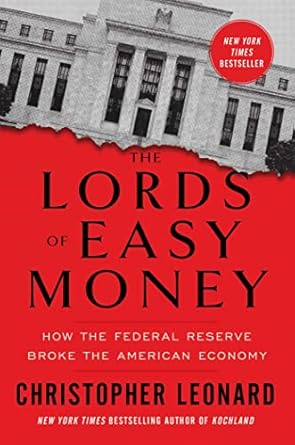

If you’re curious about the forces shaping today’s economy, look no further than *The Lords of Easy Money: How the Federal Reserve Broke the American Economy*. This New York Times bestseller by acclaimed business journalist Christopher Leonard takes you on a gripping journey inside the Federal Reserve, revealing how its recent policies have fueled income inequality and jeopardized economic stability. With the Federal Reserve often hailed as a hero, Leonard uncovers the darker side of its actions, particularly the radical experiment of quantitative easing that has transformed the American financial landscape.

In this eye-opening narrative, Leonard expertly illustrates how the Fed’s decisions have left the middle class struggling, while stock prices soar, and corporate debt reaches alarming heights. *The Lords of Easy Money* is not just a book; it’s a vital exploration of the economic realities we face today and a compelling warning about the future. Perfect for anyone interested in economics, this book will change the way you view financial systems and their impact on everyday life.

The Lords of Easy Money: How the Federal Reserve Broke the American Economy

Why This Book Stands Out?

- Inside Look at the Federal Reserve: Christopher Leonard’s investigative approach provides an unprecedented glimpse into the inner workings of one of America’s most enigmatic institutions.

- Timely Analysis: The book addresses crucial economic issues, including income inequality and financial instability, making it highly relevant in today’s socio-economic climate.

- Engaging Storytelling: Leonard weaves a compelling narrative that combines thorough research with captivating storytelling, drawing readers into the complexities of monetary policy.

- Critical Perspective: It challenges the conventional wisdom surrounding the Federal Reserve’s role in economic growth and crises, encouraging readers to rethink established beliefs.

- Expert Insights: With Leonard’s background as a seasoned business journalist, the book is rich with expert commentary and real-world implications of Federal Reserve policies.

- Must-Read for Economic Enthusiasts: Whether you’re a casual reader or a seasoned economist, this book offers valuable insights that will deepen your understanding of modern finance.

Personal Experience

As I delved into The Lords of Easy Money, I found myself reflecting on my own financial journey and the broader economic landscape we navigate today. Christopher Leonard’s exploration of the Federal Reserve’s influence on our economy struck a chord with me, as I’m sure it will with many readers. It’s hard not to feel a sense of urgency when you realize how the decisions made by a few can ripple through the lives of so many.

Many of us have felt the weight of rising income inequality and stagnant wages. Perhaps you, like me, have experienced the anxiety that comes with watching the cost of living rise while your paycheck remains the same. It’s a reality that isn’t just numbers on a page; it’s the difference between affording groceries or putting off a necessary car repair. Leonard’s narrative brings these concerns to the forefront, reminding us that our struggles are part of a larger story.

Here are a few key insights that resonated with my personal experiences:

- Understanding Debt: The book sheds light on the staggering levels of debt we face—credit cards, student loans, car payments. It made me reflect on my own financial choices and the pressures that come with them.

- Economic Instability: Leonard’s insights into how the Fed’s policies have contributed to market fluctuations made me rethink my savings strategy. The fear of economic downturns feels all too real when you consider how quickly things can change.

- Impact on the Middle Class: As someone who identifies with the middle class, I found the discussions around stagnant wages and job security particularly poignant. It’s a reminder that many of us are caught in a system that doesn’t seem to work in our favor.

- Hope for Understanding: The book provides a pathway to understanding the complex forces at play in our economy. It’s empowering to gain knowledge about these issues, and I felt a sense of solidarity with others who are seeking answers.

Reading The Lords of Easy Money is more than just an academic exercise; it’s a personal journey that resonates deeply with our individual experiences in today’s economy. As I turned each page, I felt a mix of frustration and hope—frustration for the challenges we face, but hope that understanding these issues can lead to meaningful change.

