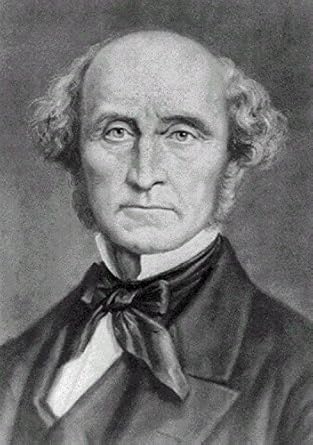

Discover the profound insights of John Stuart Mill in “The Income and Property Tax (Illustrated).” This captivating book delves into Mill’s critical analysis of income and property taxes from the historical perspectives of 1852 and 1861. With an active table of contents, navigating through Mill’s thought-provoking essays has never been easier. Whether you’re a student of economics or simply curious about tax equity, this book offers valuable perspectives that resonate in today’s discussions on fairness and taxation.

Mill, renowned as one of the most influential philosophers of the 19th century, raises essential questions about the fairness of income tax systems—issues that remain relevant across the globe. By exploring his foundational ideas, readers will gain a deeper understanding of the economic principles that continue to shape our society. Don’t miss out on this essential read that connects historical tax theories to contemporary debates!

The Income and Property Tax (Illustrated)

Why This Book Stands Out?

- Historical Insight: This book provides a unique glimpse into the evolution of income and property tax through John Stuart Mill’s critical essays from the 19th century, making it relevant to contemporary discussions on taxation.

- Active Table of Contents: Navigate effortlessly with an interactive table of contents that allows readers to jump directly to their desired chapters, enhancing the reading experience.

- Influential Thinker: Learn from one of history’s most pivotal philosophers, John Stuart Mill, whose ideas on fairness and equality in taxation continue to resonate today.

- Foundational Economics: Delve into the foundational principles of economics as Mill questions the fairness of the income tax system, providing a rich context for understanding modern economic policies.

- Lasting Impact: Mill’s work has influenced great thinkers like Henry George, linking this book to significant social and economic movements that have shaped America and beyond.

Personal Experience

As I delved into the pages of The Income and Property Tax (Illustrated), I found myself reflecting on my own experiences with taxes and the broader implications they have on society. It’s fascinating how John Stuart Mill’s insights from the 19th century still resonate with our modern conversations about fairness and equity in taxation. Have you ever sat down during tax season, feeling overwhelmed by the numbers and forms, and wondered about the fairness of the whole system? This book brings those feelings to the forefront.

Mill’s essays echo sentiments that many of us share today. His probing questions about the fairness of income tax touch on our personal beliefs and experiences. Whether we’re struggling to make ends meet or seeking to understand how our contributions support community services, Mill’s work invites us to think deeply about our role in the economic system.

- Relatable Reflections: Many readers might find themselves grappling with similar dilemmas as they read Mill’s discussions. Do we feel the burden of tax on our shoulders? Are we questioning whether we’re contributing our fair share?

- Historical Context: Understanding the origins of income and property tax through Mill’s essays can provide a sense of perspective. It’s a reminder that these debates are not new; they’ve been part of our societal fabric for centuries.

- Personal Growth: Engaging with Mill’s thoughts can inspire us to become more informed citizens. The book encourages us to think critically about policies that affect our lives, arming us with the knowledge to engage in meaningful discussions.

- Connection to Social Issues: As we explore Mill’s ideas, we might start connecting them to current social issues. How do they relate to today’s debates about wealth inequality, social justice, and economic reform?

In navigating the complexities of taxation through Mill’s profound insights, I felt a deeper connection not only to the economic theories but also to the very fabric of our society. It’s a journey that transcends mere numbers and forms, inviting us to ponder our shared responsibilities and the values we uphold as a community.

Who Should Read This Book?

If you’ve ever found yourself pondering the fairness of the income and property tax systems or simply want to dive deeper into the foundational thoughts that shape our economic policies today, then this book is tailor-made for you! Here’s why you should consider picking up The Income and Property Tax (Illustrated):

- Students of Economics: Whether you’re a budding economist or a seasoned scholar, John Stuart Mill’s insights offer a historical perspective that is essential for understanding contemporary discussions on taxation.

- Policy Makers and Analysts: If you work in government or the nonprofit sector, this book provides a critical lens through which to evaluate current tax policies and their implications for fairness and equality.

- History Buffs: For those fascinated by the evolution of economic thought, Mill’s essays from the 19th century are a treasure trove that connects past ideas to present challenges.

- Tax Professionals: Accountants, tax advisors, and financial planners will find invaluable context and philosophical grounding in the principles of taxation that can enhance their professional practice.

- Social Justice Advocates: If you’re passionate about equity and fairness in economic systems, Mill’s reflections will resonate with your mission, providing a thoughtful foundation for your advocacy.

In short, this book is not just for academics but for anyone who is curious about the principles that govern our economic systems. John Stuart Mill’s timeless insights will challenge you to think critically about taxation and its impact on society. Don’t miss out on the chance to engage with one of the greatest thinkers in economics!

The Income and Property Tax (Illustrated)

Key Takeaways

Reading “The Income and Property Tax (Illustrated)” offers valuable insights into the principles of taxation as explored by John Stuart Mill. Here are the key points that make this book a worthwhile read:

- Historical Context: Gain an understanding of income and property tax evolution through Mill’s essays from 1852 and 1861, providing a historical perspective on taxation.

- Philosophical Insights: Explore Mill’s critical examination of the fairness and equality of income tax, a topic that remains relevant in today’s economic discussions.

- Influence on Economic Thought: Discover how Mill’s ideas laid the groundwork for later economic thinkers, including Henry George, impacting modern economic policies.

- Active Table of Contents: Enjoy easy navigation through the book’s chapters, making it user-friendly for readers seeking specific insights.

- Engagement with Taxation Principles: Delve into foundational questions about taxation that provoke thought and discussion, relevant to both developed and developing nations.

- Legacy of Mill’s Work: Understand why John Stuart Mill is considered one of the founders of modern economics and how his thoughts continue to influence current debates on taxation.

Final Thoughts

If you’re intrigued by the intricate relationship between taxation and society, “The Income and Property Tax (Illustrated)” is a compelling exploration that you won’t want to miss. This book delves into the profound insights of John Stuart Mill, one of the most influential philosophers of the nineteenth century, as he examines the principles of income and property tax in two pivotal essays from 1852 and 1861. Mill’s thoughtful inquiries into fairness and equality in taxation remain remarkably relevant today, resonating with ongoing debates in both developed and developing nations.

Here are a few key reasons why this book is a valuable addition to your collection:

- Rich Historical Context: Understand the evolution of tax theory through Mill’s critical lens.

- Engaging Format: An active table of contents allows for easy navigation through the chapters.

- Influential Ideas: Discover how Mill’s work has shaped modern economic thought and influenced figures like Henry George.

- Timeless Relevance: Engage with ideas that continue to impact discussions on fairness in taxation today.

This book is a must-read for anyone interested in the philosophical underpinnings of economic policies and their societal implications. Don’t miss out on the opportunity to deepen your understanding of taxation through the eyes of one of history’s greatest thinkers. Purchase your copy today!