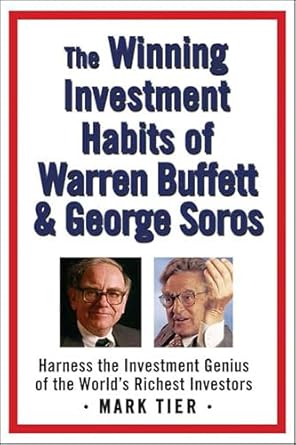

Unlock the secrets of successful investing with “The Winning Investment Habits of Warren Buffett & George Soros.” This compelling guide delves into the unique mental habits and strategies that propelled these legendary investors to billionaire status. Despite their differing approaches, Buffett, Icahn, and Soros share powerful principles that challenge conventional Wall Street wisdom—principles that you can adopt to enhance your own investment journey.

In this eye-opening book, Mark Tier reveals that true investment success doesn’t rely on diversification or following the crowd. Instead, it emphasizes focused decision-making, minimizing losses, and trusting your instincts. Discover how you can leverage the same strategies that have shaped the financial futures of the world’s wealthiest investors and start transforming your own investment results today!

The Winning Investment Habits of Warren Buffett & George Soros: Harness the Investment Genius of the World’s Richest Investors

Why This Book Stands Out?

- Uncovering Common Threads: The book reveals the surprising similarities in the investment strategies of Warren Buffett, Carl Icahn, and George Soros, despite their differing approaches.

- Challenging Conventional Wisdom: It boldly confronts Wall Street’s traditional investment mindset, offering fresh perspectives that empower readers to rethink their own strategies.

- Focus on Mental Habits: Discover the essential mental habits that drive the success of these billionaires, providing readers with actionable insights to enhance their own investment decisions.

- Direct Learning from Legends: Gain access to the wealth-building secrets of some of the world’s richest investors, allowing you to apply their strategies to your own portfolio.

- Humor and Insight: Enjoy a blend of humor and practical advice, as the author highlights Buffett’s witty take on analyst reports, making the learning experience enjoyable.

Personal Experience

As I delved into The Winning Investment Habits of Warren Buffett & George Soros, I found myself reflecting on my own journey with investing. Like many, I started with a mix of curiosity and a dash of anxiety. The world of finance can feel overwhelming, especially with all the noise from Wall Street and the pressure to diversify. However, this book opened my eyes to a different perspective—one that resonated deeply with my own experiences and aspirations.

Reading about how Buffett, Icahn, and Soros approached their investments made me realize that there’s a certain beauty in simplicity. Here are a few key insights that particularly struck a chord with me:

- Concentration over Diversification: I often felt compelled to spread my investments across multiple assets, fearing that putting all my eggs in one basket was too risky. But the idea that these titans of investing concentrated their efforts on a few key opportunities challenged my thinking. It encouraged me to trust my instincts and do deep research rather than follow the crowd.

- Mindset Matters: The notion that they didn’t invest for money but rather for the joy of the game was enlightening. It made me pause and consider my own motivations. Am I investing for financial gain alone, or is there a deeper passion driving me? This book pushed me to redefine my relationship with money and investing.

- Risk Management over Risk Taking: Understanding that true investing is more about avoiding losses than chasing profits was a revelation. I could relate to the fear of losing money, and it was reassuring to learn that even the best investors prioritize safeguarding their capital. This mindset shift has helped me approach my investments with a newfound sense of clarity and confidence.

- Independent Thinking: The idea that Buffett rarely reads analyst reports resonated with me. It’s easy to get swayed by popular opinion, but this book reinforced the importance of forming my own conclusions based on thorough analysis. It reminded me that sometimes, stepping away from the noise can lead to clearer insights.

Overall, this book felt like a conversation with a wise mentor, guiding me to rethink my strategies and align them more closely with the investment habits of some of the greatest minds in the field. It has inspired me to cultivate a mindset that embraces concentration, values independent thinking, and prioritizes risk management—habits that I hope will serve me well in my investment journey.

Who Should Read This Book?

If you’ve ever found yourself puzzled by the ups and downs of the stock market, or if you’re simply looking to enhance your investment game, then The Winning Investment Habits of Warren Buffett & George Soros is just the book for you. Here’s why it’s perfect for a variety of readers:

- Novice Investors: If you’re just starting out in the world of investing and feeling overwhelmed by the sheer amount of information available, this book cuts through the noise. It provides clear, actionable insights from some of the most successful investors in history.

- Experienced Investors: Even if you have some experience, you might find yourself stuck in conventional thinking. This book challenges traditional investment norms and encourages you to adopt unconventional strategies that could lead to greater success.

- Buffett and Soros Enthusiasts: If you admire Warren Buffett or George Soros and want to understand their mindset and investment habits in depth, this book dives deep into their mental frameworks, offering valuable lessons you can apply to your own portfolio.

- Financial Advisors: For those in the finance industry, this book is a must-read to gain a fresh perspective on investment strategies that can be shared with clients, helping them think outside the box.

- Self-Improvement Seekers: Beyond just investing, the mental habits discussed in this book can be applied to various aspects of life. If you’re looking to cultivate a mindset geared towards success, you’ll find valuable gems within its pages.

This book is not just about making money; it’s about transforming the way you think about investing. By understanding the unique habits of Buffett and Soros, you’ll be better equipped to navigate the complexities of the financial world and make decisions that align with your own goals. So, grab a copy and get ready to rethink your investment strategies!

The Winning Investment Habits of Warren Buffett & George Soros: Harness the Investment Genius of the World’s Richest Investors

Key Takeaways

This book offers invaluable insights into the investment strategies of some of the world’s most successful investors. Here are the key lessons you can expect to learn:

- Concentration Over Diversification: Buffett, Icahn, and Soros advocate for concentrating investments rather than spreading them thinly across many assets.

- Mindset Matters: The focus is not on immediate profits; instead, their mindset revolves around understanding the value of their investments.

- Risk Management: They believe that minimizing losses is more crucial than chasing big profits, emphasizing a protective approach to investing.

- Independent Thinking: These investors disregard conventional Wall Street advice and research reports, relying on their own analysis and insights.

- Behavioral Habits: The book highlights the mental habits that contribute to their success, encouraging readers to adopt similar practices.

- Practical Applications: Readers will learn how to apply these strategies to their own investment decisions to improve their financial outcomes.

Final Thoughts

In “The Winning Investment Habits of Warren Buffett & George Soros,” Mark Tier uncovers the powerful mental habits and strategies that have propelled some of the world’s richest investors to success. While their approaches may differ, the underlying principles they follow offer invaluable insights for anyone looking to enhance their investment acumen. This book not only challenges the conventional wisdom of Wall Street but also equips you with the tools to think differently about investing.

Here are some key takeaways from the book:

- Focus on concentrated investments instead of diversification.

- Prioritize capital preservation over profit-making.

- Trust your own research over Wall Street opinions.

- Learn the mental frameworks that guide successful investment decisions.

Whether you’re a seasoned investor or just starting out, the wisdom shared in this book can transform your investment strategy and results. Don’t miss the chance to learn from the best in the business. Take the next step towards financial success and invest in your future today!