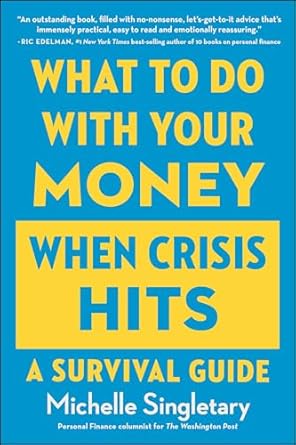

Are you feeling overwhelmed by financial uncertainties? Whether it’s a pandemic, recession, or unexpected expense, crises can strike at any moment. In “What To Do With Your Money When Crisis Hits: A Survival Guide,” award-winning personal finance columnist Michelle Singletary provides the essential strategies you need to navigate these turbulent times. This practical guide addresses your most pressing questions—like which bills to prioritize, when to dip into savings, and how to manage your investments during market fluctuations—equipping you with the knowledge to transform potential disasters into manageable challenges.

With clear, actionable advice, this book is your go-to resource for maintaining financial stability when it matters most. Michelle’s warm, conversational tone makes it feel like you’re chatting with a trusted friend, ready to help you weather any storm. Don’t let a financial crisis catch you off guard; empower yourself with the tools to secure your wealth and future today!

What To Do With Your Money When Crisis Hits: A Survival Guide

Why This Book Stands Out?

- Expert Insights: Written by award-winning personal finance columnist Michelle Singletary, this guide offers years of professional experience and wisdom, ensuring you receive credible advice.

- Practical Solutions: The book addresses real-life financial challenges with actionable strategies, helping you navigate crises with confidence.

- Comprehensive Coverage: From prioritizing bills to managing debt and cash-flow issues, it tackles a wide range of financial matters that arise during tough times.

- Calm in the Storm: Singletary provides guidance on maintaining composure during market downturns, empowering readers to make informed decisions rather than panic.

- Preparation for the Future: It not only addresses current crises but also equips you with tools to prepare for potential future downturns, securing your financial well-being.

Personal Experience

As I flipped through the pages of “What To Do With Your Money When Crisis Hits: A Survival Guide,” I couldn’t help but reflect on my own financial journey. We’ve all faced moments that felt like our world was turning upside down, whether it was a sudden job loss, unexpected medical bills, or the uncertainty that comes with economic downturns. Michelle Singletary’s insights resonated deeply with me, reminding me of the times I wished I had a roadmap to navigate those turbulent waters.

One story that stood out was when I found myself in a pinch during a recession. Bills piled up, and the anxiety of making the right financial decisions often felt overwhelming. As I read through Michelle’s guidance on prioritizing bills, I could almost feel the weight lifting off my shoulders. It was a relief to know that I wasn’t alone in my struggles, and that there were practical steps I could take to regain control.

Here are a few key points that really struck a chord with me:

- Understanding What Bills to Pay First: The clarity in knowing which expenses are truly essential versus those that can wait was a game-changer for me.

- Dipping into Savings: Michelle’s advice on when it’s appropriate to use savings made me rethink my approach to financial security.

- Cutting Back on Spending: The straightforward strategies for reducing expenses opened my eyes to areas in my budget that I could easily adjust without sacrificing too much comfort.

- Staying Calm in a Down Market: Learning how to manage the emotional rollercoaster that comes with market fluctuations was invaluable, and I found solace in the practical tips provided.

- Identifying Scams: In an age where opportunities can sometimes feel misleading, Michelle’s insights helped me develop a critical eye, ensuring I’m not swayed by fleeting trends.

This book is more than just a collection of advice; it’s a lifeline for those of us who have felt the sting of financial uncertainty. It serves as a reminder that with the right knowledge and tools, we can transform our approach to money management, especially in times of crisis. Whether you’re currently facing a challenge or simply want to prepare for the inevitable ups and downs of life, this guide feels like a trusted friend, ready to help you navigate through the storm.

Who Should Read This Book?

If you’ve ever felt anxious about your financial future, or if you’re simply looking to be better prepared for life’s unexpected challenges, then this book is tailor-made for you. “What To Do With Your Money When Crisis Hits” is a must-read for anyone who wants to take control of their finances, especially during tough times. Here are some key groups of readers who will find immense value in this guide:

- Individuals Facing Financial Uncertainty: If you’re currently navigating a financial crisis—be it job loss, medical expenses, or other emergencies—this book offers practical steps to manage your money effectively and reduce stress.

- Young Professionals: Just starting out in your career and want to build a solid financial foundation? This guide helps you understand how to prioritize your spending and savings, ensuring you’re ready for any bumps in the road.

- Families: Parents juggling multiple expenses can benefit from Michelle Singletary’s advice on budgeting and cutting costs without sacrificing quality of life. It’s all about making informed choices for your family’s future.

- Investors: If you’re worried about market downturns and want to know how to react calmly, this book provides strategies for maintaining your investment perspective during volatile times.

- Anyone Seeking Financial Literacy: Whether you’re a novice or a seasoned financial planner, this book breaks down complex financial concepts into easy-to-understand language, empowering you to make smarter choices.

Ultimately, this book is perfect for anyone who wants to transform fear into knowledge and insecurity into confidence. It’s not just about surviving a crisis; it’s about thriving in your financial life, regardless of the challenges that come your way. So if you’re ready to take charge of your financial destiny, grab a copy and start your journey today!

What To Do With Your Money When Crisis Hits: A Survival Guide

Key Takeaways

This book is an essential guide for anyone looking to navigate financial crises with confidence and clarity. Here are the key insights and benefits you can expect:

- Prioritization of Bills: Learn which bills are crucial to pay first during tough financial times to maintain stability.

- Smart Savings Strategies: Understand when it’s appropriate to dip into savings and how to do so wisely.

- Effective Spending Cuts: Discover practical methods to cut back on spending without sacrificing your quality of life.

- Managing Market Panic: Gain strategies to keep your composure when the stock market experiences downturns.

- Identifying Opportunities: Learn how to distinguish between legitimate investment opportunities and potential scams during a crisis.

- Debt and Credit Solutions: Get insights on handling debt concerns and credit card issues effectively in times of financial strain.

- Cash Flow Management: Acquire tools to manage cash-flow problems and maintain financial health.

- Long-term Wealth Security: Equip yourself with strategies to secure your wealth and ensure a stable financial future.

Final Thoughts

In “What To Do With Your Money When Crisis Hits: A Survival Guide,” Michelle Singletary offers invaluable insights and practical strategies to navigate the turbulent waters of financial uncertainty. This book is not just a guide; it’s a lifeline for anyone looking to safeguard their financial future during crises, whether they arise from global pandemics, economic downturns, or personal financial setbacks.

With her seasoned experience as an award-winning personal finance columnist, Michelle addresses the most pressing questions that arise when money becomes tight. Readers will find clarity on topics such as:

- Which bills to prioritize during a financial crunch

- When to dip into savings wisely

- Effective strategies to cut back on spending

- How to maintain composure in a volatile stock market

- Identifying genuine opportunities versus scams

This hands-on guide is essential for both those currently facing financial challenges and those looking to prepare for future uncertainties. With its straightforward advice on debt management, cash-flow issues, and credit card concerns, this book is a must-have resource in your financial toolkit.

Don’t wait for the next crisis to hit—arm yourself with the knowledge that can make a difference. Invest in your financial education and peace of mind by purchasing this insightful guide today. Click here to buy now: What To Do With Your Money When Crisis Hits.