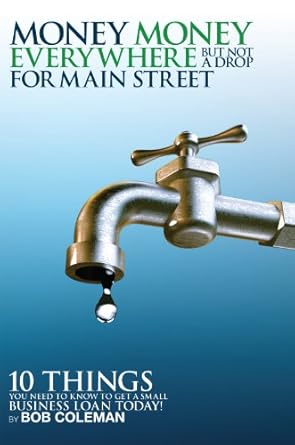

If you’ve ever felt the sting of economic downturns and wondered why it seems that Wall Street thrives while Main Street struggles, then “Money, Money Everywhere But Not a Drop for Main Street” is a must-read for you. In this eye-opening book, Bob Coleman, a leading expert on small business lending, delves into the aftermath of the 2008 financial crisis, revealing how the big banks tightened their purse strings just when America’s small businesses needed them the most. With vivid anecdotes and expert insights, Coleman unpacks the disconnect between financial institutions and local entrepreneurs, providing you with a roadmap to navigate today’s lending landscape.

Whether you’re a small business owner seeking funding or simply curious about the shifting dynamics of the economy, this book offers invaluable lessons on the “new bank think” and the essential steps to secure a loan in today’s market. Discover how to unlock the capital that fuels job creation and economic growth right where you live!

Money, Money Everywhere But Not a Drop for Main Street

Why This Book Stands Out?

- Expert Insight: Authored by Bob Coleman, a leading authority on small business lending, this book provides unparalleled expertise and perspective on the current financial landscape.

- Real Conversations: Coleman spent a year engaging with both bankers and small business owners, offering unique firsthand accounts that reveal the struggles and strategies within the lending ecosystem.

- Timely Relevance: Written in the wake of the 2008 financial crisis, it addresses the critical disconnect between Wall Street and Main Street, making it a must-read for understanding today’s economic climate.

- Actionable Knowledge: The book distills complex financial concepts into ten essential insights about securing small business loans, empowering readers with the tools they need to navigate the lending landscape.

- Compelling Narrative: Engaging storytelling captures the resilience of small businesses, making the book not just informative but also inspiring for entrepreneurs and aspiring business owners.

Personal Experience

As I dove into Money, Money Everywhere But Not a Drop for Main Street, I couldn’t help but reflect on my own experiences during the tumultuous times following the 2008 economic meltdown. Like many, I watched as friends and family faced the harsh realities of job losses and financial instability. The juxtaposition of Wall Street’s bailout with the struggles of everyday Americans felt all too personal, and it resonated deeply within me.

Bob Coleman’s insights into the world of small business lending struck a chord. I recall conversations with local business owners who poured their hearts into their ventures, only to find themselves stifled by a lack of credit and support. Their stories echoed the themes in Coleman’s book, making it impossible not to empathize with their plight. It was a stark reminder of how the economic system can sometimes overlook the very backbone of our communities.

Reading about the shift in “bank think” and understanding the new landscape of small business financing was eye-opening. It made me think about the dreams and aspirations that drive entrepreneurs to take risks. Here are a few key points that stood out to me:

- Resilience of Small Business Owners: The tenacity displayed by those who continue to operate on Main Street is a testament to the human spirit. Their stories of survival and adaptation in the face of adversity are both inspiring and relatable.

- Importance of Relationships: Coleman emphasizes the necessity of building relationships with bankers. This reminded me of how crucial personal connections are in any business endeavor, especially when seeking support during difficult times.

- Understanding the New Lending Landscape: The book provides valuable insights into what banks look for today, which feels vital for anyone considering starting or sustaining a small business. It’s a guide that feels like it’s written for people just like us.

Overall, Money, Money Everywhere isn’t just a book about finance; it’s about real people navigating real challenges. It invites us to reflect on our own experiences and the broader implications of financial systems on our communities. I found myself pondering how we can collectively advocate for better support for Main Street, and how each of us can play a part in this ongoing conversation.

