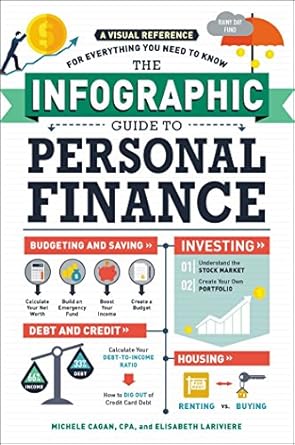

Are you ready to take control of your finances? Look no further than The Infographic Guide to Personal Finance. This visually engaging book transforms the often daunting world of personal finance into digestible, easy-to-understand infographics. With colorful illustrations and concise information, you’ll learn how to balance your budget, build an emergency fund, and make informed investment decisions—all while enjoying a format that makes complex topics approachable and fun.

From choosing the right bank to understanding the intricacies of health and property insurance, this guide covers everything you need to know to secure your financial future. Perfect for visual learners and anyone looking to enhance their money management skills, The Infographic Guide to Personal Finance is your go-to resource for achieving financial wellness and growing your wealth!

The Infographic Guide to Personal Finance: A Visual Reference for Everything You Need to Know (Infographic Guide Series) [Print Replica]

Why This Book Stands Out?

- Visually Engaging: The Infographic Guide to Personal Finance presents complex financial concepts in a visually appealing format, making it easier to digest and understand.

- Comprehensive Coverage: Covers essential topics such as budgeting, investing, insurance, and taxes, ensuring you have a well-rounded understanding of personal finance.

- Easy-to-Follow Structure: Information is organized into bite-sized, colorful infographics, allowing for quick reference and enhanced retention.

- Practical Tips: Offers actionable advice on managing your money, choosing banks and financial planners, and building an emergency fund.

- Expert Endorsement: Praised by The Washington Post for its ability to simplify tough topics, making it a trusted resource for financial literacy.

Personal Experience

As I flipped through the pages of The Infographic Guide to Personal Finance, I couldn’t help but feel a sense of relief wash over me. Personal finance has always been a daunting topic, but this book transforms the overwhelming into the manageable. The colorful infographics and straightforward explanations made it feel less like a textbook and more like a conversation with a knowledgeable friend.

Have you ever found yourself staring blankly at a budget spreadsheet, feeling lost and discouraged? I have. But as I read through the sections on budgeting and planning for my future, I began to see the light. The way the information is presented—visually and in digestible bites—made it so much easier to grasp the concepts. I remember the moment I learned about building an emergency fund; it felt like a lightbulb moment. Suddenly, I understood the importance of having that safety net, and I was inspired to take action.

Here are a few key insights that resonated with me:

- Choosing Your Bank: I found the tips on selecting the right bank incredibly helpful. It made me reflect on my own banking choices and how they could be impacting my financial health.

- Building an Emergency Fund: The infographic made it clear why this is non-negotiable, and I felt motivated to start setting aside savings.

- Understanding Health Insurance: This was a topic I always avoided, but the way it was broken down made it less intimidating and much more relatable.

- What Not to Buy: This section was both eye-opening and liberating. It challenged me to rethink my spending habits in a way I hadn’t considered before.

- Investing Basics: I loved how it simplified the complex world of investing, making it accessible for someone just starting out like me.

Reading this book felt like a personal journey towards financial empowerment, and I could see how it could resonate deeply with anyone looking to take control of their money. Whether you’re just starting out or looking to refine your financial skills, this guide feels like a trusted companion on that path.

Who Should Read This Book?

If you’ve ever felt overwhelmed by the complexities of personal finance, then this book is tailor-made for you! Whether you’re just starting your financial journey or looking to sharpen your money management skills, The Infographic Guide to Personal Finance is the perfect companion. Here’s why this book is a must-read for various audiences:

- Young Adults and College Students: If you’re stepping into adulthood and starting to manage your own finances, this book provides essential knowledge in an engaging format. You’ll learn everything from budgeting basics to how to choose a bank, making it easier to navigate your financial future.

- New Professionals: Just landed your first job? This guide will help you understand how to balance your budget, save for emergencies, and even plan for retirement early on. You’ll gain the confidence to make informed financial decisions that set you up for success.

- Busy Parents: Juggling family responsibilities and finances can be challenging. This book presents financial concepts in bite-sized, visually appealing infographics, making it easy to grasp essential information quickly and efficiently—perfect for parents on the go!

- Anyone Looking to Improve Their Financial Literacy: If you feel lost in a sea of financial jargon or just want to brush up on your knowledge, this guide breaks down complex topics in a friendly and accessible way, empowering you to take control of your financial life.

- Visual Learners: For those who find traditional text-heavy finance books daunting, the colorful illustrations and organized layout in this guide make learning about personal finance enjoyable and easy to digest.

Overall, The Infographic Guide to Personal Finance is an invaluable resource for anyone seeking to improve their financial well-being. With its engaging visuals and practical advice, it’s bound to inspire you to take charge of your money like a pro!

The Infographic Guide to Personal Finance: A Visual Reference for Everything You Need to Know (Infographic Guide Series) [Print Replica]

Key Takeaways

If you’re looking to take control of your finances, “The Infographic Guide to Personal Finance” is a must-read. Here are the most important insights you can expect from this visually engaging guide:

- Understanding Banking: Learn how to choose the right bank for your needs to maximize your savings and minimize fees.

- Emergency Fund Essentials: Discover the importance of building an emergency fund and how to get started.

- Financial Planning: Get tips on selecting a financial planner who aligns with your financial goals.

- Expense Tracking: Gain insights into where your money is going and how to manage your spending effectively.

- Smart Purchases: Identify what not to buy, helping you avoid unnecessary expenses.

- Insurance Insights: Understand health and property insurance, ensuring you’re adequately protected.

- Tax Awareness: Learn what federal taxes are funding, helping you make informed decisions about your finances.

- Investment Basics: Get introduced to sound investment strategies to grow your wealth over time.

- Budgeting Skills: Master the art of budgeting to save for significant purchases like a house or college tuition.

Final Thoughts

If you’re looking to take control of your finances in a way that’s both engaging and informative, then The Infographic Guide to Personal Finance: A Visual Reference for Everything You Need to Know is the perfect addition to your reading list. This book transforms the often daunting world of personal finance into a visually appealing and easily digestible format, making it accessible for everyone, regardless of their financial background.

With vibrant illustrations and clear infographics, you’ll discover essential skills such as:

- How to choose the right bank for your needs

- Building a robust emergency fund

- Navigating health and property insurance

- Understanding where your money goes and what to avoid buying

- Making informed investment decisions

- Budgeting for major life expenses like a home or college tuition

By breaking down complex topics into bite-sized pieces, this guide empowers you to make sound financial choices and grow your personal wealth. Whether you’re a beginner or someone looking to refine your financial knowledge, this book is a valuable resource that you won’t want to miss.

Ready to transform your financial future? Don’t wait any longer! Grab your copy of The Infographic Guide to Personal Finance today and start your journey towards financial literacy and success. Click here to purchase: The Infographic Guide to Personal Finance.