

- Reframing Self-Doubt: If you’ve ever felt ashamed of your financial situation, Love’s epiphany about self-doubt and societal expectations can be eye-opening. Her perspective encourages readers to shift focus from shame to empowerment.

- Embracing Emotional Health: The connection between emotional well-being and financial stability is a central theme in the book. Readers may find themselves reflecting on their own emotional triggers related to spending and budgeting.

- Creating Personalized Budgets: Love emphasizes the importance of crafting a budget that aligns with your life and values. This can inspire readers to rethink traditional budgeting methods and develop a plan that feels authentic and achievable.

- Finding Motivation in Debt Repayment: The idea of turning a daunting debt pay-off plan into a motivating journey can resonate deeply. Readers may feel a renewed sense of hope and excitement about their financial futures.

- Sharing Personal Stories: As Love shares her experiences with divorce, financial hardship, and eventual triumph, readers may be encouraged to reflect on their own stories and how they can leverage them for growth.

Ultimately, “My Money My Way” invites readers to embark on a transformative journey toward financial empowerment. By aligning your emotional health with your financial goals, you can begin to reshape your relationship with money and cultivate a life filled with purpose and fulfillment.

Who Should Read This Book?

This book is ideal for anyone struggling with financial anxiety or seeking to take control of their financial life. If you resonate with feelings of self-doubt, shame, or guilt regarding your finances, Kumiko Love’s insights and practical strategies can help you shift your mindset and improve your situation.

- Single Parents: Especially single mothers who may feel overwhelmed by financial responsibilities and societal expectations.

- Individuals Facing Debt: Anyone dealing with the stress of debt will find actionable steps to create a sustainable debt pay-off plan.

- People Seeking Financial Independence: Those looking to break free from financial stress and align their emotional health with their financial well-being.

- Budgeting Beginners: Readers new to budgeting will appreciate the straightforward, relatable approach to creating a personalized budget.

- Individuals Experiencing Major Life Changes: Anyone navigating divorce, job loss, or other significant life transitions will benefit from the author’s relatable experiences and insights.

This book not only addresses the practical aspects of managing finances but also emphasizes the emotional journey, making it a valuable resource for those ready to transform their relationship with money.

My Money My Way: Taking Back Control of Your Financial Life

Key Takeaways

Readers of My Money My Way: Taking Back Control of Your Financial Life can expect to gain invaluable insights and practical tools to transform their relationship with money. Here are the key takeaways from the book:

- Overcome Financial Anxiety: Learn how to address and manage the emotions of fear, shame, and guilt that can hinder financial decision-making.

- Empower Yourself: Understand that self-doubt is a major barrier and that you hold the key to your financial success.

- Real-Life Budgeting: Create a budget that reflects your actual needs and lifestyle, moving away from unrealistic self-denial.

- Motivating Debt Pay-Off Plans: Develop a personalized debt repayment strategy that inspires and excites you about your financial future.

- Align Emotions with Finances: Discover how to leverage your emotions positively to support your financial goals.

- Honor Your Values: Learn to respect and incorporate your unique personal values, driving emotions, and individual needs into your financial planning.

- Transformative Stories: Gain insights from Kumiko Love’s experiences and those of her clients facing life’s challenges, from divorce to economic setbacks.

- Financial Fulfillment: Shift from a mindset of deprivation to one of abundance, enabling you to live a financially fulfilled life.

Final Thoughts

“My Money My Way: Taking Back Control of Your Financial Life” by Kumiko Love is a transformative guide that empowers readers to overcome financial anxiety and reclaim their financial futures. With personal anecdotes and actionable strategies, Love illustrates how emotional well-being is intricately linked to financial success.

This book is invaluable for anyone who has felt overwhelmed by money management or burdened by debt, offering a refreshing perspective that emphasizes self-worth and personal values. Here are some key takeaways:

- Learn to harness your emotions to make informed financial decisions.

- Create a realistic budget that aligns with your lifestyle and aspirations.

- Develop an exciting debt pay-off plan that motivates rather than intimidates.

- Shift your mindset from shame and guilt to empowerment and fulfillment.

By prioritizing emotional health alongside financial health, Kumiko Love provides readers with the tools to break free from the cycle of financial stress. Don’t miss the chance to transform your relationship with money and start living a financially fulfilling life. Purchase your copy of My Money My Way today and take the first step towards a brighter financial future!