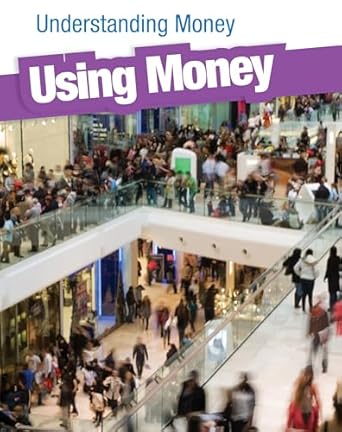

Discover the essential guide to financial literacy with “Using Money (Understanding Money).” This insightful book explores the fundamental concepts of checking and savings accounts, providing readers with a clear understanding of how to effectively manage their finances. Ideal for those looking to enhance their financial knowledge, this title breaks down the complexities of money management into easily digestible information.

With practical examples and engaging content, “Using Money” empowers individuals to make informed decisions about their spending and saving habits. Whether you’re a student learning about finances for the first time or an adult seeking to improve your financial skills, this book is a valuable resource that highlights various ways people utilize their money to achieve their goals.

Using Money (Understanding Money)

Why This Book Stands Out?

- Comprehensive Overview: “Using Money” provides an in-depth exploration of checking and savings accounts, making it an essential resource for understanding the fundamentals of personal finance.

- User-Friendly Format: The book is designed to be accessible, breaking down complex financial concepts into easy-to-understand language suitable for all readers.

- Practical Insights: It emphasizes real-world applications of money management, helping readers to understand how to effectively use their finances in everyday life.

- Age-Appropriate Content: Tailored for a younger audience, this book serves as an excellent educational tool for beginners looking to build a solid foundation in financial literacy.

- Engaging Presentation: The use of relatable examples and scenarios keeps readers engaged, making learning about money not only informative but also enjoyable.

Personal Experience

Reading “Using Money (Understanding Money)” can evoke a variety of relatable insights and experiences for many readers. This book not only delves into the mechanics of checking and savings accounts but also encourages reflections on personal financial habits and choices. Here are some potential experiences that might resonate on a personal level:

- Understanding Personal Finance: Many readers might find themselves reflecting on their own experiences with managing money. The book prompts a reassessment of how checking and savings accounts have played a role in their financial journeys.

- Relating to Real-Life Scenarios: The examples provided in the book could mirror situations readers have encountered, such as the excitement of opening their first savings account or the frustration of unexpected bank fees.

- Valuing Savings: Readers may connect with the idea of setting financial goals and the importance of saving for future needs, whether it’s for emergencies, education, or a dream vacation.

- Reflecting on Spending Habits: The discussion on various ways people use their money encourages readers to evaluate their own spending habits, leading to possible improvements in financial literacy.

- Inspiring Conversations: This book can serve as a catalyst for discussions with family or friends about money management, fostering a community of shared experiences and learning.

By engaging with the content, readers are likely to find themselves inspired and motivated to take control of their finances, making the insights from “Using Money” deeply personal and impactful.

Who Should Read This Book?

This book is ideal for a diverse audience looking to enhance their understanding of personal finance and money management. Here are the key groups who will benefit from its insights:

- Students: Those studying finance or economics will find this book a helpful resource for foundational concepts in money management.

- Young Adults: Newly independent individuals who are starting to manage their own finances will gain practical knowledge about checking and savings accounts.

- Parents: Parents seeking to teach their children about financial responsibility will appreciate the clear explanations and relatable examples.

- Financial Educators: Teachers and educators can use this book as a teaching tool to introduce important financial concepts to their students.

- General Readers: Anyone interested in improving their financial literacy and learning about the different ways to use and manage money will find value in this title.

Using Money (Understanding Money)

Key Takeaways

This book provides valuable insights into the fundamental aspects of managing money through checking and savings accounts. Readers can expect to gain a deeper understanding of financial practices and the various ways money can be utilized effectively.

- Understanding the differences between checking and savings accounts.

- Exploring the importance of budgeting and tracking expenses.

- Learning how to prioritize savings for future needs and emergencies.

- Identifying various spending habits and their impact on financial health.

- Gaining insights into responsible money management strategies.

- Discovering tips for optimizing account usage to maximize benefits.

- Recognizing the role of financial institutions in personal finance.

Final Thoughts

“Using Money” by Gail Fay is an insightful exploration into the world of personal finance, particularly focusing on checking and savings accounts. This book is not just informative; it serves as an essential guide for readers looking to enhance their understanding of how money works in everyday life.

Here are some key points that highlight the book’s value:

- Comprehensive overview of checking and savings accounts.

- Practical insights into everyday money management.

- Accessible language suitable for readers of all ages.

- Encourages responsible financial habits.

Whether you’re a student learning to manage your first bank account or an adult seeking to sharpen your financial skills, this book is a valuable resource. Don’t miss the opportunity to empower yourself with essential financial knowledge. Buy “Using Money” today and take the first step towards mastering your finances!