Who Should Read This Book?

If you’re someone who’s curious about the intricate workings of the American economy, or if you’ve ever wondered how we got to this point of stark income inequality and financial volatility, then The Lords of Easy Money is the perfect read for you. This book dives deep into the actions of the Federal Reserve and how its policies have shaped the economic landscape we navigate today.

Here’s why this book is a must-read for you:

- Economics Enthusiasts: If you have a passion for understanding economic principles, this book provides a fascinating insider’s look at the Federal Reserve’s strategies, particularly quantitative easing, which is crucial for grasping contemporary economic issues.

- Students and Scholars: For those studying economics, finance, or political science, Leonard’s detailed narrative offers real-world examples and critical analysis that can enhance your studies and provide context to theoretical concepts.

- Policy Makers and Activists: If you’re involved in shaping policies or advocating for economic reform, this book equips you with knowledge about the consequences of monetary policy decisions, which can inform your arguments and strategies for change.

- Concerned Citizens: If you’re simply a citizen who feels the weight of rising debts and stagnant wages, this book articulates your concerns and connects the dots between governmental actions and personal financial realities, empowering you with a deeper understanding of what’s at stake.

- Investors and Financial Professionals: For those in the finance industry, this book provides critical insights into the potential risks and bubbles created by current monetary policies, helping you make informed decisions in a market that may not reflect underlying economic health.

In short, The Lords of Easy Money is not just a book about economics—it’s a story of our times that invites you to think critically about the structures that affect us all. Engaging and enlightening, it’s a read that will leave you not just informed, but ready to engage with the world around you in a more impactful way.

The Lords of Easy Money: How the Federal Reserve Broke the American Economy

Key Takeaways

The Lords of Easy Money provides a deep dive into the impact of the Federal Reserve’s policies on the American economy, particularly emphasizing the consequences of quantitative easing. Here are the most important insights and lessons readers can expect from the book:

- Understanding the Federal Reserve: Gain insight into the inner workings of one of America’s most powerful institutions and how its decisions shape the economy.

- Impact of Quantitative Easing: Learn how the Fed’s radical intervention in 2010 led to a significant increase in the money supply and its long-term consequences.

- Income Inequality: Discover how the Fed’s policies have accelerated the gap between the rich and poor, contributing to unprecedented income inequality in America.

- Financial Stability Risks: Understand the risks associated with high corporate debt and inflated stock prices, and how these factors threaten economic stability.

- Historical Context: Explore the evolution of the Fed’s role in the economy, from being credited for economic growth to being blamed for financial crises.

- Consumer Debt Crisis: Examine the rising burden of credit card, car loan, and student debt on middle-class Americans and how it reflects broader economic issues.

- Warnings Ignored: Follow the narrative of the individuals who recognized the dangers of these policies and their attempts to sound the alarm.

- Future Implications: Reflect on the potential frightening future of the American economy if current trends continue unchecked.

Final Thoughts

“The Lords of Easy Money: How the Federal Reserve Broke the American Economy” by Christopher Leonard is a compelling and eye-opening exploration of the Federal Reserve’s role in shaping the economic landscape of the United States. This New York Times bestseller delves into the controversial policies of quantitative easing and reveals how they have contributed to the widening gap between the rich and poor, as well as the precarious state of our economy.

The book offers readers an in-depth understanding of complex economic concepts in an accessible manner, making it a valuable addition to any reader’s collection. Here are a few key takeaways:

- Insightful analysis of the Federal Reserve’s impact on income inequality.

- Thorough examination of the risks associated with unprecedented monetary policies.

- Engaging storytelling that brings to life the struggles of the American middle class.

- Timely warnings about the future implications of current economic practices.

Leonard’s investigation not only informs but also empowers readers to grasp the underlying forces shaping their financial reality. Whether you’re a seasoned economist or someone seeking to understand the economic challenges faced by everyday Americans, this book is a must-read.

Don’t miss out on this opportunity to enhance your understanding of the economy and its complexities. Purchase “The Lords of Easy Money” today and equip yourself with the knowledge to navigate the financial landscape of the future!