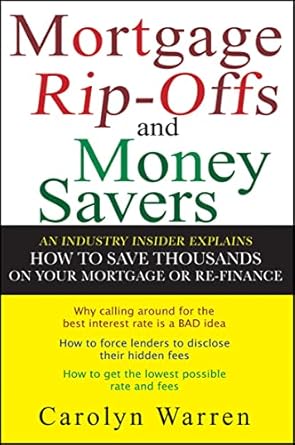

Are you tired of feeling overwhelmed by the mortgage process? Look no further than “Mortgage Rip-offs and Money Savers: An Industry Insider Explains How to Save Thousands on Your Mortgage or Re-Finance.” In this eye-opening guide, Carolyn Warren, a seasoned mortgage expert, reveals the hidden pitfalls and sneaky tactics that lenders use to take advantage of unsuspecting borrowers. With her insider knowledge, you’ll learn how to navigate the mortgage maze and avoid costly mistakes that could save you thousands of dollars.

This book isn’t just a dry read; it’s packed with practical advice and easy-to-understand tips that empower you to make informed financial decisions. Whether you’re a first-time homebuyer or looking to refinance, “Mortgage Rip-offs and Money Savers” equips you with the tools you need to secure the best possible rates and steer clear of bogus fees. Say goodbye to confusion and frustration—it’s time to take control of your mortgage journey!

Mortgage Rip-offs and Money Savers: An Industry Insider Explains How to Save Thousands on Your Mortgage or Re-Finance

Why This Book Stands Out?

- Insider Knowledge: Authored by Carolyn Warren, a seasoned expert with over a decade of experience in the mortgage industry, this book offers unparalleled insights that only an insider can provide.

- Avoid Costly Mistakes: Learn to navigate the pitfalls that often trap unsuspecting borrowers, helping you save tens of thousands of dollars on your mortgage or refinance.

- Clear and Accessible: The information is presented in an engaging and easy-to-understand format, making it suitable for both novice and experienced readers alike.

- Practical Tips: Discover actionable strategies to secure the best rates, avoid unnecessary fees, and negotiate like a pro, empowering you to take control of your financial future.

- Consumer Advocacy: This book is a powerful tool for anyone looking to become a savvy borrower, equipping you with the knowledge to challenge the industry’s hidden practices.

Personal Experience

When I first stumbled upon Mortgage Rip-offs and Money Savers by Carolyn Warren, I was in the midst of navigating the often overwhelming world of home financing. Like many others, I had my fair share of fears and questions about the mortgage process. Would I end up paying more than I should? Were there hidden fees lurking in the shadows? I found myself questioning whether I could truly trust the experts, and that uncertainty was daunting.

As I delved into the pages of this book, I felt an immediate connection with Carolyn Warren’s candid storytelling. It was as if she was sitting across from me, sharing her hard-earned wisdom over a cup of coffee. Her insights resonated deeply, bringing to light the very real concerns that I, and many others, face when dealing with lenders. I found myself nodding along as she described the tricks and traps that the mortgage industry often employs, feeling a sense of relief that I wasn’t alone in my apprehensions.

- Relatable Experiences: Many readers may find themselves recalling their own stressful moments—like the day they first stepped into a bank or a mortgage office, filled with excitement yet overwhelmed by the complexities of interest rates and fees.

- Empowerment through Knowledge: The book empowered me to take control of my financial journey. Carolyn’s guidance provided me with the tools to ask the right questions and stand my ground against potential pitfalls, which is a feeling I believe many will cherish.

- A Sense of Community: Reading this book felt like joining a community of informed borrowers. We were all in this together, seeking to outsmart the system and secure the best deals possible.

What struck me most was the way Carolyn demystified the mortgage process. She took what felt like an intimidating labyrinth and turned it into a clear path, guiding readers toward making informed decisions. I remember the thrill of reading about real-life examples of individuals who saved thousands, and I couldn’t help but imagine my own potential savings. It ignited a spark of hope that I could navigate this journey successfully, armed with the knowledge she so generously shared.

