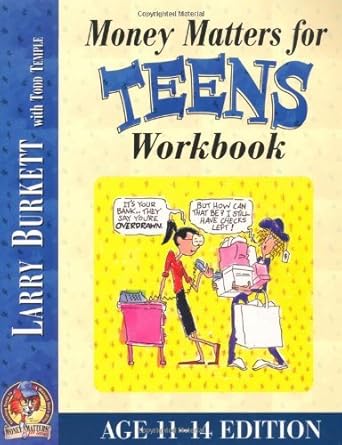

Introducing the Money Matters Workbook for Teens, specifically designed for ages 11-14, this engaging guide empowers young adults to take charge of their finances! Did you know the average American teenager spends around $3,000 a year? That’s a staggering $21,000 by the time they graduate high school! This workbook provides essential skills to help teens understand where their money goes, so they can make informed decisions, avoid being misled by ads, and learn to save for future goals like a car or college.

Created by financial experts Larry Burkett and Todd Temple, the Money Matters Workbook equips teens with practical tools to manage their finances effectively. By learning to budget, save, and spend wisely, they’ll not only enjoy their money now but also set themselves up for a successful financial future. Give your teen the gift of financial literacy, and watch them thrive as they begin their journey toward smart money management!

Money Matters Workbook for Teens (ages 11-14)

Why This Book Stands Out?

- Engaging Content: Tailored specifically for teens aged 11-14, this workbook speaks their language, making financial literacy relatable and fun.

- Practical Skills: It teaches critical money management skills that empower teens to make informed spending decisions and avoid common pitfalls.

- Real-Life Scenarios: With relatable examples, readers can easily see the impact of their choices, helping them understand the value of money.

- Goal-Oriented: The workbook encourages saving for personal goals like a car or college, fostering a sense of responsibility and future planning.

- Expert Guidance: Authored by financial experts Larry Burkett and Todd Temple, it combines trustworthy advice with practical exercises for hands-on learning.

- Empowerment: This book equips teens with the confidence to navigate financial decisions, ensuring they can avoid debt and make their money work for them.

Personal Experience

You know, when I was a teenager, I often felt like managing money was a distant concern—something that would come later in life. I remember the thrill of getting my first job and the rush of having my own income. It felt so liberating, but I quickly realized how unprepared I was to handle it. I spent money on impulse buys, trendy clothes, and outings with friends, often without thinking about the bigger picture. That’s why discovering the Money Matters Workbook for Teens was such a game changer for me.

This workbook opened my eyes to the reality of my spending habits. It made me reflect on how much I was actually spending each year—about $3,000! Can you believe that? By the end of high school, I would have blown through a whopping $21,000. The thought of that was staggering, and it made me realize that I needed to take control of my finances.

Here are a few insights and experiences that resonated with me while going through the workbook:

- Understanding Value: The workbook helped me learn how to pay fair prices for quality items. I started to question whether I really needed that trendy shirt or if I could find a better deal elsewhere.

- Avoiding Pitfalls: I became more aware of misleading ads and the tactics salespeople use. It was empowering to know when I was being ripped off and how to stand my ground.

- Debt Awareness: Learning to stay out of debt was a huge takeaway. I began to understand the importance of saving and budgeting, which I had never considered before.

- Future Goals: As I thought about my dreams of owning a car or saving for college, the workbook provided practical steps to help me reach those goals. It felt like having a roadmap for my financial future.

- Giving Back: The workbook also inspired me to think about how I could give money that makes a difference. It was refreshing to realize that even as a teenager, I could contribute to causes I cared about.

- Fun with Friends: I learned to set aside money for fun activities with friends, balancing enjoyment with responsibility. It made outings even more enjoyable when I knew I could afford them without guilt.

Overall, this workbook not only educated me but also motivated me to take charge of my finances at a young age. It’s like having a trusted mentor guiding me through the maze of money management, and I can’t help but wish I had found it sooner. If you’re like me and want to make the most of your money, this is definitely a resource worth exploring.

Who Should Read This Book?

If you’re a teenager aged 11-14 or know someone who is, this workbook is made just for you! Have you ever wondered where all your allowance or birthday money goes? Do you want to make smarter choices with your cash? If so, this book is perfect for you! Here’s why:

- Curious Teens: If you’re eager to learn about managing money but don’t know where to start, this workbook provides easy-to-understand guidance.

- Budgeting Beginners: For those who want to get a grip on their spending habits, this book teaches you how to create a budget and stick to it.

- Future Savers: If you dream of buying your first car, saving for college, or even starting your own business, this book will help you set those goals and achieve them!

- Smart Shoppers: Want to avoid being tricked by advertisements or salespeople? This workbook gives you the tools to recognize value and make informed purchases.

- Generous Givers: If you’re interested in making a difference in your community or the world, this book shows you how to allocate funds for charitable giving.

With insights from Larry Burkett and Todd Temple, you’ll gain valuable skills that not only help you now but also lay the groundwork for a successful financial future. Start taking control of your money today!

Money Matters Workbook for Teens (ages 11-14)

Key Takeaways

The “Money Matters Workbook for Teens” is an essential guide for young individuals looking to take charge of their finances. Here are the most important insights and benefits you can expect from this book:

- Understanding Spending Habits: Learn how the average teenager spends $3,000 a year and why it’s crucial to be aware of where your money goes.

- Smart Shopping Skills: Acquire techniques to pay fair prices for quality items and avoid being misled by deceptive advertisements.

- Debt Awareness: Gain knowledge on how to stay out of debt and make informed financial decisions.

- Saving for the Future: Discover effective strategies to save for big goals like a car, college, or starting your own business.

- Making a Difference: Learn the importance of giving back and how to use your money to create a positive impact in the world.

- Enjoying Life with Friends: Find out how to have fun and enjoy activities with friends without overspending.

- Building Financial Confidence: Empower yourself with skills that will not only benefit you now but also set you up for a successful financial future.

Final Thoughts

The “Money Matters Workbook for Teens” is an essential guide for young individuals aged 11-14 who are beginning to navigate the often confusing world of personal finance. Authored by financial experts Larry Burkett and Todd Temple, this workbook makes a compelling case for why mastering money management is crucial, even for teenagers who may feel they don’t have much to manage. With the average American teenager spending around $3,000 annually, understanding where that money goes can significantly impact their financial future.

This workbook empowers teens to:

- Pay fair prices for quality items

- Avoid being misled by advertisements and sales tactics

- Stay out of debt

- Save for important goals like college or a first car

- Make a difference by giving back

- Enjoy fun activities with friends without financial stress

By engaging with this material, readers will not only learn valuable skills to manage their current finances but also lay a strong foundation for a successful financial future. Imagine the confidence and control they can gain by making informed spending choices from an early age!

If you’re ready to empower yourself or a teen in your life with the financial knowledge that will pay dividends for years to come, don’t hesitate to add this invaluable resource to your collection. Purchase the “Money Matters Workbook for Teens” today!