Who Should Read This Book?

If you’re a small business owner, a budding entrepreneur, or even someone just curious about the world of finance, then Money, Money Everywhere But Not a Drop for Main Street is a must-read for you. Bob Coleman’s insights are tailored for those who want to understand the intricate dance between Wall Street and Main Street, especially in the wake of the 2008 financial crisis.

Here’s why this book is perfect for you:

- Small Business Owners: If you’re struggling to secure funding for your business, this book offers a clear roadmap of what lenders are thinking and the ten essential things you need to know to improve your chances of getting a loan.

- Entrepreneurs: For those looking to start a new venture, understanding the landscape of small business lending can give you a competitive edge. Coleman’s insights will help you navigate the often murky waters of financing.

- Bankers and Financial Professionals: Whether you’re in the trenches of lending or working in finance, this book provides a fresh perspective on the changing mindset of both bankers and business owners in today’s economy.

- Students and Educators: If you’re studying business, economics, or finance, this book serves as a valuable resource to understand real-world applications and the impact of policy decisions on small businesses.

- Policy Makers and Advocates: For those involved in shaping economic policy, Coleman’s work sheds light on the critical relationship between government bailouts and the health of small businesses, informing better decisions for the future.

Ultimately, Money, Money Everywhere But Not a Drop for Main Street isn’t just a book; it’s a crucial guide for anyone invested in the future of small businesses in America. You’ll walk away equipped with knowledge that can empower you to make informed decisions, whether you’re seeking funding, crafting policies, or simply wanting to understand the economic climate better.

Money, Money Everywhere But Not a Drop for Main Street

Key Takeaways

“Money, Money Everywhere But Not a Drop for Main Street” by Bob Coleman offers valuable insights into the challenges of small business lending in the wake of the 2008 financial crisis. Here are the key points that make this book a must-read:

- Understanding the Bailout Disparity: Gain perspective on how Wall Street received substantial government support while Main Street faced foreclosures and job losses.

- Insights from Industry Experts: Benefit from Coleman’s year-long conversations with bankers and small business owners, revealing the stark realities of lending practices.

- The Evolution of “Bank Think”: Learn about the shifting mindset of bankers and how it impacts lending to small businesses today.

- Practical Strategies for Small Business Owners: Discover ten essential tips to navigate the current lending landscape and increase your chances of securing a loan.

- Real-life Business Stories: Read compelling accounts from small business survivors who adapted and thrived despite financial hardships.

- Restoring Capital Flow: Understand the critical need for revitalizing funding to small businesses, the backbone of the American economy.

- Actionable Advice: Equip yourself with actionable insights that can guide your approach to seeking financing in today’s market.

Final Thoughts

In “Money, Money Everywhere But Not a Drop for Main Street,” Bob Coleman shines a light on the stark reality faced by small businesses in the wake of the 2008 economic crisis. This compelling book offers an insightful exploration of how the financial meltdown affected the lifeblood of our economy—Main Street—and the critical role that small businesses play in job creation and community resilience.

Through a year of conversations with bankers and small business owners, Coleman unveils the disconnect between Wall Street and Main Street, revealing the challenges that entrepreneurs encounter in securing the funding they need to thrive. The book is not just a narrative of hardship; it provides a roadmap for understanding the evolving landscape of small business lending and equips readers with the knowledge necessary to navigate it.

- Gain insights into the mindset of bankers post-crisis.

- Discover ten essential tips for securing a small business loan today.

- Understand the importance of small businesses in the economic recovery process.

This book is a must-read for aspiring entrepreneurs, small business owners, and anyone interested in the economic fabric of our communities. It offers both hope and practical advice, making it a valuable addition to any reader’s collection. If you’re ready to empower yourself with knowledge and drive change in your business, don’t hesitate to dive into this enlightening read.

Take the first step towards understanding the intricacies of small business lending and click here to purchase Money, Money Everywhere But Not a Drop for Main Street today!