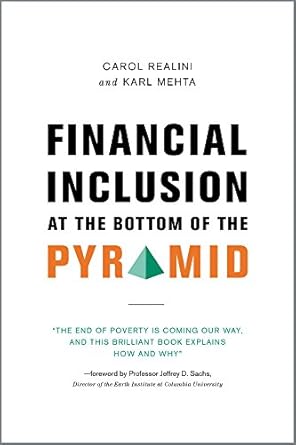

Discover the transformative power of “Financial Inclusion at the Bottom of the Pyramid,” a compelling read by Karl Mehta and Carol Realini that shines a light on the financial struggles faced by billions. In an age where technology connects us like never before, this insightful book explores the plight of “financial nomads” who navigate life without traditional banking services, highlighting the urgent need for innovative solutions to uplift those at the pyramid’s base.

With a warm and engaging approach, the authors outline a visionary blueprint for achieving financial inclusion for all. They delve into how advances in communication technology can bridge the gap and empower the unbanked and underserved populations globally. If you’re passionate about creating a more equitable world, this book is a must-read that not only educates but inspires action toward a brighter financial future for everyone.

Financial Inclusion at the Bottom of the Pyramid

Why This Book Stands Out?

- Timely and Relevant: In a world where financial services are often out of reach for billions, this book tackles a pressing global issue with urgency and insight.

- Innovative Solutions: Authors Karl Mehta and Carol Realini provide a visionary blueprint that leverages technology to advocate for financial inclusion for the unbanked and underserved.

- Engaging Narrative: The book combines compelling storytelling with practical examples, making complex ideas accessible and relatable to all readers.

- Expert Insights: Drawing from their extensive experience, the authors share valuable perspectives on the evolving landscape of finance and technology.

- Global Perspective: It explores the challenges faced by financial nomads across different regions, highlighting diverse experiences and potential solutions.

- Actionable Framework: Readers will find concrete strategies and recommendations that empower individuals and organizations to drive change in their communities.

Personal Experience

As I delved into Financial Inclusion at the Bottom of the Pyramid, I found myself reflecting on my own financial journey and the many ways it has shaped my understanding of security and opportunity. The authors, Karl Mehta and Carol Realini, invite us into a world where financial services are not just privileges but essential lifelines for billions. This idea resonated deeply with me, as I considered how easy it is to take access to banking for granted.

Reading this book made me think about moments in my life when I felt the weight of financial uncertainty. Perhaps it was during my college years, trying to navigate student loans while juggling part-time jobs, or the times I had to make tough choices about spending because of limited resources. These experiences, although challenging, were cushioned by the knowledge that I had access to financial tools and support systems. For many, however, this is not the case.

Here are some insights that stood out to me and might resonate with you:

- The Concept of Financial Nomads: The term struck a chord with me. I’ve often felt like a nomad in my own financial landscape, constantly searching for stability. It’s eye-opening to consider that half the world’s population navigates their lives without the safety net of traditional banking.

- Empowerment Through Technology: The authors’ optimism about technological advancements is infectious. It made me think about how tools like mobile banking apps have transformed my own financial management and how similar innovations can empower those at the bottom of the pyramid.

- Shared Humanity: The stories of individuals striving for financial inclusion reminded me of the universal desire for security and dignity. I couldn’t help but feel a sense of connection to those who face these challenges daily, and it ignited a desire in me to contribute to solutions.

- Vision for a Better World: The blueprint proposed by Mehta and Realini is not just theoretical; it feels like a call to action. It inspired me to think about how I can be part of the change, whether through advocacy, supporting inclusive businesses, or simply spreading awareness.

This book is more than just a collection of facts and figures; it’s a heartfelt exploration of what it means to be financially included and the transformative power of access to financial services. I’m grateful for the insights it has provided, and I believe many readers will find it a mirror reflecting their own experiences and aspirations.

Who Should Read This Book?

If you’re curious about the intersection of technology, finance, and social justice, then Financial Inclusion at the Bottom of the Pyramid is a must-read. This book is perfect for a diverse audience, including:

- Social Entrepreneurs: If you’re passionate about creating solutions that empower underserved communities, this book offers insights and strategies to help you make a real impact.

- Financial Services Professionals: For those in the financial sector, understanding the challenges faced by the unbanked is crucial. This book provides a fresh perspective on how technology can transform financial services for everyone.

- Students and Academics: If you’re studying finance, economics, or social sciences, this book presents a compelling case for financial inclusion, backed by research and case studies that can enhance your understanding.

- Policy Makers and Advocates: Those involved in policy-making or advocacy will find valuable insights into the systemic barriers to financial inclusion and innovative solutions that can shape effective policies.

- Tech Enthusiasts: If you’re excited about the potential of technology to solve real-world problems, this book showcases how digital innovations are driving change in financial access.

This book stands out because it not only highlights the challenges of financial exclusion but also offers a hopeful vision and practical blueprint for achieving financial inclusion for all. It’s not just a read; it’s a call to action for anyone who believes in a more equitable financial future.

Financial Inclusion at the Bottom of the Pyramid

Key Takeaways

In “Financial Inclusion at the Bottom of the Pyramid,” authors Karl Mehta and Carol Realini provide valuable insights into the pressing issue of financial exclusion. Here are the key points that make this book a must-read:

- Understanding Financial Nomads: Gain insight into the lives of the billions who live without traditional banking services, navigating their finances in innovative ways.

- Impact of Technology: Discover how advances in technology and communication can transform financial services, making them accessible to the unbanked and underserved populations globally.

- Blueprint for Inclusion: Learn about a strategic vision and actionable blueprint for achieving financial inclusion for all, highlighting pathways to empower the financially excluded.

- Empowering the Underserved: Explore the potential for innovative financial solutions that can uplift communities at the base of the pyramid and improve their quality of life.

- Global Perspective: Understand the broader implications of financial inclusion on global economies and social stability, emphasizing the interconnectedness of financial systems.

- Inspiration for Change: Be inspired by real-world examples and success stories that demonstrate the possibilities for creating a more inclusive financial landscape.

Final Thoughts

“Financial Inclusion at the Bottom of the Pyramid” by Karl Mehta and Carol Realini is an enlightening exploration of the challenges faced by the unbanked and underserved populations around the globe. The authors shed light on the plight of “financial nomads”—individuals who navigate life without the security and support of traditional banking services. In a world so technologically advanced, it is staggering to realize that half of the planet’s population remains financially excluded.

This book not only highlights the dire need for financial inclusion but also offers a hopeful vision for a better future. Through innovative use of technology and communication, the authors propose practical solutions that can help bridge the gap between the financially secure and those struggling at the bottom of the pyramid. Their insights serve as a compelling reminder that financial inclusion is not just a dream, but an achievable goal within our reach.

- Understand the significance of financial inclusion and its impact on global poverty.

- Learn about the role of technology in providing financial services to the underserved.

- Discover actionable strategies to foster financial empowerment for all.

This book is a must-read for anyone interested in social justice, economic development, or the transformative power of technology. It is an invaluable addition to your collection, providing both knowledge and inspiration to make a difference in the world.

Don’t miss the chance to explore this vital subject and be part of the change. Purchase “Financial Inclusion at the Bottom of the Pyramid” today!