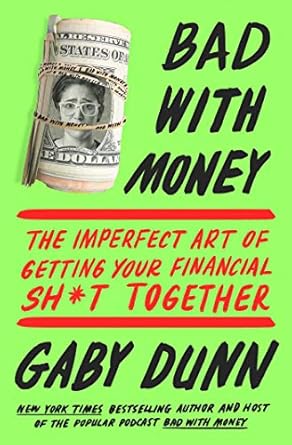

If you’ve ever felt overwhelmed by your finances, Gaby Dunn’s “Bad with Money: The Imperfect Art of Getting Your Financial Sh*t Together” is here to change that. This hilarious and relatable guide brings financial literacy to Millennials and Gen Z in a way that feels genuine and accessible. Dunn transforms the often-dry subject of personal finance into an engaging conversation, tackling everything from budgeting basics to navigating student loans—all while sharing her own amusing anecdotes and insights from a diverse cast of voices.

What sets this book apart is its candid approach to the taboo nature of discussing money. Dunn dives deep into the systemic issues that leave many feeling anxious and alone, empowering readers to confront their financial fears head-on. With practical tips and a warm, conversational style, “Bad with Money” not only helps you get your financial sh*t together but also makes the journey feel fun and achievable. Say goodbye to financial shame and hello to a brighter, more informed future!

Bad with Money: The Imperfect Art of Getting Your Financial Sh*t Together

Why This Book Stands Out?

- Humor Meets Finance: Gaby Dunn transforms the often-dry subject of personal finance into an engaging and funny read, making financial literacy accessible and enjoyable.

- Relatable and Forthright: Dunn’s candid approach resonates with Millennials and Gen Z, tackling the awkwardness around money conversations and encouraging open dialogue.

- Real-Life Solutions: The book provides practical advice on navigating financial challenges, from choosing insurance to budgeting effectively, all while maintaining a light-hearted tone.

- Empowered Storytelling: Dunn weaves personal anecdotes with insights from a diverse range of voices, creating a rich tapestry of experiences that demystify financial topics.

- Addressing Systemic Issues: The book goes beyond individual responsibility, exploring the systemic barriers that contribute to financial anxiety and offering a broader perspective on money management.

- Engaging Format: Whether you’re a financial novice or looking to refine your skills, Dunn’s engaging narrative style makes learning about money feel approachable and fun.

Personal Experience

As I dove into Bad with Money: The Imperfect Art of Getting Your Financial Sh*t Together, I couldn’t help but feel a wave of nostalgia mixed with a touch of relief wash over me. Gaby Dunn’s approach to financial literacy felt like sitting down with a good friend over coffee, sharing our most awkward stories about money and the life lessons that came with them. I found myself nodding along, recalling my own struggles with budgeting, student loans, and the sheer anxiety of navigating adulthood without a financial roadmap.

Have you ever found yourself in a situation where discussing your bank account felt more taboo than revealing your deepest secrets? I know I have. Dunn hits the nail on the head when she discusses the societal stigma surrounding money talk. It’s like we all collectively agreed that we should whisper about our finances, yet shout from the rooftops about our latest dating mishaps. This book invites us to break that silence, and it feels liberating.

- Relatable Anecdotes: Dunn weaves her personal stories with those of others, making it clear that financial struggles are not just individual battles, but a shared experience. I found comfort in knowing I wasn’t alone in my money woes.

- Humor as a Tool: Who would have thought that a book about finances could make me laugh out loud? Dunn’s humor transforms daunting topics like credit scores and insurance plans into relatable conversations, making it easier to digest.

- Empowerment through Knowledge: Just like Dunn, I’ve often felt overwhelmed by financial jargon. But this book breaks it down into manageable pieces, empowering readers to take charge of their financial futures without feeling like they need a finance degree.

- Real-World Applications: I appreciated the practical advice on navigating money in relationships and freelancing. It’s the kind of guidance that feels immediately applicable to my life, offering actionable steps rather than vague ideas.

