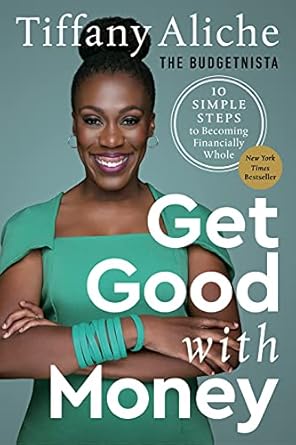

Transform your relationship with money and achieve financial wholeness with “Get Good with Money: Ten Simple Steps to Becoming Financially Whole” by Tiffany Aliche, the beloved Budgetnista. This New York Times bestseller offers a practical, ten-step plan designed to empower you, whether you’re just starting your financial journey or looking to improve your existing strategies. Say goodbye to overwhelming money management systems and hello to a realistic, achievable approach that has already inspired over a million women worldwide.

In this invaluable guide, you’ll discover actionable insights and tools, including checklists, worksheets, and expert advice from Tiffany’s trusted “Budgetnista Boosters.” From assessing your spending habits to maximizing your savings and investments, “Get Good with Money” provides the clarity and support you need to make your financial dreams a reality. Start building a solid foundation for a rich and fulfilling life today!

Get Good with Money: Ten Simple Steps to Becoming Financially Whole

Why This Book Stands Out?

- Proven Success: “Get Good with Money” is a New York Times, Wall Street Journal, and USA Today bestseller, making it a highly trusted resource for anyone seeking financial improvement.

- Accessible 10-Step Plan: Tiffany Aliche, known as the “Budgetnista,” offers a straightforward ten-step formula designed for achieving financial security and peace of mind, regardless of your starting point.

- Real-Life Experience: The author shares her personal journey from financial struggle to success, providing relatable insights that resonate with readers facing similar challenges.

- Comprehensive Tools: The book includes helpful checklists, worksheets, and a toolkit of resources, making it easy to apply the principles and track your progress.

- Focus on Financial Wholeness: Unlike typical get-rich-quick schemes, this book emphasizes building wealth through financial wholeness, promoting sustainable habits for long-term success.

- Expert Insights: Gain access to advanced advice from the author’s trusted “Budgetnista Boosters,” offering additional strategies and perspectives to enhance your financial journey.

- Practical Assessments: The book features tools to identify whether you have a spending or earning issue, helping you tailor your approach for effective solutions.

- Legacy Planning: Learn how to safeguard your beneficiaries’ futures and ensure your financial wishes are honored, providing peace of mind for you and your loved ones.

Personal Experience

As I delved into “Get Good with Money,” I couldn’t help but feel a deep sense of connection with Tiffany Aliche’s journey. Like many, I’ve faced financial ups and downs, often feeling overwhelmed by the sheer complexity of managing my money. Tiffany’s story resonated with me on a personal level, as I too have experienced the anxiety that comes from financial uncertainty. Her candidness about hitting rock bottom and her determination to rise above it inspires hope and serves as a reminder that it’s never too late to take control of your financial future.

One of the aspects that struck me most was her ten-step plan. It’s not just a list of tips; it feels like a roadmap crafted from real-life experiences. I appreciated how each step is actionable and relatable, guiding readers through the process of achieving financial wholeness. It made me reflect on my own budgeting practices and consider how I can apply these principles to my life. Here are a few key insights that resonated with me:

- Understanding Your Budget: The idea of the “noodle budget” was particularly enlightening. I realized I often avoid looking closely at my expenses, but Tiffany’s method encourages a proactive approach, making budgeting feel less daunting.

- Identifying Financial Issues: The assessment tool she provides helped me recognize whether my struggles stem from not earning enough or from overspending. This clarity is empowering and sets the stage for real change.

- Saving for the Future: Tiffany’s advice on saving for emergencies and big purchases made me rethink my savings strategies. It’s comforting to have practical steps to prepare for life’s unpredictability.

- Credit Score Management: I found her insights on taking charge of your credit score particularly useful. With everything we hear about credit, having a clear plan to improve it feels like a valuable addition to my financial toolkit.

- Protecting Your Legacy: The emphasis on planning for beneficiaries struck a chord with me. It’s a reminder that financial health isn’t just about the present; it’s about securing a future for those we love.

