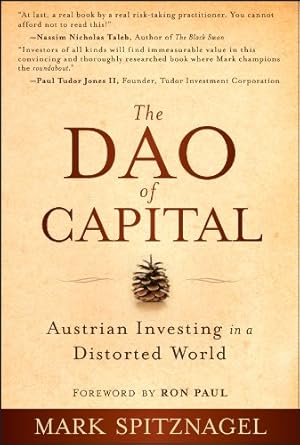

If you’re seeking a fresh perspective on investing that challenges conventional wisdom, look no further than “The Dao of Capital: Austrian Investing in a Distorted World” by Mark Spitznagel. This engaging read introduces you to the fascinating world of Austrian Investing, a counterintuitive approach rooted in the timeless principles of the Austrian School of economics. Spitznagel, a renowned hedge fund manager and tail-hedging pioneer, takes you on a captivating journey through history, blending insights from ancient Chinese strategy and 19th-century Austrian economics to craft a unique investment methodology.

In “The Dao of Capital,” you’ll discover how true victory in investing often comes from indirect means—what Spitznagel calls the roundabout approach. This book not only decodes the complexities of monetary distortions and market behaviors but also offers a practical guide for navigating today’s turbulent financial landscape. If you’re ready to transform your investment strategy and embrace a new way of thinking, this book is an invaluable resource you won’t want to miss!

The Dao of Capital: Austrian Investing in a Distorted World

Why This Book Stands Out?

- Unique Investment Philosophy: Mark Spitznagel introduces the counterintuitive principles of Austrian Investing, emphasizing that sometimes you gain by losing and lose by gaining.

- Historical and Cultural Insights: The book weaves a rich narrative through history, from ancient China to Napoleonic Europe, providing a deep understanding of economic thought and its evolution.

- Practical Application: Spitznagel distills complex Austrian economic theories into actionable investment strategies, making them accessible for both novice and seasoned investors.

- Focus on Market Distortions: Learn how to identify monetary distortions and market anomalies, a crucial skill in navigating today’s volatile financial landscape.

- Timeless Relevance: The principles discussed are not just historically significant; they are incredibly relevant in today’s distorted economic environment.

- Engaging Narrative Style: Spitznagel’s storytelling prowess makes complex theories engaging and digestible, ensuring readers remain captivated throughout the journey.

Personal Experience

As I delved into The Dao of Capital, I found myself reflecting on my own journey with investing and the complex emotions that come with it. The book’s premise of winning through losing resonated deeply with me. There have been moments in my own financial endeavors where I felt like I’d taken two steps back, only to realize later that those setbacks were crucial learning experiences that ultimately shaped my approach to investing.

Mark Spitznagel’s insights into the roundabout approach of Austrian Investing opened my eyes to a new perspective. It reminded me of times when I would chase immediate gains, often leading to disappointment. His emphasis on patience and understanding the broader economic landscape made me reconsider my strategies. It felt like a gentle nudge to embrace a more thoughtful and strategic mindset, rather than getting caught up in the frantic pace of the market.

- Have you ever experienced a setback in your investments that later turned out to be a blessing in disguise?

- Can you recall moments when taking a step back allowed you to see the bigger picture?

- Spitznagel’s reflections on time and patience might resonate with your own life experiences—how often do we rush towards our goals without appreciating the journey?

Reading this book felt like having a conversation with a wise mentor. Spitznagel’s ability to weave together historical context and practical investment strategies created a rich tapestry that was not only informative but also deeply relatable. I found myself nodding along, recognizing my own struggles and triumphs mirrored in his words.

For anyone who has ever felt overwhelmed by the complexities of investing, The Dao of Capital serves as a reminder that sometimes, the best approach is not the most direct one. There’s a certain comfort in knowing that successful investing can be a journey of exploration, marked by both challenges and victories. This book has not only expanded my understanding of investing but has also encouraged me to embrace the process with a sense of curiosity and resilience.

Who Should Read This Book?

