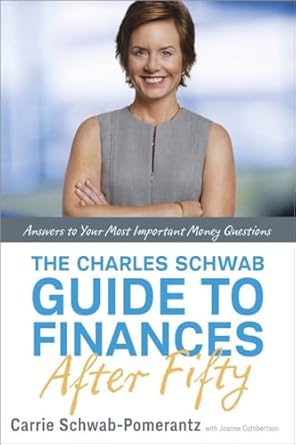

Unlock the secrets to financial security with “The Charles Schwab Guide to Finances After Fifty.” This essential resource is designed for those aged fifty and older, providing clear, actionable answers to the pressing financial questions that often arise during this pivotal life stage. Whether you’re navigating the complexities of funding your children’s education, contemplating a downsizing move, or seeking to optimize your Social Security benefits, this guide offers expert insights you can trust.

Authored by the renowned Carrie Schwab-Pomerantz, this book distills decades of financial wisdom into practical advice tailored to your unique needs. With a focus on clarity and straightforwardness, it empowers you to make informed decisions about protecting and growing your assets in an increasingly complicated financial landscape. Don’t let uncertainty keep you up at night—discover the guidance you need to secure your financial future.

The Charles Schwab Guide to Finances After Fifty: Answers to Your Most Important Money Questions

Why This Book Stands Out?

- Targeted Guidance: Specifically addresses the financial concerns of those aged fifty and older, providing tailored advice for this unique life stage.

- Expertise of the Author: Written by Carrie Schwab-Pomerantz, a trusted financial advisor with decades of experience and a proven track record in helping clients navigate complex financial issues.

- Comprehensive Coverage: Answers a wide range of financial questions—from college funding to retirement planning—ensuring that readers find solutions to both common and overlooked issues.

- Clear and Accessible Language: Prioritizes straightforward explanations over financial jargon, making complex concepts easy to understand for readers of all backgrounds.

- Research-Backed Insights: Offers deeply researched advice, ensuring that readers receive reliable and actionable financial strategies.

- Holistic Approach: Encourages readers to think beyond immediate concerns by addressing a breadth of financial topics, enhancing overall financial literacy.

- Proven Track Record: Builds on the successful “Ask Carrie” columns, reinforcing the author’s credibility and connection with her audience.

Personal Experience

As you navigate the often turbulent waters of financial planning after fifty, “The Charles Schwab Guide to Finances After Fifty” serves as more than just a reference; it becomes a companion in your journey. Many readers can relate to the unique challenges that arise during this stage of life, where the stakes feel higher and the decisions carry more weight. Here are some insights and potential experiences that may resonate with you:

- Feeling Overwhelmed: You might find yourself grappling with an avalanche of financial questions, from saving for retirement to managing medical expenses. This book addresses those very concerns, offering clarity in a complex landscape.

- Seeking Security: The desire to protect your nest egg is paramount. Readers often appreciate the book’s insights on safer investment options, which can provide peace of mind as you plan for the future.

- Navigating Family Finances: Many find themselves in the position of supporting children through college or helping aging parents. The book offers guidance on how to balance these responsibilities without compromising your own financial health.

- Understanding Social Security: The complexities of when and how to claim Social Security can be daunting. Readers often find valuable strategies within these pages that help them make informed choices that benefit their long-term financial well-being.

- Reassessing Home Ownership: If you are contemplating downsizing or relocating, the book provides insights into the financial implications, helping you weigh your options thoughtfully.

Ultimately, “The Charles Schwab Guide to Finances After Fifty” is more than just a financial manual; it’s a source of reassurance and empowerment. It encourages readers to take control of their financial futures with confidence, fostering a sense of community among those facing similar life challenges.

Who Should Read This Book?

This book is designed for individuals aged fifty and older who are navigating the complexities of their financial lives. It is particularly suitable for:

- Pre-retirees: Those approaching retirement who need guidance on how to protect and grow their assets.

- Parents of college students: Individuals who want to understand how to finance their children’s education without jeopardizing their own savings.

- Homeowners considering downsizing: Those contemplating a move to a smaller home and seeking clarity on the financial implications of such a decision.

- Individuals facing unexpected medical expenses: Readers looking for strategies to manage and assess their healthcare costs more effectively.

- Social Security beneficiaries: People who want to optimize their Social Security benefits and understand the best timing and methods for claiming.

By addressing a wide range of financial concerns relevant to this age group, the book offers valuable insights and actionable advice, enabling readers to make informed decisions about their financial futures.

The Charles Schwab Guide to Finances After Fifty: Answers to Your Most Important Money Questions

Key Takeaways

Readers can expect to gain valuable insights and practical advice from “The Charles Schwab Guide to Finances After Fifty.” Here are the key takeaways:

- Comprehensive answers to common financial questions faced by individuals aged fifty and older.

- Guidance on protecting and growing assets during retirement planning.

- Strategies for managing college expenses for children without depleting savings.

- Advice on transitioning to safer investments to secure nest eggs.

- Insights into the financial implications of downsizing homes.

- Assessment of medical expenses and options for managing healthcare costs.

- Tips for optimizing Social Security benefits regarding timing and application.

- Clear and straightforward financial advice from experienced professionals.

- Access to a wealth of knowledge from Carrie Schwab-Pomerantz and the Schwab team’s expertise.

- Encouragement to consider important financial questions that may have been overlooked.

Final Thoughts

The Charles Schwab Guide to Finances After Fifty is an invaluable resource for individuals navigating the complex financial landscape as they age. With expert insights from Carrie Schwab-Pomerantz and her team, this book addresses a wide range of critical financial questions faced by those over fifty, making it a must-have for anyone in this life stage.

Here are some key reasons why this book is worth purchasing:

- Expert Guidance: Benefit from the authoritative advice of financial professionals with years of experience.

- Comprehensive Coverage: Tackle various financial puzzles, from college savings to retirement planning and medical expenses.

- Clarity and Accessibility: Enjoy straightforward explanations that cut through financial jargon.

- Proactive Planning: Prepare for the future with insights that help you make informed decisions about your financial well-being.

Don’t leave your financial future to chance. Equip yourself with the knowledge you need to make sound decisions and secure your financial health. Buy The Charles Schwab Guide to Finances After Fifty today!