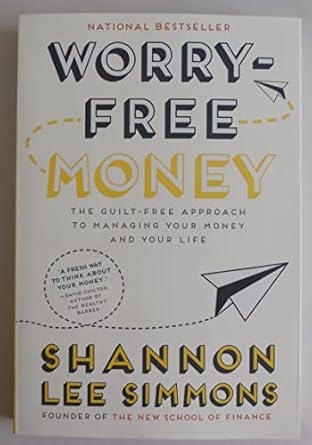

Discover a transformative approach to personal finance with “Worry-Free Money: The Guilt-Free Approach to Managing Your Money and Your Life” by Shannon Lee Simmons. A national bestseller, this groundbreaking book offers a refreshing perspective that empowers you to stop budgeting and start living. Designed for anyone feeling the pressure of modern financial demands, Simmons’ method promises clarity and peace of mind, whether you earn $30,000 or $130,000 a year.

Say goodbye to restrictive budgets that leave you feeling deprived and confused. With Worry-Free Money, you’ll learn practical strategies to manage your finances without the guilt. This insightful guide helps you understand the root causes of overspending, identify your “f*ck it” moments, and ultimately enjoy your hard-earned money. Join the thousands who have transformed their financial lives and embrace a guilt-free way to achieve your dreams!

Worry-Free Money: The guilt-free approach to managing your money and your life

Why This Book Stands Out?

- Fresh Perspective: Shannon Lee Simmons offers a modern approach to personal finance that resonates with the pressures of contemporary life, moving beyond traditional budgeting methods.

- Guilt-Free Spending: The book empowers readers to manage their money without guilt, focusing on enjoying life while being financially responsible.

- Real-Life Solutions: Worry-Free Money addresses the emotional aspects of spending, helping readers understand their financial behaviors and break the cycle of guilt and overspending.

- Practical Advice: Simmons provides actionable strategies that are deeply practical, equipping readers with tools to feel secure about their finances while enjoying their earnings.

- Relatable Voice: The author’s approachable and non-judgmental tone makes financial planning accessible and enjoyable for readers from all income levels.

- Focus on Emotional Well-Being: The book emphasizes the importance of mental well-being in financial management, addressing how feelings of being “broke” can impact spending habits.

Personal Experience

As you delve into the pages of Worry-Free Money, you may find yourself nodding along to Shannon Lee Simmons’ relatable insights. Many readers have felt the weight of financial stress, regardless of their income level. This book speaks to those moments when you open your wallet and feel an overwhelming sense of uncertainty. Here are some potential experiences you might resonate with:

- The Pressure to Keep Up: In an age where social media showcases the seemingly perfect lives of others, it’s easy to feel inadequate. You may find yourself questioning whether you can afford that new outfit or a dinner out with friends, leading to feelings of guilt and anxiety.

- Rigid Budgets that Don’t Work: If you’ve ever tried to stick to a strict budget, only to find yourself breaking it mere days later, Simmons’ approach may feel like a breath of fresh air. The frustration of budgeting can often lead to more spending and emotional turmoil, something many can relate to.

- Feeling Broke Regardless of Income: The feeling of being ‘broke’ can overshadow your finances, even if you’re earning a decent salary. Simmons addresses this emotional aspect, helping you understand that your feelings are valid and that you’re not alone in this struggle.

- Guilt-Free Spending: Imagine a world where you can enjoy your money without the nagging feeling of guilt. Simmons guides you towards recognizing your spending triggers and teaches you how to make informed choices that align with your values.

- Finding Joy in Financial Freedom: The ultimate goal of Worry-Free Money is to help you reclaim joy in your financial life. Readers often express a newfound sense of hope and control after applying Simmons’ principles, transforming their relationship with money.

Through engaging anecdotes and practical advice, this book offers a pathway to not just financial stability, but also personal liberation. You might find yourself inspired to rethink your approach to money and embrace a more fulfilling life, free from the shackles of guilt and stress.

Who Should Read This Book?

Worry-Free Money is a must-read for a diverse audience seeking a refreshing and practical approach to personal finance. This book is suitable for:

- Young Professionals: If you’re starting your career and facing the pressures of student loans, living expenses, and social expectations, this book will help you manage your finances without the burden of guilt.

- Anyone Feeling Financially Overwhelmed: If you feel broke despite a decent income, Shannon Lee Simmons offers insights that can shift your perspective and help you regain control over your spending.

- Budgeting Skeptics: For those who find traditional budgeting methods unrealistic and restrictive, this book presents an alternative that encourages enjoyment in spending while ensuring financial security.

- Individuals Struggling with Overspending: If you often find yourself making impulse purchases or regretting your financial decisions, this book will guide you to understand the roots of your spending habits and how to change them.

- Social Media Influenced Consumers: If you feel pressured to keep up with trends and lifestyles portrayed online, Simmons provides a framework to navigate these influences without compromising your financial health.

Overall, Worry-Free Money offers valuable insights and practical strategies that empower readers to manage their finances with confidence and ease.

Worry-Free Money: The guilt-free approach to managing your money and your life

Key Takeaways

Readers of Worry-Free Money can expect to gain valuable insights and practical strategies for managing their finances without the stress of traditional budgeting. Here are the key takeaways:

- Shift Your Mindset: Learn to stop viewing money through the lens of guilt and restriction, and start seeing it as a tool for living fully.

- Understand Your Spending Triggers: Identify the root causes of your spending habits and recognize why you might feel compelled to overspend.

- Rethink Budgeting: Discover why traditional budgeting methods may not work for you and explore a more flexible approach to managing your finances.

- Embrace Worry-Free Money: Implement a system that allows you to cover your essential expenses while still enjoying your money guilt-free.

- Avoid Unhappy Spending: Learn to distinguish between joyful spending and spending that leads to regret, and make more mindful choices.

- Recognize Your ‘F*ck It’ Moments: Understand the moments when you might impulsively spend and develop strategies to navigate them effectively.

- Find Joy in Financial Control: Experience the relief and empowerment that comes from taking control of your finances and planning for your future.

Final Thoughts

“Worry-Free Money” by Shannon Lee Simmons offers a refreshing perspective on personal finance that resonates with many who feel overwhelmed by traditional budgeting methods. This book stands out for its accessible approach, making financial management less about rigid constraints and more about living life fully while ensuring financial security.

Here are some key takeaways that highlight the book’s value:

- Innovative approach to managing money that prioritizes enjoyment over guilt.

- Insights into the psychological factors that lead to overspending.

- Practical strategies to break free from traditional budgeting traps.

- Encourages a positive relationship with money, emphasizing hope and fun.

Whether you’re struggling to make ends meet or simply want to enhance your financial well-being, this book provides the tools you need to take control of your finances without the stress. Don’t miss out on the opportunity to transform your financial life—purchase “Worry-Free Money” today!