Discover the untold story behind the glitzy facade of Wall Street in “Confessions of a Wall Street Analyst.” This gripping memoir by Dan Reingold, a former top analyst, takes you on a rollercoaster ride through the corruption and chaos of the 1990s stock market bubble. Reingold pulls back the curtain on the insider dealings, corporate fraud, and the intense pressures that come with being at the forefront of the telecom sector. With a blend of humor and shocking revelations, he shares how his initial enthusiasm for Wall Street turned into disillusionment as he witnessed the rampant greed and ethical breaches that left investors in the lurch.

Perfect for anyone interested in finance, business ethics, or the real stories behind market trends, this book offers a front-row seat to one of the most tumultuous times in financial history. Whether you’re a seasoned investor or just curious about the inner workings of Wall Street, Reingold’s candid insights and captivating storytelling will keep you engaged from start to finish.

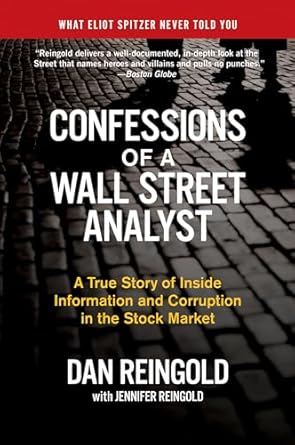

Confessions of a Wall Street Analyst: A True Story of Inside Information and Corruption in the Stock Market

Why This Book Stands Out?

- First-Hand Perspective: Dan Reingold’s unique position as a top Wall Street analyst provides readers with an insider’s view of the tumultuous financial landscape during the 1990s.

- Unflinching Honesty: This memoir pulls no punches, revealing the corruption and ethical breaches that plagued the stock market, making it a compelling narrative of moral decline.

- Engaging Storytelling: With a mix of outrageous, hilarious, and absurd anecdotes, Reingold’s storytelling captivates and entertains while delivering a serious message about greed.

- Key Industry Insights: Readers gain valuable insights into the inner workings of Wall Street, including the behind-the-scenes deal-making and corporate fraud that shaped the era.

- Timely Revelations: The book exposes how government investigators failed to address the ethical violations at the heart of the financial crisis, providing a sobering reflection on accountability.

- Rivalries and Relationships: Reingold’s encounters with notable figures like Jack Grubman and John Mack add depth to his narrative, illustrating the fierce competition and pressure within the industry.

Personal Experience

Reading “Confessions of a Wall Street Analyst” felt like taking a deep dive into the chaotic and often murky waters of the financial world. Dan Reingold’s candid storytelling resonates on multiple levels—whether you’re an investor, a finance enthusiast, or simply someone curious about the behind-the-scenes machinations of Wall Street. As I turned each page, I found myself reflecting on my own experiences and perceptions of trust, ambition, and the pursuit of success in a world that sometimes feels rigged.

- Revelation of Corruption: Like many, I’ve often viewed Wall Street through a lens of admiration, seeing it as a realm of opportunity and success. However, Reingold’s account starkly reveals the unsettling reality of corruption and greed. It was eye-opening to consider how much of the financial system can be influenced by self-interest and unethical practices.

- Relatable Ambition: Reingold’s journey from a passionate analyst to a disillusioned insider struck a chord with me. It reminded me of times in my own life when enthusiasm turned to skepticism as I encountered the harsh realities of various professional environments. His experiences serve as a cautionary tale about maintaining integrity while navigating ambition.

- Impact of Corporate Culture: The book highlights the toxic elements of corporate culture—lavish spending and the pressure to conform to questionable ethics. I couldn’t help but draw parallels to workplaces I’ve encountered, where the values often clash with the flashy façade. It prompts a personal reflection on the importance of cultivating a culture that prioritizes ethical behavior over mere profit.

- Lessons in Trust: Trust is a delicate currency, especially in business. Reingold’s experiences with leaks and secret deals made me think about how crucial it is to foster transparent and honest relationships, both personally and professionally. It’s a reminder of the importance of staying vigilant and questioning the “norms” when they feel off.

- Humor in Absurdity: Amid the serious themes, Reingold injects humor into his narrative, which made me laugh and reflect on the absurdity found in many aspects of life and business. It’s a reminder to not take everything too seriously and to find solace in shared experiences, even when they’re wrapped in chaos.

