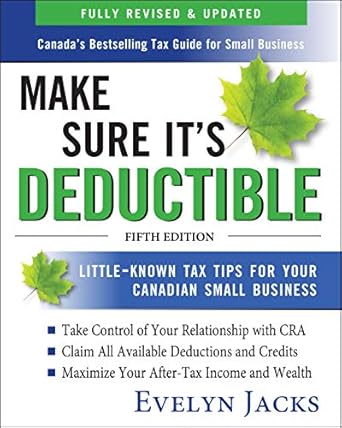

If you’re a Canadian small business owner, it’s time to maximize your profits and keep more of what you earn with the newly updated fifth edition of Make Sure It’s Deductible: Little-Known Tax Tips for Your Canadian Small Business. Authored by the trusted tax expert Evelyn Jacks, this essential guide shares invaluable insights on how to navigate the complex world of tax deductions, ensuring you take full advantage of every legitimate opportunity available to you. With a friendly and straightforward approach, Jacks reveals vital tax facts that can save you money and make tax season a breeze.

Join over 40,000 savvy entrepreneurs who have transformed their financial futures by learning about fully deductible expenses, new auto and home office rules, and innovative income-splitting strategies. Whether you’re self-employed or thinking of starting a business, Make Sure It’s Deductible is your go-to resource for building wealth and running a tax-efficient, audit-proof operation. Don’t leave money on the table—unlock your business’s potential today!

Make Sure It’s Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth Edition

Why This Book Stands Out?

- Expert Guidance: Authored by Evelyn Jacks, Canada’s bestselling tax expert, ensuring trustworthy advice from a seasoned professional.

- Practical Insights: Offers clear, actionable tips on maximizing deductions tailored specifically for Canadian small businesses.

- Comprehensive Coverage: Covers essential topics like auto and home office expense claims, income splitting, and capital gains strategies.

- Reader-Friendly Format: Written in an engaging and easy-to-understand style, making complex tax concepts accessible to all entrepreneurs.

- Proven Track Record: Join over 40,000 small business owners who have relied on this classic guide to enhance their tax strategies.

- Updated Information: The fifth edition is freshly updated to reflect the latest tax regulations, ensuring you stay compliant and informed.

Personal Experience

As I delved into the pages of Make Sure It’s Deductible, I found myself reflecting on my own journey as a small business owner. The world of taxes can often feel overwhelming, and I remember the first time I faced the daunting task of filing my business taxes. There were so many questions swirling in my mind: What can I deduct? Am I missing out on potential savings? This book, with its clear and approachable style, felt like a guiding light in that chaotic time.

One of the most relatable insights I gleaned from Evelyn Jacks’ expertise is the importance of knowing which expenditures are fully deductible and which ones might be restricted. I recall a moment of relief when I read about common deductions that I had overlooked, like home office expenses. It made me realize that I wasn’t just spending money; I was also investing in my future, and I could maximize those investments with the right knowledge.

As I continued to explore the book, I was particularly drawn to the section on hiring family members and splitting income. It struck a chord with me because I had often considered involving my loved ones in my business. The idea of not only strengthening family bonds but also creating a financial strategy together felt empowering. It’s those little-known tips that can truly make a difference in our financial landscape.

Here are a few key points that resonated with me:

- Understanding the nuances of deductible versus restricted expenses.

- The financial benefits of claiming expenses under new auto and home office rules.

- Strategies for hiring family members to optimize income splitting.

- Insights on building wealth through capital gains deductions.

- Planning for a secure lifestyle, both now and in retirement.

This book isn’t just about numbers; it’s about taking control of your financial future. Each page inspired me to think differently about my business and how I approach taxes. I could almost hear Evelyn Jacks encouraging me along the way, urging me to seize every opportunity to save and grow. For anyone who has ever felt lost in the tax maze, this book is a treasure trove of practical wisdom that can truly resonate on a personal level.

Who Should Read This Book?

If you’re a Canadian small business owner, freelancer, or entrepreneur looking to maximize your profits and minimize your tax liabilities, then Make Sure It’s Deductible: Little-Known Tax Tips for Your Canadian Small Business is the perfect book for you! Whether you’re just starting out or have been in business for years, this book is a treasure trove of practical tax advice tailored specifically for your needs.

Here’s why this book is an invaluable resource:

- Small Business Owners: If you own a small business, you’ll find essential strategies to help you claim every legitimate deduction available, enabling you to keep more of what you earn.

- Freelancers and Contractors: Learn how to navigate tax laws that apply specifically to self-employed individuals, ensuring you don’t leave money on the table at tax time.

- New Entrepreneurs: Just starting your business? This book provides a solid foundation in tax planning that will set you up for success from day one.

- Financially Savvy Individuals: If you’re interested in building wealth and planning for your future, the insights on capital gains deductions and income re-investment strategies will be particularly beneficial.

- Family Business Owners: Discover the advantages of hiring family members and splitting income to optimize your tax situation.

With its clear and friendly style, Evelyn Jacks makes complex tax concepts easy to understand and apply, ensuring you can confidently navigate the world of small business taxes. Join the thousands of entrepreneurs who have already benefited from this essential guide and take control of your financial future!

Make Sure It’s Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth Edition

Key Takeaways

If you’re a Canadian small business owner or considering starting one, “Make Sure It’s Deductible” is a must-read. Here are the key insights and benefits you can expect from this invaluable guide:

- Maximize Deductions: Learn which business expenses are fully deductible and how to make the most of every tax deduction available to you.

- New Tax Rules Explained: Understand the latest auto and home office expense claims to ensure you’re compliant and maximizing your benefits.

- Income Splitting Strategies: Discover how hiring family members can help you reduce your tax burden and keep more of your earnings.

- Wealth Building Tips: Gain insights into leveraging capital gains deductions and reinvesting income for long-term financial growth.

- Retirement Planning: Get practical advice on preparing for a secure lifestyle both now and in retirement through effective tax strategies.

- Audit-Proof Your Business: Equip yourself with knowledge to run a tax-efficient business that stands up to audits.

- Trusted Expertise: Benefit from the wisdom of Evelyn Jacks, a highly respected tax author and educator, whose insights have already helped over 40,000 entrepreneurs.

Final Thoughts

If you’re a small business owner in Canada, “Make Sure It’s Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth Edition” by Evelyn Jacks is an invaluable resource that you simply can’t afford to miss. This book is designed to help you maximize your profits by uncovering every legitimate tax deduction available to you. With its friendly and accessible writing style, Evelyn Jacks has made complex tax concepts easy to understand and apply, ensuring that you can take full advantage of the tips and strategies provided.

Here’s why this book is a worthwhile addition to your collection:

- Gain insights into fully deductible expenditures and those that are restricted.

- Learn how to navigate new auto and home office expense claims.

- Discover strategies for hiring family members and splitting income to retain more of your earnings.

- Explore how to build wealth using capital gains deductions and wise reinvestment approaches.

- Plan for both a secure present and a comfortable retirement.

Join the ranks of over 40,000 entrepreneurs who have benefited from this tax-saving classic. As noted by Gordon Pape, a bestselling author and trusted editor, this book could save you thousands of tax dollars, whether you are self-employed, running a small business, or contemplating starting one.

Don’t leave your hard-earned money on the table! Equip yourself with the knowledge you need to run a tax-efficient and audit-proof business. Purchase “Make Sure It’s Deductible” today!