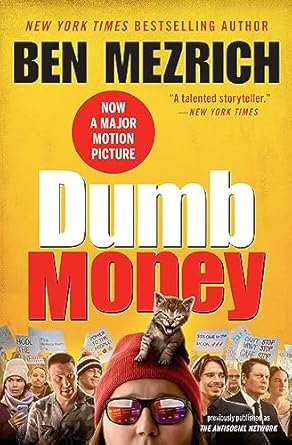

Discover the thrilling saga of “The Dumb Money: The GameStop Short Squeeze and the Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees,” a captivating read that dives into one of the most electrifying events in financial history. Written by bestselling author Ben Mezrich, this book recounts how a group of everyday investors on the WallStreetBets subreddit turned the tables on Wall Street titans, igniting a battle that shook the foundations of the financial world. Named a Best Book of the Year by the New York Post, it’s an unforgettable tale of ambition, risk, and the unexpected power of the individual.

Join Mezrich as he paints a vivid picture of the characters involved—from hedge fund giants to ordinary traders—who all played a role in the GameStop phenomenon. With pulse-pounding prose and an engaging narrative, “The Dumb Money” offers not just a recount of events, but an insightful look into the future of investing and the shifting dynamics of power in the marketplace. If you’re looking for a gripping exploration of rebellion against the establishment, this book is a must-read!

The Dumb Money: The GameStop Short Squeeze and the Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees (Previously Published as The Antisocial Network)

Why This Book Stands Out?

- Authentic Storytelling: Ben Mezrich, renowned for his compelling narratives, brings to life the incredible saga of the GameStop short squeeze with his signature engaging style.

- Real-Life Drama: Experience the thrilling events as a ragtag group of amateur traders takes on Wall Street giants, transforming a meme-filled subreddit into a battleground for financial supremacy.

- Unforgettable Characters: Meet an eclectic cast, from everyday heroes like nurse Kim Campbell to iconic billionaires, each navigating a world turned upside down by a collective grassroots movement.

- Timely and Relevant: As a pivotal moment in financial history, this book captures the essence of a revolution that challenges the status quo and redefines the landscape of investing.

- In-Depth Analysis: Gain insights into the motivations and strategies behind the trades, revealing the complexities of modern finance in an accessible and entertaining way.

- Critical Acclaim: Recognized as a Best Book of the Year by the New York Post, this title is a must-read for anyone interested in finance, culture, or the power of collective action.

Personal Experience

Reading The Dumb Money: The GameStop Short Squeeze was like diving into a rollercoaster ride of emotions and revelations. As I turned each page, I found myself reflecting on my own experiences with investing, risk-taking, and the unpredictable nature of the financial world. This book isn’t just about stocks and hedge funds; it’s a vivid portrayal of the power dynamics between ordinary people and financial giants, something that truly resonates with me.

Here are a few personal insights that stood out to me during my reading:

- Empowerment through Knowledge: Just like the amateur traders on WallStreetBets, I’ve often felt the exhilaration of learning something new and using that knowledge to make bold decisions. This book captures that feeling perfectly, showcasing how information can empower individuals to challenge the status quo.

- The Thrill of Community: I was reminded of the times I’ve connected with others over shared interests—whether it’s discussing financial strategies or simply sharing memes. The camaraderie depicted among the traders on Reddit made me reflect on how community can amplify personal experiences, giving us confidence to take risks we might shy away from alone.

- Facing Uncertainty: The unpredictability of the stock market mirrors many aspects of life. Just as the traders faced the unknown during the GameStop saga, I’ve had my own moments of uncertainty in personal and professional choices. This book brilliantly illustrates that while the stakes can be high, it’s often the journey through uncertainty that leads to growth.

- Heroes Among Us: The portrayal of everyday individuals stepping up to challenge financial titans made me think about the unsung heroes in my own life. It’s a reminder that courage can come from the most unexpected places, inspiring me to appreciate the small victories in my own battles.

Ultimately, The Dumb Money isn’t just a retelling of a significant financial event; it’s an exploration of human resilience, community, and the ever-present struggle against the odds. It’s a book that invites readers to reflect on their own journeys, making it not just a story of others, but a mirror reflecting our shared experiences and aspirations.

Who Should Read This Book?

