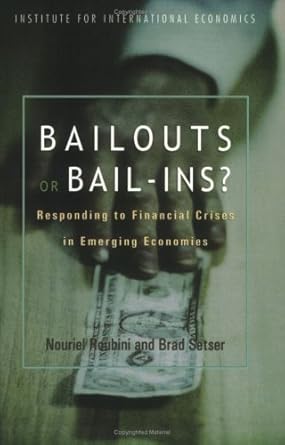

Discover the insightful exploration of financial crises in emerging markets with “Bailouts or Bail-Ins: Responding to Financial Crises in Emerging Economies.” This compelling book delves into the urgent calls for rescue loans from finance ministers facing dwindling foreign reserves and lost confidence. It presents a nuanced approach to understanding that every financial crisis is unique, emphasizing the need for tailored solutions that provide consistency and predictability for both borrowing nations and their investors.

With expert analyses and thought-provoking arguments, this book is a must-read for anyone interested in international finance and economic policy. Whether you’re a student, a professional in the field, or simply curious about how countries navigate financial turmoil, “Bailouts or Bail-Ins” offers valuable insights and practical frameworks to comprehend the complexities of global economics. Grab your copy today and equip yourself with the knowledge to understand the dynamics of financial rescue operations!

Bailouts or Bail-Ins: Responding to Financial Crises in Emerging Markets: Responding to Financial Crises in Emerging Economies

Why This Book Stands Out?

- In-depth Analysis: The book provides a comprehensive examination of financial crises specifically in emerging markets, offering insights that are often overlooked in conventional economic discussions.

- Real-world Relevance: With timely examples from actual crises, it connects theory with practice, making it a valuable resource for understanding contemporary economic challenges.

- Policy Framework: It introduces a flexible policy framework that advocates for tailored solutions, recognizing the uniqueness of each crisis while maintaining consistency for stakeholders.

- Expert Perspectives: Authored by experts in the field, it brings authoritative voices together, ensuring readers gain diverse viewpoints on complex economic issues.

- Accessible Language: Written in a clear and engaging style, the book is approachable for both seasoned economists and general readers interested in global finance.

- Global Impact: By addressing the needs of emerging economies, it highlights the interconnectedness of global markets, making it crucial for anyone looking to understand the broader economic landscape.

Personal Experience

As I delved into the pages of Bailouts or Bail-Ins: Responding to Financial Crises in Emerging Markets, I found myself reflecting on the intricate dance between economics and human experience. The narrative painted a vivid picture of the high-stakes decisions faced by finance ministers in times of crisis, and it felt almost personal. It struck me how similar these situations are to the challenges we face in our own lives, where the stakes may not involve national economies, but rather our personal financial health and security.

Reading about the urgency of a finance minister calling upon the International Monetary Fund resonated deeply with me. I couldn’t help but think about my own experiences of uncertainty—those moments when I felt out of control, whether from unexpected expenses or job instability. It’s a reminder that while the figures and policies might seem distant, the emotions tied to financial crises are universal. We all seek stability and assurance in an unpredictable world.

- Relatable Challenges: The book brings to light the desperation of losing access to resources, mirroring our own fears of financial instability.

- Empathy for Decision-Makers: Understanding the burden on those making tough decisions for entire nations made me appreciate the complexity of leadership.

- Framework for Crisis: The call for a consistent framework in handling crises reminded me of the importance of having a plan in our personal finances.

- Lessons in Adaptability: Just as the book discusses the need for tailored solutions to different crises, I found parallels in my own life where adaptability was key to overcoming challenges.

This book is not just a resource for understanding economic policies; it is a mirror reflecting our own vulnerabilities and resilience in the face of adversity. I finished reading it with a renewed sense of hope and a deeper understanding of how interconnected we all are in this vast, complex economic landscape. It’s a reminder that whether on a personal or global scale, we all navigate our own financial storms, and the lessons learned can guide us toward calmer waters.

Who Should Read This Book?

If you’re curious about the intricacies of financial crises and want to understand how emerging markets navigate these turbulent waters, then “Bailouts or Bail-Ins” is the perfect read for you. This book is designed for a diverse audience, including:

- Students and Academics: If you’re studying economics, finance, or international relations, this book offers valuable insights into real-world applications of theories. It bridges the gap between classroom learning and actual financial practices.

- Finance Professionals: Whether you work in investment banking, asset management, or risk assessment, understanding the dynamics of emerging markets will enhance your expertise and decision-making capabilities.

- Policy Makers and Government Officials: For those involved in shaping economic policies, this book provides a framework for responding to financial crises, ensuring you have the tools to implement effective solutions.

- Investors: If you’re considering investments in emerging markets, this book will help you assess risks and opportunities, allowing you to make informed decisions in a volatile environment.

- General Readers with a Keen Interest in Economics: If you simply want to better understand how financial crises unfold and the various strategies employed to address them, this book presents complex concepts in an accessible manner.

What makes “Bailouts or Bail-Ins” unique is its emphasis on the idea that each financial crisis is distinct and requires tailored approaches. It’s not just about providing solutions; it’s about understanding the context behind each situation. This perspective will not only enhance your knowledge but also equip you with a more nuanced view of global economic dynamics.

Bailouts or Bail-Ins: Responding to Financial Crises in Emerging Markets: Responding to Financial Crises in Emerging Economies

Key Takeaways

This book offers valuable insights into the complex dynamics of financial crises in emerging markets and the strategic responses required to navigate them. Here are the key points that highlight why this book is worth reading:

- Understanding Crisis Dynamics: Gain a comprehensive understanding of how financial crises unfold in emerging markets and the unique challenges faced by these economies.

- Policy Frameworks: Discover the importance of establishing a consistent and predictable policy framework to guide responses to financial emergencies.

- Diverse Solutions: Learn that there is no one-size-fits-all solution; each crisis demands a tailored approach based on its specific circumstances.

- International Collaboration: Explore the role of global financial institutions, such as the IMF, in coordinating responses to crises and the implications for national policies.

- Investor Confidence: Understand how government actions during crises affect both domestic and international investor confidence, which is crucial for economic recovery.

- Real-World Examples: Benefit from case studies and examples that illustrate successful and unsuccessful crisis management strategies in different countries.

- Policy Recommendations: Receive actionable recommendations for policymakers to better prepare for and respond to future financial crises.

Final Thoughts

“Bailouts or Bail-Ins: Responding to Financial Crises in Emerging Markets” offers a compelling exploration of the complexities surrounding financial crises in emerging economies. This insightful book delves into the intricate dynamics that unfold when a country finds itself on the brink of economic collapse, providing readers with a nuanced understanding of the various policy options available to address such challenges.

Key highlights of the book include:

- An examination of the roles played by international financial institutions and national governments during crises.

- A discussion on the importance of tailoring responses to the unique circumstances of each financial crisis.

- Insights into how consistent and predictable frameworks can benefit both borrowing nations and their investors.

- Real-world examples and case studies that illustrate the consequences of different approaches to crisis management.

This book is a valuable addition to any reader’s collection, especially for those interested in economics, finance, and international relations. Its analytical approach and practical implications make it a must-read for policymakers, investors, and scholars alike.

If you’re looking to deepen your understanding of financial crises and the strategies to combat them, don’t hesitate to purchase this enlightening book today! Your journey to understanding the complexities of emerging market economies begins here.