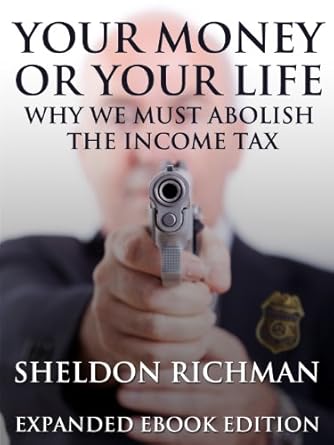

Discover the transformative insights of “Your Money or Your Life: Why We Must Abolish the Income Tax (Expanded Ebook Edition)” by Richard M. Richman. This compelling read delves deep into the origins and implications of the income tax and the IRS, challenging the notion that these systems are integral to American society. Richman argues that the inherent flaws of the income tax make it a barrier to financial freedom, and he proposes a bold solution: total repeal. With this book, you’ll gain a fresh perspective on how the income tax impacts your wealth and well-being.

This expanded edition enriches your understanding with a new epilogue featuring four insightful articles that dissect the myths surrounding income-tax denial. Perfect for anyone seeking financial empowerment, Richman’s articulate analysis not only exposes the truth behind the tax system but also empowers you to reclaim your financial future. Don’t miss the chance to read this eye-opening discussion and start your journey toward greater wealth today!

Your Money or Your Life: Why We Must Abolish the Income Tax (Expanded Ebook Edition)

Why This Book Stands Out?

- Historical Insight: Richman delves deep into the origins of the income tax and the IRS, providing a historical context that sheds light on why these systems exist today.

- Provocative Argument: The book challenges the notion that the income tax is a necessary evil, positing instead that it is fundamentally flawed and should be abolished altogether.

- Unique Perspective: Richman argues that the issues surrounding the IRS and income tax are not merely administrative; they are intrinsic to their very design and purpose.

- Expanded Edition Benefits: The new epilogue features four insightful articles that delve into the concept of “income-tax denial,” enriching the reader’s understanding of the topic.

- Wealth of Knowledge: By exploring how the income tax system impacts your finances, Richman equips readers with the knowledge to better navigate their economic landscape.

- Engaging Style: The book presents complex ideas in a clear and engaging manner, making it accessible to both casual readers and those well-versed in economic theory.

Personal Experience

As I dove into Your Money or Your Life: Why We Must Abolish the Income Tax, I found myself reflecting on my own financial journey and the weight that taxes have carried throughout my life. It’s a topic that often feels heavy and daunting, yet Richman’s insights make it approachable, almost like sitting down with a knowledgeable friend over coffee.

Many of us have experienced that sinking feeling when we see our paychecks after taxes are taken out. It’s a stark reminder of how much of our hard-earned money disappears into a system that often feels opaque and unfair. Richman’s perspective resonated deeply with my frustrations; he articulates the notion that the income tax is not just a bureaucratic necessity but a significant barrier to financial freedom.

Here are a few key reflections I had while reading:

- Understanding the Origins: Richman delves into the history of the income tax and the IRS, which made me realize how little I actually knew about its roots. It’s fascinating—and a bit alarming—to learn that it wasn’t always a part of our financial landscape.

- Personal Finances: I started to think about how the income tax has impacted my own financial planning. Have I been making decisions based on the constraints imposed by the tax system rather than what I truly want for my life?

- Empowerment through Knowledge: Reading this book felt liberating. Knowledge is power, and understanding the implications of the income tax gave me a sense of agency over my financial decisions.

- Rethinking Wealth: Richman encourages readers to reconsider what it means to be wealthy. It’s not just about accumulating money but about having the freedom to use it in ways that enrich our lives.

This book is more than just a critique of the income tax; it’s a call to rethink our relationship with money and how we allow external factors to dictate our financial well-being. As I turned the pages, I couldn’t help but feel a sense of camaraderie with others who might be grappling with similar thoughts and experiences. It’s a conversation starter, one that I believe many would find valuable in their own lives.

Who Should Read This Book?