Overall, this memoir is more than just a recounting of financial shenanigans; it’s a personal journey that challenges readers to think critically about the systems we inhabit and the choices we make within them. Each story serves as a mirror, reflecting not just the world of finance but the broader human experience of navigating ethics, ambition, and the consequences of our actions.

Who Should Read This Book?

If you’ve ever been curious about the inner workings of Wall Street, or if you want to understand the complexities of the financial world during one of its most tumultuous periods, then Confessions of a Wall Street Analyst is a must-read for you. This book is perfect for a variety of readers, each gaining unique insights that can enhance their understanding of finance, ethics, and the human condition within high-stakes environments.

- Finance Students and Professionals: If you’re studying finance or already working in the industry, this book provides a candid look at the ethical dilemmas and corruption that can exist in high finance. Reingold’s experiences offer invaluable lessons about the importance of integrity and transparency.

- Investors: Whether you’re a seasoned investor or just starting out, Reingold’s account sheds light on the factors that can influence stock prices and the importance of due diligence. Understanding the behind-the-scenes activities of analysts and corporations can empower you to make better investment decisions.

- Business Enthusiasts: For those fascinated by corporate America and its inner workings, this memoir dives deep into the culture of greed and ambition that characterized the 1990s. It’s a gripping narrative that demonstrates how personal motivations can intersect with professional responsibilities.

- Readers Interested in Ethics: If you have a keen interest in ethics or corporate governance, Reingold’s revelations about the ethical lapses and the regulatory failures of the time will resonate with you. This book challenges you to think critically about the moral implications of business decisions.

- General Readers: If you simply enjoy a good story filled with drama, humor, and real-life intrigue, then this book is for you too! Reingold’s engaging writing style and memorable anecdotes make complex financial concepts accessible and entertaining.

Ultimately, Confessions of a Wall Street Analyst is more than just a memoir; it’s a revealing exposé that resonates with anyone who wants to grasp the realities behind the numbers and understand the human stories that drive the financial markets.

Confessions of a Wall Street Analyst: A True Story of Inside Information and Corruption in the Stock Market

Key Takeaways

“Confessions of a Wall Street Analyst” offers readers a compelling and eye-opening look into the inner workings of Wall Street during a tumultuous period in financial history. Here are the key insights and lessons you can expect from this book:

- Insider Perspective: Gain a firsthand account of the pressures and ethical dilemmas faced by financial analysts in a highly competitive environment.

- Corruption Revealed: Understand the extent of corruption and malpractice that occurred during the stock market bubble of the 1990s, highlighting systemic issues within Wall Street and corporate America.

- Impact of Corporate Culture: Learn how the culture of greed and ego shaped decision-making and led to significant financial scandals, including the WorldCom debacle.

- Lessons in Ethics: Explore the moral challenges analysts faced and the consequences of prioritizing profit over integrity in the financial sector.

- Behind-the-Scenes Stories: Enjoy engaging anecdotes that illustrate the absurdity and humor found in the high-stakes world of finance.

- Consequences for Investors: Recognize how the lack of accountability and transparency impacted investors, emphasizing the importance of ethical practices in finance.

- Historical Context: Place the events of the 1990s in the broader context of financial history, providing a cautionary tale for future generations.

Final Thoughts

“Confessions of a Wall Street Analyst” by Dan Reingold is not just a memoir; it is a gripping exposé of the dark underbelly of Wall Street during one of the most tumultuous periods in financial history. With a candid and personal narrative, Reingold takes readers on a journey through the highs and lows of the stock market bubble of the 1990s, revealing the shocking levels of corruption, greed, and ethical transgressions that plagued the industry.

This book is invaluable for anyone interested in understanding the complexities of Wall Street and the real stories behind the headlines. Here are some key takeaways:

- Insightful firsthand accounts of corporate fraud and insider dealings.

- Behind-the-scenes look at the fierce competition among top analysts.

- Revelations about the pressures faced by financial analysts from corporate executives and investment bankers.

- A humorous yet sobering portrayal of the excesses of Wall Street during the market boom.

- A cautionary tale about the consequences of unchecked greed and the failure of regulatory oversight.

Whether you’re a finance professional, a student of economics, or simply curious about the financial world, Reingold’s experiences offer invaluable lessons that resonate even today. This book serves as both an engaging read and an important reminder of the ethical responsibilities that come with financial power.

If you’re ready to dive into this captivating narrative and uncover the truths that shaped an era, I encourage you to purchase “Confessions of a Wall Street Analyst” today. You won’t regret adding this eye-opening memoir to your collection. Get your copy now!