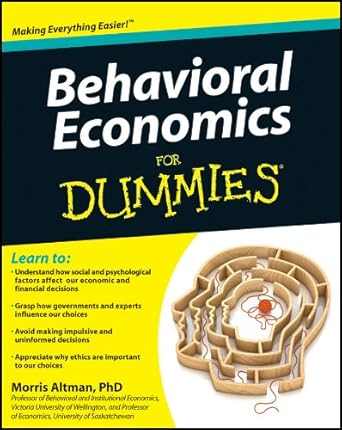

Are you curious about why you splurge on that pricey watch or hesitate before making a big purchase? Dive into the fascinating world of behavioral economics with Behavioral Economics For Dummies. This engaging guide unpacks the real reasons behind our financial decisions by exploring the psychological and social factors that drive our choices. Say goodbye to the myth of rational self-interest as you discover how instincts, social pressures, and mental framing shape your spending habits.

Written by a seasoned professor at Victoria University, this book is perfect for anyone looking to enhance their financial decision-making skills. Whether you’re an investor aiming to sidestep impulsive mistakes or simply someone interested in understanding everyday spending behaviors, Behavioral Economics For Dummies offers valuable insights that can transform how you approach your finances. Get ready to empower yourself with knowledge that can influence your bank account and improve your understanding of the world around you!

Behavioral Economics For Dummies

Why This Book Stands Out?

- Accessible Insights: Written in a friendly and engaging tone, this book makes complex concepts in behavioral economics easy to understand for readers of all backgrounds.

- Real-World Relevance: Packed with practical examples, it connects theory to everyday financial decisions, helping you grasp how psychological factors influence spending.

- Expert Author: Authored by a professor of behavioral and institutional economics, the book is grounded in academic expertise while remaining relatable and applicable.

- Actionable Advice: Learn strategies to avoid impulsive financial mistakes, empowering you to make smarter decisions whether you’re an investor, consumer, or policymaker.

- Broad Applicability: Ideal for anyone with a bank account, this book not only enhances personal finance understanding but also sheds light on broader economic trends.

Personal Experience

As I delved into the pages of Behavioral Economics For Dummies, I found myself reflecting on my own financial decisions and the myriad of influences that have shaped them over the years. It’s fascinating how our choices can often feel so instinctive, yet upon closer examination, they reveal layers of psychological and social factors at play. Have you ever splurged on something you didn’t really need, only to question your decision later? This book speaks to those moments.

One of the most relatable aspects of the book is how it addresses the internal tug-of-war we often experience between rational thought and impulse. I remember vividly a time when I bought an expensive gadget that I thought would change my life, only to realize weeks later it sat unused on my shelf. It’s experiences like these that make you ponder: Why did I do that? Behavioral Economics For Dummies offers insights that resonate deeply, helping to decipher those puzzling choices.

Here are a few key reflections that struck me as I read:

- Understanding Impulse: It’s eye-opening to acknowledge that so many of our purchases are driven by impulse rather than necessity. The book highlights how social pressure and marketing can sway our decisions, making me more aware of my surroundings when I shop.

- The Power of Mental Framing: The concept of mental framing really hit home. I’ve often found myself purchasing items that were presented as “limited time offers” or “exclusive deals,” only to realize later that I wasn’t in need of them at all. This book sheds light on those tactics.

- Learn from Mistakes: The author’s insights into how we can learn from our financial missteps are empowering. It encourages a mindset shift towards viewing past errors as opportunities for growth rather than regrets.

- Relatability of Real-World Examples: The book is filled with relatable anecdotes that remind us we’re not alone in our struggles with money. It’s comforting to know that others grapple with the same dilemmas, and it fosters a sense of community.

Engaging with this book feels like having a conversation with a knowledgeable friend who gently nudges you to think critically about your choices. It’s a reminder that financial decision-making isn’t just about numbers; it’s an intricate dance of emotions, social influences, and personal values. I found that reflecting on my own experiences while reading deepened my understanding of the principles discussed, allowing me to see the bigger picture of my financial life.

Who Should Read This Book?

If you’re someone who has ever wondered why you make certain financial choices—like splurging on that fancy gadget or hesitating to invest in your future—then Behavioral Economics For Dummies is tailor-made for you! This book is a friendly guide that breaks down complex concepts into relatable insights, making it perfect for a diverse range of readers. Here’s a closer look at who will benefit the most:

- Everyday Consumers: If you want to understand the psychological triggers behind your spending habits, this book will illuminate the mental shortcuts and biases that influence your decisions.

- Investors: For anyone looking to sharpen their investment strategies, the insights on behavioral patterns can help you avoid impulsive mistakes and make more rational choices.

- Business Professionals: Whether you’re in marketing or management, grasping the mechanisms behind consumer choices can enhance your ability to connect with clients and improve your product offerings.

- Students and Academics: If you’re studying economics, psychology, or business, this book serves as a wonderful supplementary resource that bridges theory with real-world application.

- Policymakers and Nonprofit Leaders: Understanding behavioral economics can help you make more effective public decisions and initiatives that resonate with the communities you serve.

In short, whether you’re managing a personal budget, leading a team, or shaping public policy, Behavioral Economics For Dummies provides you with the tools to navigate the complex world of financial decision-making. Dive in and discover how your mind works when it comes to money—you might be surprised by what you learn!

Behavioral Economics For Dummies

Key Takeaways

Behavioral Economics For Dummies offers valuable insights into the psychology behind financial decision-making. Here are the key points you can expect to learn:

- Understanding Irrational Behavior: Discover why people often make financial decisions that seem illogical, such as impulse purchases or emotional spending.

- Influence of Social and Psychological Factors: Learn how social pressure, mental framing, and instinctual behavior patterns shape our financial choices.

- Real-World Examples: Benefit from relatable case studies that illustrate behavioral economics concepts in action, making the theory more accessible and relevant.

- Avoiding Impulsive Mistakes: Gain strategies to recognize and mitigate the impact of cognitive biases on your financial decisions.

- Insights for Investors and Businesses: Understand the mechanisms behind consumer choices to make better investment decisions and improve marketing strategies.

- Application to Public Policy: Explore how governments and nonprofits can utilize behavioral insights to enhance public decision-making and policy design.

- Improving Financial Literacy: Equip yourself with knowledge that not only enhances your own financial decision-making but also helps you understand broader economic trends and current events.

Final Thoughts

Behavioral Economics For Dummies is an enlightening guide that dives deep into the fascinating world of how our minds influence our financial decisions. By blending psychology with economics, this book sheds light on why we sometimes make choices that seem irrational, such as splurging on luxury items or falling prey to social pressures. With its accessible writing style and relatable real-world examples, it serves as an invaluable resource for anyone looking to understand the intricate workings of their own financial behavior.

Here are some key takeaways that highlight the book’s overall value:

- Explores the psychological factors that influence money-related decisions.

- Provides insights to help investors avoid impulsive mistakes.

- Assists businesses in understanding the motivations behind consumer choices.

- Offers a foundational understanding of behavioral economics applicable to everyday life.

Whether you’re a seasoned investor, a business professional, or simply someone curious about human behavior, this book is a must-have addition to your collection. It not only enhances your financial decision-making skills but also enriches your understanding of the world around you.

If you’re ready to transform the way you think about spending and saving, don’t hesitate to purchase Behavioral Economics For Dummies today and embark on a journey towards smarter financial choices!