If you’ve ever questioned the fairness of the income tax system, or if you’re simply curious about the historical and philosophical underpinnings of taxation in America, then “Your Money or Your Life: Why We Must Abolish the Income Tax” is the perfect read for you. This book speaks directly to a variety of audiences who will find its insights both enlightening and empowering.

- Libertarians and Fiscal Conservatives: If you believe in minimal government intervention in personal finances and are passionate about individual freedoms, Richman’s arguments will resonate deeply with your beliefs. His call for the abolition of the income tax aligns perfectly with the principles of limited government.

- Students of History and Political Science: For those who love to dive into the historical context of government systems, this book offers a thorough examination of the origins of the IRS and the income tax, providing a fascinating narrative that connects past decisions to present-day implications.

- Taxpayers Seeking Financial Wisdom: If you’re looking for ways to better manage your finances and understand how taxation affects your wealth, Richman’s analysis will help you see how the income tax system can make you poorer. This book equips you with knowledge that can lead to smarter financial choices.

- Policy Makers and Activists: For those involved in advocacy or policy-making, this book presents a compelling case for reform. Richman’s unique perspective highlights the systemic issues within the current tax framework, making it a must-read for anyone seeking to drive meaningful change.

- Curious Minds: Finally, if you simply enjoy exploring new ideas and challenging the status quo, this book is full of thought-provoking arguments and engaging discussions that will keep you intrigued from start to finish.

In summary, whether you’re a policy enthusiast, a financial thinker, or just someone interested in understanding the implications of taxation on your life, this book has something valuable to offer you. Dive in and discover how understanding the income tax can lead to a richer perspective on your personal finances and freedom!

Your Money or Your Life: Why We Must Abolish the Income Tax (Expanded Ebook Edition)

Key Takeaways

In “Your Money or Your Life: Why We Must Abolish the Income Tax,” author Richman presents a compelling argument against the income tax and the IRS, revealing insights that challenge conventional views. Here are the most important lessons and benefits readers can expect from this thought-provoking book:

- Historical Context: Understand the origins of the income tax and the IRS, and how they diverged from the Founders’ vision for the country.

- Intrinsic Issues: Learn why the problems associated with the income tax and the IRS are not merely a result of poor leadership or reforms but are fundamental to their design.

- Economic Impact: Discover how the income tax system contributes to personal financial decline and limits wealth accumulation.

- Call for Repeal: Explore Richman’s radical yet thought-provoking proposal for the complete repeal of the income tax as a viable solution.

- Expanded Insights: Benefit from the new epilogue featuring four insightful articles that delve deeper into the “flimflam of income-tax denial.”

- Empower Your Finances: Gain a richer perspective on personal finance that challenges the status quo and encourages financial independence.

Final Thoughts

If you’ve ever questioned the fundamental nature and implications of the income tax, then “Your Money or Your Life: Why We Must Abolish the Income Tax” is a must-read. Author Richman delves deep into the origins of the income tax and the IRS, presenting a compelling argument that these institutions were never part of the vision laid out by the Founding Fathers. Instead, he reveals how the income tax is not merely a bureaucratic inconvenience but a systemic issue that diminishes wealth and freedom.

This expanded edition enriches the conversation with a new epilogue featuring four insightful articles that challenge prevailing misconceptions about income tax. Here are a few key takeaways:

- Understanding the historical context of the income tax and IRS.

- Recognizing the intrinsic problems associated with the income tax system.

- Learning how the income tax impacts your financial well-being.

- Exploring a radical yet thought-provoking solution: complete repeal.

This book is not just a critique; it’s a clarion call for awareness and action that can empower you to rethink your financial landscape. Whether you’re a tax novice or a seasoned financial strategist, Richman’s insights offer valuable perspectives that can enrich your understanding of economics and personal finance.

Don’t miss out on the opportunity to elevate your financial literacy and challenge the status quo. Grab your copy of “Your Money or Your Life: Why We Must Abolish the Income Tax” today and start your journey toward financial empowerment! Purchase the book here!