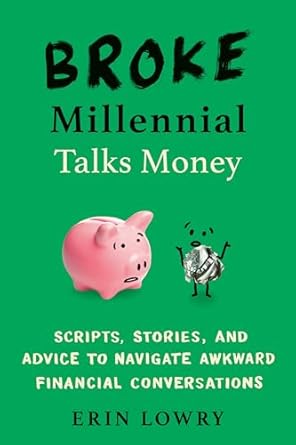

Unlock the secrets to seamless financial conversations with “Broke Millennial Talks Money: Scripts, Stories, and Advice to Navigate Awkward Financial Conversations.” This essential guide by finance expert Erin Lowry is designed to help you tackle the most uncomfortable money discussions in your life, from negotiating salaries with coworkers to discussing retirement plans with your parents. With practical scripts and relatable stories, Lowry empowers you to navigate these tricky topics with confidence.

Whether you’re addressing lifestyle differences with friends or initiating a prenup conversation with your fiancé, this book offers invaluable insights and strategies to ease the tension. Say goodbye to financial awkwardness and hello to open, honest dialogues that strengthen your relationships. Transform your approach to money talks today with this indispensable resource from the acclaimed Broke Millennial series.

Broke Millennial Talks Money: Scripts, Stories, and Advice to Navigate Awkward Financial Conversations (Broke Millennial Series)

Why This Book Stands Out?

- Comprehensive Coverage: Addresses a wide range of financial conversations, from discussing lifestyle choices with friends to negotiating salaries at work.

- User-Friendly Approach: Written in an approachable style, making complex money topics accessible for readers of all backgrounds.

- Practical Scripts and Tips: Provides actionable scripts and troubleshooting advice for various scenarios, empowering readers to tackle uncomfortable discussions confidently.

- Expert Insight: Authored by finance writer Erin Lowry, a trusted voice in the personal finance space, ensuring credible and relatable guidance.

- Focus on Relationships: Emphasizes the importance of discussing money within personal relationships, enhancing communication and understanding.

- Real-World Scenarios: Includes relatable situations, such as talking to parents about retirement and discussing prenups, making the content relevant and applicable.

Personal Experience

Engaging with “Broke Millennial Talks Money” can be a transformative experience for readers navigating the often uncomfortable terrain of financial conversations. Many of us have found ourselves in situations where discussing money feels like walking on eggshells. Erin Lowry’s approachable writing style resonates deeply, turning what could be an intimidating topic into an empowering dialogue.

As readers delve into the book, they may find themselves reflecting on their own experiences, such as:

- Feeling awkward when friends discuss lavish vacations while you’re budgeting for essentials.

- Wondering how to approach family discussions about their retirement plans and your potential role in supporting them.

- Experiencing anxiety over salary negotiations at work, unsure how to advocate for oneself without feeling confrontational.

- Questioning how to introduce discussions about finances with a partner, especially when considering long-term commitments like marriage.

The relatable scenarios outlined in the book provide a sense of validation, reminding readers that they are not alone in their struggles. With practical scripts and tips, Lowry empowers readers to tackle these conversations with confidence. The book serves not just as a guide, but as a supportive companion, helping to foster open and honest discussions about money that can strengthen relationships and promote financial well-being.

Who Should Read This Book?

“Broke Millennial Talks Money” is ideal for a diverse range of readers who find themselves navigating the often uncomfortable realm of financial conversations. This book is particularly suitable for:

- Young Professionals: Those starting their careers who need guidance on discussing salaries and negotiating raises.

- Recent Graduates: Individuals entering the workforce and managing student loans, seeking advice on budgeting and financial planning.

- Millennials and Gen Z: Anyone in these age groups looking to address financial topics with friends and family without feeling awkward.

- Individuals in Relationships: Couples preparing for discussions about finances, including prenuptial agreements and shared expenses.

- Parents and Caregivers: Those needing to have conversations about financial support for aging parents or financial education for their children.

This book provides valuable scripts, tips, and insights that empower readers to tackle difficult money discussions with confidence and clarity, making it a must-read for anyone looking to improve their financial communication skills.

Broke Millennial Talks Money: Scripts, Stories, and Advice to Navigate Awkward Financial Conversations (Broke Millennial Series)

Key Takeaways

Readers can expect to gain valuable insights and practical advice from “Broke Millennial Talks Money” that will empower them to navigate financial conversations with confidence and ease. Here are the key takeaways from the book:

- Practical Scripts: The book provides ready-to-use scripts for various financial discussions, making it easier to approach sensitive topics.

- Real-Life Scenarios: Erin Lowry includes relatable examples and scenarios that readers may encounter in their own lives.

- Tips for Transparency: Learn how to foster open communication about finances with friends, family, and partners.

- Negotiation Strategies: Gain insights on how to discuss salary and benefits with confidence, including tips for effective negotiation.

- Support for Aging Parents: Understand how to approach the conversation about financial support for aging parents and their retirement needs.

- Relationship Discussions: Get advice on discussing money matters with a partner, including the sensitive topic of prenuptial agreements.

- Financial Knowledge: Equip yourself with essential financial knowledge to make informed decisions during conversations.

- Demystifying Money Talks: The book aims to reduce the stigma and discomfort surrounding financial discussions, empowering readers to engage openly.

Final Thoughts

“Broke Millennial Talks Money” by Erin Lowry is an essential guide for anyone looking to navigate the often uncomfortable conversations surrounding finances. With its user-friendly approach and practical scripts, this book empowers readers to engage in meaningful discussions about money without the anxiety that typically accompanies such topics.

- Comprehensive coverage of financial conversations in various contexts: work, family, friendships, and relationships.

- Real-life scenarios that provide relatable insights and actionable advice.

- Equips readers with the confidence and knowledge needed to tackle tough discussions.

- Encourages open dialogue about finances, fostering healthier relationships and financial well-being.

If you’re looking to demystify money talks and enhance your financial communication skills, this book is a valuable investment. Don’t miss out on the opportunity to transform your financial conversations—buy “Broke Millennial Talks Money” today!