If you’re someone who is curious about investing but feels overwhelmed by the conventional approaches often promoted in the financial world, then The Dao of Capital is the perfect read for you! This book isn’t just for seasoned investors; it’s for anyone looking to understand a different, more nuanced approach to capital markets. Here’s why this book might just be your next favorite read:

- Beginner Investors: If you’re just starting out in investing and want to grasp the foundational concepts of Austrian economics, this book breaks it down in an engaging way. Spitznagel makes complex ideas accessible and relatable.

- Experienced Investors: For those who have been in the game for a while but are seeking new strategies, Spitznagel offers a refreshing perspective on investing that challenges standard practices. His counterintuitive approach can help refine your investment philosophy.

- Economics Enthusiasts: If you have an interest in economics, especially the Austrian School, this book provides a historical journey that connects economic theory with practical investment strategies. You’ll appreciate the depth and context Spitznagel provides.

- Doomsday Investors: For those who are drawn to contrarian investment strategies and have a keen interest in tail-risk hedging, Spitznagel’s insights are invaluable. His experiences during financial crises can help you navigate uncertainty with confidence.

- Philosophical Thinkers: If you enjoy exploring philosophical concepts and their application in real-world scenarios, the Daoist principles interwoven throughout the book will resonate with you. You’ll find a unique blend of philosophy and practical advice.

Overall, The Dao of Capital is not just a book about investing; it’s a guide to thinking differently about markets and opportunity. Whether you’re new to investing or looking to deepen your understanding, this book offers unique insights that can enhance your financial journey.

The Dao of Capital: Austrian Investing in a Distorted World

Key Takeaways

The Dao of Capital by Mark Spitznagel offers readers a unique perspective on investment strategies rooted in Austrian economics. Here are the key insights and lessons that make this book a must-read:

- Austrian Investing Philosophy: Understand the principles of Austrian economics and how they translate into a successful investment methodology that focuses on long-term gains through strategic positioning.

- Counterintuitive Strategies: Learn the importance of embracing a roundabout approach to investing, where gaining often involves losing in the short term, ultimately leading to greater long-term success.

- Market Timing and Distortions: Gain insights into how to identify monetary distortions and market inefficiencies, allowing you to better navigate stock market fluctuations.

- Historical Context: Explore the rich history of economic thought, from ancient China to 19th-century Austria, and see how these ideas inform modern investment practices.

- Intertemporal Perspective: Shift your understanding of time in investing, recognizing that success often comes from planning for the future rather than reacting to immediate market conditions.

- Practical Applications: Discover how Spitznagel has effectively applied these concepts in his own investment strategies, providing real-world examples that illustrate the effectiveness of Austrian investing.

- Accessible Insights: Experience complex economic theories distilled into practical advice, making the principles of Austrian economics accessible and actionable for everyday investors.

Final Thoughts

“The Dao of Capital: Austrian Investing in a Distorted World” by Mark Spitznagel is not just a book; it’s a transformative guide to understanding the nuances of investing through the lens of Austrian economics. Spitznagel’s unique perspective emphasizes the importance of a roundabout approach to investing, where patience and strategic positioning pave the way for success. This book delves into the timeless principles of the Austrian School, offering readers a roadmap to navigate the complexities of today’s financial landscape.

Here are some key takeaways that make this book a valuable addition to your collection:

- Insightful exploration of Austrian investing principles and their real-world application.

- Engaging stories that intertwine historical economic thought with modern investment strategies.

- A unique perspective on market timing and positional advantage that challenges conventional wisdom.

- Practical advice for recognizing market distortions and capitalizing on them effectively.

This book is essential for anyone looking to deepen their understanding of investment strategies that stand the test of time. Whether you’re a seasoned investor or just starting your journey, Spitznagel’s insights can illuminate your path to financial success.

Don’t miss the opportunity to enhance your investment knowledge and strategy. Purchase “The Dao of Capital” today and discover how to navigate the market with wisdom and foresight!