For anyone who has ever felt lost in the sea of mortgage jargon, or worried about being taken advantage of, this book is a beacon of clarity. It’s not just about numbers and contracts; it’s about understanding your worth as a borrower and walking away with a deal that reflects that. I believe many readers will find themselves experiencing a similar sense of empowerment and encouragement as they turn each page.

Who Should Read This Book?

If you’re considering getting a mortgage or refinancing your existing one, then Mortgage Rip-offs and Money Savers is a must-read for you! This book is perfect for anyone who wants to navigate the often murky waters of the mortgage industry without falling prey to common pitfalls. Here’s why you should pick it up:

- First-Time Homebuyers: If you’re stepping into the world of homeownership for the first time, this book will arm you with knowledge to avoid costly mistakes and understand the ins and outs of mortgage agreements.

- Real Estate Investors: For those looking to invest in properties, this book highlights the dangers you need to be aware of, helping you secure the best financing options for your investments.

- Homeowners Looking to Refinance: If you’re considering refinancing, you’ll discover valuable tips on how to get the best rates and avoid unnecessary fees that could eat into your savings.

- Anyone Feeling Overwhelmed by Mortgage Jargon: Carolyn Warren breaks down complicated terms and concepts into easy-to-understand language, making it accessible for everyone.

- Consumers Wanting to Save Money: This book reveals insider secrets that can help you save thousands of dollars, making it an invaluable resource for anyone looking to improve their financial situation.

With Carolyn Warren’s insider knowledge, you’ll be empowered to make informed decisions and avoid being a victim of the mortgage industry’s common traps. Whether you’re buying your first home, refinancing, or investing, this book is tailored just for you!

Mortgage Rip-offs and Money Savers: An Industry Insider Explains How to Save Thousands on Your Mortgage or Re-Finance

Key Takeaways

Mortgage Rip-offs and Money Savers is an essential read for anyone looking to navigate the complexities of the mortgage industry. Here are the most important insights and benefits you can expect from this book:

- Insider Knowledge: Gain valuable insights from Carolyn Warren, a seasoned industry professional, who reveals the hidden tricks and tactics used by lenders to exploit borrowers.

- Avoid Common Traps: Learn about the major pitfalls that many consumers fall into, enabling you to sidestep costly mistakes when obtaining a mortgage.

- Save Money: Discover how to save thousands of dollars by avoiding unnecessary fees and securing better rates, ultimately leading to a more favorable mortgage experience.

- Easy-to-Understand Guidance: The book presents complex information in a clear and engaging manner, making it accessible for readers of all backgrounds.

- Empowerment: Equip yourself with the tools and knowledge to negotiate effectively with lenders and get the best possible deal on your mortgage.

- Comprehensive Tips: Benefit from practical advice and strategies that can be immediately applied to your mortgage or refinancing process.

Final Thoughts

If you’re looking to navigate the complex and often confusing world of mortgages, then Mortgage Rip-offs and Money Savers is an essential read. Authored by industry insider Carolyn Warren, this book demystifies the mortgage process and equips you with the knowledge needed to avoid the pitfalls that can cost you thousands. With a decade of experience, Warren reveals the hidden tricks and traps lenders often use to their advantage, ensuring that you can secure the best rates and avoid unnecessary fees.

- Understand the dangers of the mortgage industry through insider knowledge.

- Learn practical tips for getting the right price and financing.

- Avoid common mistakes that can lead to financial loss.

- Empower yourself with actionable strategies to save money.

This book is not just another financial guide; it’s a powerful tool that can help you take control of your financial future. Whether you’re a first-time buyer or looking to refinance, Warren’s insights will put you on the path to making informed decisions that save you money.

Don’t miss out on this invaluable resource! Enhance your financial savvy and make your mortgage work for you. Purchase your copy of Mortgage Rip-offs and Money Savers today!