If you’re curious about the wild world of finance, the GameStop saga, or just love a good underdog story, then The Dumb Money is the perfect read for you! This book dives deep into a fascinating moment in financial history that shook Wall Street to its core, making it a must-read for several types of readers:

- Investors and Traders: Whether you’re a seasoned investor or a newcomer to the stock market, this book offers insights into the dynamics of trading, market psychology, and the power of community in investing. You’ll gain a deeper understanding of how everyday people can influence massive financial institutions.

- Finance Enthusiasts: If you enjoy following financial news and trends, this book provides an engaging narrative that goes beyond the headlines. It gives you a front-row seat to the events that unfolded during the GameStop short squeeze, making complex financial concepts accessible and entertaining.

- Students and Young Adults: For those just starting their journey in finance or entrepreneurship, this book serves as an inspiring example of how a group of amateur traders harnessed the power of social media and community to challenge the status quo. It’s a modern-day David vs. Goliath tale that can motivate and educate young readers.

- Fans of True Stories: If you love gripping narratives based on true events, The Dumb Money captures the drama, excitement, and unpredictability of the stock market in a way that reads like a thriller. You’ll find yourself rooting for the underdogs as they navigate their way through uncharted territories.

- Social Media Users: Anyone who spends time on platforms like Reddit or Twitter will appreciate the role that social media played in this saga. The book highlights how online communities can create real-world impact, making it highly relatable for those engaged in today’s digital landscape.

This book isn’t just about numbers and charts; it’s about people, passion, and the unexpected twists of fate that can change lives overnight. So if any of this resonates with you, grab a copy of The Dumb Money and get ready for a thrilling ride!

The Dumb Money: The GameStop Short Squeeze and the Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees (Previously Published as The Antisocial Network)

Key Takeaways

Ben Mezrich’s “The Dumb Money” offers a riveting exploration of the GameStop short squeeze phenomenon, presenting crucial insights into the evolving landscape of finance and investment. Here are the key takeaways from the book:

- David vs. Goliath Narrative: The book illustrates the power dynamics between amateur traders and established financial giants, showcasing how ordinary individuals can disrupt the status quo.

- The Rise of Retail Investors: It highlights the growing influence of retail investors, particularly through platforms like Reddit’s WallStreetBets, and their ability to impact major stock market events.

- Understanding Market Mechanics: Readers will gain insights into the mechanics of short selling, hedge funds, and the risks associated with market speculation.

- Character-Driven Storytelling: The narrative is filled with compelling characters, from everyday traders to billionaires, making complex financial concepts relatable and engaging.

- Lessons on Risk and Reward: The book examines the unpredictable nature of investing, emphasizing both the potential for significant gains and the risks of substantial losses.

- Cultural Impact of Meme Trading: It delves into how internet culture and memes have transformed trading into a social phenomenon, affecting how people perceive and engage with the stock market.

- The Future of Wall Street: Mezrich provides a thought-provoking look at how the events surrounding GameStop may signal a shift in the financial landscape and the way we invest.

Final Thoughts

If you’re looking for a riveting tale that combines the thrill of high-stakes finance with the underdog spirit of everyday individuals, then The Dumb Money: The GameStop Short Squeeze is a must-read. Bestselling author Ben Mezrich masterfully recounts the extraordinary events surrounding the GameStop frenzy, where a group of amateur traders took on Wall Street’s titans and emerged victorious, if only for a moment. This book not only captures the electrifying atmosphere of those pivotal days but also delves into the personalities involved, from hedge fund managers to the passionate Redditors who sparked a financial revolution.

Here are a few reasons why this book deserves a spot on your bookshelf:

- Engaging Narrative: Mezrich’s storytelling draws you in, making complex financial concepts accessible and entertaining.

- Inspiring Characters: Meet the everyday heroes and heroines who dared to challenge the status quo, reminding us all of the power of collective action.

- Historical Insight: Gain a deeper understanding of a pivotal moment in financial history that has implications for the future of investing.

This gripping account of the GameStop saga is more than just a financial story; it’s a reflection of our times, where technology and community can reshape the landscape of finance. Don’t miss out on this opportunity to explore a fascinating chapter in modern history. Purchase your copy today and join the conversation about what it means to invest in the future!