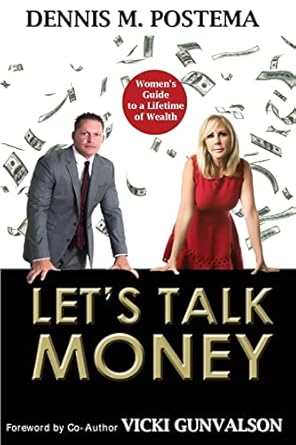

Empower your financial future with “Let’s Talk Money: Women’s Guide to a Lifetime of Wealth.” This essential guide addresses the unique challenges women face in building a secure retirement, a critical issue highlighted by alarming statistics showing that 70% of seniors living below the poverty level are women. With practical advice and straightforward strategies, this book is designed for women who aspire to break free from the cycle of financial insecurity and create a lasting income for their golden years.

“Let’s Talk Money” offers a wealth of knowledge tailored specifically for women, providing actionable insights to help you navigate the complexities of saving for retirement. From budgeting tips to investment strategies, this guide empowers you to take control of your financial destiny and combat the growing trend of poverty among older women. Discover how to build a robust financial foundation and ensure your retirement dreams become a reality.

Let’s Talk Money: Women’s Guide to a Lifetime of Wealth

Why This Book Stands Out?

- Targeted Guidance: Specifically addresses the unique financial challenges women face, particularly regarding retirement savings and income stability.

- Timely and Relevant: Highlights alarming statistics about women’s financial security, making the content urgent and necessary for today’s readers.

- Empowering Approach: Offers actionable advice for women to build a strong financial foundation and combat poverty trends affecting their demographic.

- Accessible Information: Provides straightforward and conservative strategies that are easy to understand and implement, catering to a wide audience.

- Comprehensive Resource: Serves as a complete guide for women at various stages of their financial journey, from budgeting to retirement planning.

- Focus on Longevity: Emphasizes the importance of creating a sustainable income that lasts throughout retirement, addressing a crucial aspect of financial planning.

Personal Experience

As you dive into “Let’s Talk Money: Women’s Guide to a Lifetime of Wealth,” you may find yourself reflecting on your own financial journey and the unique challenges you’ve faced as a woman in today’s world. This book speaks directly to those experiences, offering not just information, but a sense of solidarity and understanding. Here are some relatable insights and potential experiences that may resonate with you:

- Recognizing the Gap: You might relate to the statistics that highlight the financial struggles many women face, especially as they age. Understanding that you are not alone in this fight can be empowering.

- Addressing Financial Anxiety: The book could mirror your own feelings of anxiety about retirement savings, providing reassurance and practical strategies to tackle this head-on.

- Empowerment Through Knowledge: You may find that the straightforward advice inspires you to take control of your finances, transforming fear into action and knowledge into confidence.

- Real-Life Stories: The anecdotes and examples included may resonate with your personal experiences, allowing you to see reflections of your own life choices and financial decisions.

- Coping with Societal Pressures: The discussion around societal expectations and the unique pressures women face could echo your own challenges, making the content feel particularly relevant and relatable.

- Building a Support Network: You might be inspired to connect with others who share similar financial goals, fostering a community of support as you navigate your financial future.

Overall, “Let’s Talk Money” not only provides valuable insights but also resonates on a personal level, encouraging you to embrace your financial journey with confidence and resilience.

Who Should Read This Book?

“Let’s Talk Money: Women’s Guide to a Lifetime of Wealth” is ideal for a diverse range of readers who are looking to enhance their financial literacy and secure their financial future. The following groups will find this book particularly beneficial:

- Women in their 20s and 30s: Young women starting their careers can gain foundational knowledge on saving and investing for retirement.

- Women approaching retirement: Those in their 50s and 60s will find critical insights on how to maximize their retirement income and avoid common pitfalls.

- Caregivers: Women who may be caring for aging parents and need to understand financial planning for both generations.

- Financial educators: Professionals looking for resources to help guide their clients or students in financial planning tailored for women.

- Advocates for women’s financial empowerment: Anyone involved in organizations focused on women’s issues will find valuable information to support their mission.

This book offers practical advice, empowering women to take control of their financial destinies and combat the growing trend of poverty among older women. With straightforward guidance, readers will learn how to build lasting wealth and ensure a secure retirement.

Let’s Talk Money: Women’s Guide to a Lifetime of Wealth

Key Takeaways

“Let’s Talk Money: Women’s Guide to a Lifetime of Wealth” offers essential insights and practical strategies tailored specifically for women facing unique financial challenges. Here are the key takeaways from the book:

- Understanding Unique Financial Challenges: Recognizes the specific hurdles women face in retirement savings and income generation.

- Statistics on Poverty: Highlights alarming statistics regarding poverty rates among senior women, emphasizing the urgency of financial planning.

- Strategies for Wealth Building: Provides actionable advice for women to build a strong, lasting income throughout their lives.

- Empowerment Through Knowledge: Encourages women to take charge of their financial future with conservative and straightforward information.

- Long-Term Financial Planning: Guides readers on how to create a sustainable retirement income that can withstand economic challenges.

- Networking and Support: Stresses the importance of building a support network for financial education and empowerment.

- Financial Independence: Advocates for achieving financial independence and breaking the cycle of poverty that affects many women.

Final Thoughts

“Let’s Talk Money: Women’s Guide to a Lifetime of Wealth” is an essential resource for women navigating the complex landscape of financial planning and retirement. This book addresses the unique challenges women face in achieving financial security, especially as they age. With practical advice and straightforward strategies, it empowers readers to take control of their financial futures and combat the alarming trends of poverty among senior women.

- Offers a clear understanding of the financial obstacles women encounter.

- Provides actionable steps to build a sustainable income for retirement.

- Encourages financial literacy and confidence in money management.

- Addresses societal issues regarding women’s financial security.

Invest in your future and break free from the cycle of financial insecurity. This book is not just a guide; it’s a lifeline for women seeking to create a lasting legacy of wealth. Don’t wait—purchase “Let’s Talk Money” today and take the first step towards financial independence!