Reading “Get Good with Money” felt like having a trusted friend alongside me, guiding me through the often intimidating world of personal finance. Tiffany’s warmth and encouragement shine through every page, making it clear that no matter where you are in your financial journey, there’s always a path forward. It’s more than just a book; it’s a lifeline for anyone looking to cultivate healthier financial habits and a deeper sense of peace with their money.

Who Should Read This Book?

If you’re feeling overwhelmed by your finances or simply want to take charge of your money, then Get Good with Money: Ten Simple Steps to Becoming Financially Whole is the perfect book for you! Whether you’re just starting out on your financial journey or looking to refine your existing knowledge, Tiffany Aliche’s practical advice is designed to meet you where you are and guide you to where you want to be.

This book is especially beneficial for:

- Young Professionals: If you’re navigating your first job and trying to balance student loans with saving for your future, Tiffany’s simple steps will help you build a solid financial foundation.

- Women Seeking Financial Empowerment: With a focus on helping women overcome unique financial challenges, this book speaks directly to those looking to gain confidence in managing their money.

- Anyone Struggling with Debt: If you’re feeling trapped by debt, Tiffany’s straightforward strategies will provide you with actionable steps to regain control and start your journey toward financial freedom.

- Families Looking to Budget Wisely: Parents and caregivers can benefit from the budgeting techniques and saving tips that help create a secure financial environment for their loved ones.

- Individuals Ready to Build Wealth: Whether your goal is to save for a home, invest for the future, or simply have a safety net, Tiffany’s insights will empower you to make informed financial decisions.

This book doesn’t just offer theory; it provides practical tools like checklists and worksheets that make financial planning approachable and engaging. With Tiffany’s guidance, you’ll feel inspired and equipped to build a life that’s rich in every way!

Get Good with Money: Ten Simple Steps to Becoming Financially Whole

Key Takeaways

If you’re looking to gain control over your finances and achieve your financial goals, “Get Good with Money” by Tiffany Aliche offers invaluable insights and practical steps. Here are the key takeaways from the book:

- Ten-Step Formula: Discover a straightforward ten-step plan designed to help you attain financial security and peace of mind, regardless of your starting point.

- Financial Wholeness: Learn the concept of building wealth through financial wholeness, focusing on sustainable, long-term strategies instead of get-rich-quick schemes.

- Practical Tools: Access helpful checklists, worksheets, and resources that simplify the process of managing your finances and achieving your goals.

- Baseline Budgeting: Master a simple technique to establish your “noodle budget,” allowing you to assess your expenses and create a plan to fulfill your dreams.

- Spending Assessment: Utilize an assessment tool to identify whether your financial struggles stem from insufficient income or excessive spending, with actionable solutions for both scenarios.

- Emergency Savings: Learn best practices for saving for unexpected expenses, major purchases, and investments to secure your future.

- Credit Management: Gain detailed advice on improving your credit score, automating bill payments, and understanding your insurance needs.

- Legacy Planning: Understand how to protect your beneficiaries’ future and ensure your financial wishes are honored long-term.

This book is not just a guide; it’s a roadmap to cultivating good financial habits and making your money work for you, setting the stage for a rich life and legacy.

Final Thoughts

If you’re looking to take control of your financial future, Get Good with Money by Tiffany Aliche is a must-read. This inspiring book is not just a guide; it’s a comprehensive roadmap that offers a ten-step plan designed to help you achieve financial peace and security. Whether you’re just starting your journey or looking to refine your existing financial habits, Tiffany’s practical advice and relatable anecdotes make complex financial concepts accessible to everyone.

- Learn how to manage debt effectively and create a sustainable budget.

- Discover ways to save for both short-term needs and long-term goals.

- Gain insights on improving your credit score and automating your finances.

- Understand the importance of protecting your financial legacy and ensuring your wishes are honored.

Tiffany’s approach emphasizes financial wholeness over get-rich-quick schemes, making it a realistic and achievable guide for anyone. With engaging worksheets, checklists, and expert advice, you’ll find yourself motivated to take actionable steps toward a brighter financial future.

Don’t hesitate to invest in your financial wellbeing. Make Get Good with Money a part of your reading collection today, and empower yourself to create the financial life you’ve always dreamed of. Purchase the book now!