Reading Bad with Money was more than just an educational experience; it felt like a personal revelation. It’s a reminder that we can approach our finances with honesty, vulnerability, and a touch of humor. If you’ve ever felt lost in the financial maze, Dunn’s book might just be the compass you need to find your way. It’s not just about getting your sh*t together; it’s about embracing the journey with all its imperfections.

Who Should Read This Book?

If you’ve ever felt overwhelmed by money, confused about budgeting, or simply unsure where to start when it comes to your finances, then Bad with Money: The Imperfect Art of Getting Your Financial Sh*t Together is the perfect read for you! This book is tailored for:

- Millennials and Gen Z: If you’re navigating the tricky waters of student loans, credit cards, and the gig economy, Gaby Dunn speaks your language and understands the unique financial challenges you face.

- Anyone Who Finds Money Talk Awkward: If you cringe at the thought of discussing finances, Dunn’s humorous approach will help you feel more comfortable and empowered to tackle these conversations head-on.

- People Seeking Financial Literacy: Whether you’re just starting out or looking to improve your financial knowledge, this book breaks down complex topics into relatable, digestible advice that’s easy to understand.

- Fans of Humor and Storytelling: If you appreciate a good laugh while learning, Dunn’s witty anecdotes and engaging storytelling will keep you entertained while you gain valuable insights.

- Those Looking to Take Control of Their Finances: If you want practical tips on budgeting, insurance, and financial planning without the jargon, this book will guide you on your journey to financial empowerment.

In short, if you’re ready to demystify your money issues and gain the confidence to take charge of your financial future, Bad with Money is the book for you!

Bad with Money: The Imperfect Art of Getting Your Financial Sh*t Together

Key Takeaways

Gaby Dunn’s “Bad with Money” offers a refreshing and humorous approach to financial literacy, particularly aimed at Millennials and Gen Z. Here are the essential insights and lessons you can expect from the book:

- Breaking the Money Taboo: Dunn emphasizes the importance of open conversations about money, helping to dismantle the shame and anxiety surrounding financial discussions.

- Systemic Understanding: The book provides context for the feelings of helplessness many experience with personal finance, addressing the larger systemic issues at play.

- Practical Guidance: Readers will learn how to tackle everyday financial decisions, from choosing insurance plans to understanding credit cards and student loans.

- Freelance Financial Strategies: Dunn offers specific advice for navigating money management as a freelancer, making it relatable and actionable.

- Budgeting Made Fun: The book presents budgeting techniques that are straightforward and enjoyable, without the need for advanced economic knowledge.

- Engaging Stories: Dunn weaves in personal anecdotes along with perspectives from comedians and artists, making the content relatable and entertaining.

- Empowerment Over Helplessness: The overall message encourages readers to take control of their financial futures without resorting to extreme measures.

Final Thoughts

Bad with Money: The Imperfect Art of Getting Your Financial Sh*t Together by Gaby Dunn is not just another dry financial guide; it’s a refreshing and humorous take on the often daunting world of personal finance. Dunn masterfully combines her comedic flair with actionable insights, making complex topics like budgeting, credit cards, and insurance feel accessible and even enjoyable.

This book is particularly valuable for Millennials and Gen Z, who often grapple with financial anxiety in a society that leaves them feeling overwhelmed and unsupported. Dunn’s candid approach encourages open conversations about money, dismantling the stigma and shame that so many face. Through her own stories and the experiences of others, she provides a sense of community, reminding readers that they are not alone in their struggles.

- Engaging and relatable writing style

- Practical advice tailored for younger audiences

- Humorous take on serious financial issues

- Encourages open dialogue about money

If you’re ready to take control of your financial future while having a few laughs along the way, Bad with Money is a must-have addition to your reading list. Don’t miss out on the chance to transform your relationship with money—grab your copy today! Purchase here.