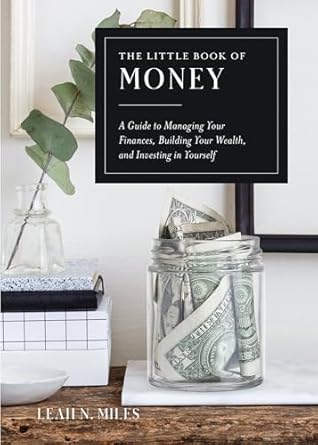

Transform your financial future with The Little Book of Money: A Guide to Managing Your Finances, Building Your Wealth, & Investing in Yourself. This compact, beautifully illustrated guide is designed to take the stress out of managing your finances, offering practical tips and creative strategies to help you achieve financial prosperity. Whether you’re a recent graduate or someone looking to improve your wealth, this book covers everything from the basics of banking to savvy investing in stocks, bonds, and mutual funds.

Discover inventive techniques like the mason jar challenge to enhance your financial health and develop effective habits that free you from money-related stress. With simple, actionable advice, The Little Book of Money empowers you to declutter your finances, maximize your income, and invest in yourself, paving the way for a more fruitful and prosperous life.

The Little Book of Money: A Guide to Managing Your Finances, Building Your Wealth, & Investing in Yourself

Why This Book Stands Out?

- Comprehensive Financial Guidance: Covers essential topics from opening bank accounts to advanced investment strategies, making it suitable for all financial literacy levels.

- Practical Tips and Tricks: Offers actionable advice for decluttering finances and maximizing income through budgeting and side hustles.

- Creative Strategies: Introduces inventive methods such as the mason jar challenge to enhance financial health and alleviate money-related stress.

- Structured Schedules: Provides practical timelines for daily, monthly, and yearly financial tasks to help readers stay organized and focused on their goals.

- Visually Engaging: Features beautiful illustrations and photographs in a compact hardcover format, making it both enjoyable and easy to navigate.

- Ideal for All Ages: Whether you’re a recent graduate or seeking lifelong financial advice, this book caters to diverse audiences looking to improve their financial knowledge.

Personal Experience

As you delve into The Little Book of Money, you may find yourself reflecting on your own financial journey. Perhaps you’ve experienced the overwhelming stress that comes with managing bills and budgeting, or maybe you’ve longed for a roadmap to navigate the complexities of investing. This book serves not only as a guide but also as a companion that resonates with your aspirations for financial freedom and personal growth.

Many readers might relate to the struggles of living paycheck to paycheck or the anxiety of unexpected expenses. You might remember the first time you set up a savings account or the sense of accomplishment when you finally tackled your debt. These moments are pivotal, and this book captures them beautifully, offering insights that can transform your relationship with money.

Through its practical tips and relatable advice, The Little Book of Money encourages readers to envision a future where financial stress is minimized, and wealth is attainable. Here are some key experiences you might resonate with:

- Understanding Financial Basics: The book breaks down complicated concepts into digestible pieces, making it easier for you to grasp the fundamentals of finance.

- Finding Creative Solutions: You may discover innovative strategies for maximizing your income, such as side hustles that align with your passions.

- Establishing Healthy Habits: Implementing daily, monthly, and yearly financial tasks could lead to a newfound sense of control over your budgeting and spending.

- Reducing Financial Anxiety: The inventive techniques presented can help you overcome the emotional stressors associated with money, allowing you to focus on what truly matters.

- Visual Inspiration: The beautiful illustrations throughout the book not only enhance its appeal but also serve as visual reminders of your financial goals.

Ultimately, The Little Book of Money invites you to engage with your finances in a way that is both practical and empowering, making it a relatable and invaluable addition to your personal finance journey.

Who Should Read This Book?

This book is designed for anyone looking to take control of their finances and improve their overall financial health. It is particularly suitable for:

- Recent College Graduates: Transitioning into the workforce can be overwhelming, and this guide provides essential financial basics to help navigate this new phase.

- Individuals Seeking Financial Advice: Whether you’re starting from scratch or looking to refine your financial strategies, this book offers practical tips to enhance your understanding of money management.

- Those Facing Financial Stress: The techniques outlined can help alleviate emotional stress related to money, enabling readers to approach their finances with confidence.

- Budget-Conscious Individuals: The book includes creative strategies for mastering budgets and identifying side hustles that can maximize income.

- Visual Learners: With its beautiful illustrations and photographs, this compact hardcover guide appeals to those who appreciate a visually engaging learning experience.

Overall, “The Little Book of Money” is a valuable resource for anyone eager to declutter their finances and build a prosperous future. Its straightforward approach makes it accessible to readers at various stages of their financial journey.

The Little Book of Money: A Guide to Managing Your Finances, Building Your Wealth, & Investing in Yourself

Key Takeaways

Readers of The Little Book of Money can expect to gain valuable insights and practical strategies for managing their finances and building wealth. Here are the key takeaways from the book:

- Understanding Financial Basics: Learn essential concepts such as opening a bank account and the importance of budgeting.

- Wealth Growth Strategies: Discover how to grow your wealth through stocks, bonds, and mutual funds.

- Creative Income Maximization: Master budgeting techniques and explore ways to invest in your passions and side hustles.

- Practical Financial Schedules: Utilize daily, monthly, and yearly tasks to maintain and enhance your financial health.

- Stress Reduction Techniques: Implement inventive methods to alleviate the emotional stress associated with money management.

- Compact and Accessible Format: Enjoy a beautifully illustrated hardcover book that makes learning about finance easy and engaging.

Final Thoughts

“The Little Book of Money: A Guide to Managing Your Finances, Building Your Wealth, & Investing in Yourself” is an invaluable resource for anyone looking to take control of their financial future. This compact guide distills complex financial concepts into simple, actionable advice that anyone can implement, regardless of their financial background.

Here are some of the key benefits of this book:

- Simple tips and tricks for understanding the basics of finance.

- Creative strategies for maximizing your income through budgeting and side hustles.

- Practical schedules for daily, monthly, and yearly financial tasks.

- Inventive techniques to alleviate the emotional stressors associated with money.

- Beautiful illustrations and photographs that enhance the reading experience.

This book is particularly beneficial for recent college graduates or anyone seeking to improve their financial literacy. With its practical tips and straightforward approach, it empowers readers to declutter their finances and build a prosperous future.

Don’t miss out on the opportunity to transform your financial life. Invest in yourself and your financial well-being by purchasing The Little Book of Money today!