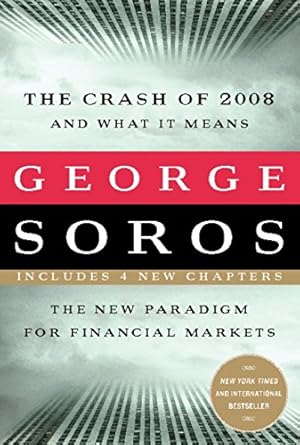

Discover the profound insights of legendary financier George Soros in “The Crash of 2008 and What it Means: The New Paradigm for Financial Markets.” This compelling read delves into the origins of the 2008 financial crisis, offering a unique perspective shaped by Soros’s extensive experience and decades of research on economic cycles. In just a few pages, he articulates the complexities of the crisis while proposing actionable policies to navigate these turbulent waters.

Soros combines practical financial wisdom with philosophical depth, making this book an invaluable guide for anyone looking to understand the great credit crisis and its far-reaching implications. Whether you’re an investor, student, or simply curious about economic trends, this concise essay is a must-read that equips you with the knowledge to better comprehend today’s financial landscape. Don’t miss the chance to learn from one of the foremost experts in the field!

The Crash of 2008 and What it Means: The New Paradigm for Financial Markets

Why This Book Stands Out?

- Expert Insight: Authored by George Soros, a legendary financier with decades of experience, providing unparalleled perspectives on financial markets.

- Timely Analysis: Offers a profound understanding of the 2008 financial crisis, contextualizing it within historical boom and bust cycles.

- Practical Policy Proposals: Suggests actionable policies to address the crisis and prevent future economic turmoil, making it not just a retrospective analysis but a guide for the future.

- Philosophical Depth: Balances rigorous financial analysis with philosophical reflections, inviting readers to think critically about economic systems.

- Concise and Accessible: Written as a short essay, it distills complex ideas into clear, digestible insights for readers of all backgrounds.

- Global Perspective: Explores the implications of the crisis not just for the U.S., but for the global economy, highlighting interconnectedness in today’s markets.

Personal Experience

Reading “The Crash of 2008 and What it Means” by George Soros was more than just a dive into the financial turmoil that shook the world; it was a journey into understanding the very fabric of our economic reality. As I turned each page, I found myself reflecting on my own experiences during those tumultuous times. The anxiety of watching the news, the uncertainty of job security, and the feeling of helplessness were emotions that many of us shared. Soros’ insights struck a chord, making me realize I wasn’t alone in feeling overwhelmed.

This book resonates on a personal level for several reasons:

- Relatable Context: Many of us lived through the 2008 crisis, witnessing firsthand its impact on families, communities, and our own lives. Soros articulates these sentiments, helping readers process their experiences.

- Reflection on Choices: The book encourages us to reflect on our financial choices and the broader implications of those choices. It’s a reminder that our decisions can have far-reaching effects, not just for us but for society as a whole.

- Understanding Complexity: Soros delves into complex economic theories with an approachable style. This made me feel empowered to grasp concepts that once seemed daunting, inspiring me to engage more deeply with financial matters.

- Philosophical Depth: The philosophical insights offered by Soros encourage us to think critically about the values that underpin our economic systems. It’s a call to ponder not just what happened, but why and how we can shape a better future.

As I closed the book, I felt a mixture of hope and responsibility. Soros doesn’t just recount a story; he invites us to be part of the narrative moving forward. This personal connection to the material is what makes “The Crash of 2008 and What it Means” more than just a financial analysis—it’s a reflection of our shared human experience in the face of adversity.

Who Should Read This Book?

If you’ve ever found yourself puzzled by the twists and turns of the financial markets, or if you’re simply interested in understanding the forces that shape our economy, then this book is tailor-made for you. George Soros, with his extensive experience and keen insights, provides a clear lens through which to view the complexities of financial crises. Here’s why you should dive into this compelling read:

- Finance Enthusiasts: Whether you’re a student of finance, an investor, or just someone who follows the markets, Soros offers invaluable lessons that can deepen your understanding of market dynamics.

- Policymakers and Economists: This book is essential for those in government or economic advisory roles. Soros presents a set of policies aimed at navigating financial crises, making it a crucial resource for informed decision-making.

- History Buffs: If you’re curious about the events leading to the 2008 financial crisis, this book provides a historical context that enriches your knowledge and understanding of economic cycles.

- Concerned Citizens: For anyone interested in how economic policies affect everyday life, Soros’s insights can help you grasp the broader implications of financial decisions made at the national and global levels.

- Philosophical Thinkers: Soros doesn’t just present financial facts; he delves into the philosophical underpinnings of market behavior, making this book a thought-provoking read for those who enjoy reflective thinking.

In short, whether you’re looking to enhance your professional skills, expand your knowledge, or simply satisfy your curiosity, “The Crash of 2008 and What it Means” offers a treasure trove of insights that can benefit a wide range of readers.

The Crash of 2008 and What it Means: The New Paradigm for Financial Markets

Key Takeaways

This book offers valuable insights into the financial crisis of 2008 and its broader implications. Here are the key points that make this read worthwhile:

- Understanding the Crisis: Soros provides a detailed analysis of the origins of the 2008 financial collapse, helping readers grasp the complexities behind the event.

- Policy Recommendations: The author proposes actionable policies that could be implemented to address the economic fallout and prevent future crises, making it a practical guide for policymakers.

- Market Cycles Insight: Readers will gain a deeper understanding of how boom and bust cycles operate, informed by Soros’s extensive experience in financial markets.

- Philosophical Depth: The book combines practical financial insights with philosophical reflections, encouraging readers to think critically about economic systems and human behavior.

- Global Perspective: Soros places the crisis within a global context, examining its implications not just for the U.S., but for economies worldwide.

- Concise and Engaging: The essay format allows for a quick yet comprehensive read, making complex ideas accessible without overwhelming the reader.

Final Thoughts

In “The Crash of 2008 and What it Means: The New Paradigm for Financial Markets,” George Soros delivers an insightful exploration of the financial crisis that shook the world. Drawing from his extensive experience and profound understanding of market dynamics, Soros not only analyzes the origins of the crisis but also offers thought-provoking solutions to mitigate such upheavals in the future. His reflections are underpinned by decades of study into the cyclical nature of economic booms and busts, providing readers with a holistic perspective on the challenges faced by individuals and institutions alike.

This concise essay is a treasure trove of practical insights and philosophical depth, making it a valuable addition to any reader’s collection. Here are a few reasons why you should consider adding this book to your library:

- Expert Insights: Gain access to the thoughts of one of the most influential financiers of our time.

- Timeless Relevance: Understand the lasting implications of the 2008 crisis on current financial markets.

- Actionable Policies: Discover policies that can help confront future economic challenges.

Don’t miss the opportunity to enrich your understanding of the financial world. Whether you’re a seasoned investor, a student of economics, or someone simply interested in the forces that shape our economy, Soros’s work is essential reading. Purchase your copy today and gain valuable insights that could shape your perspective on financial markets for years to come!