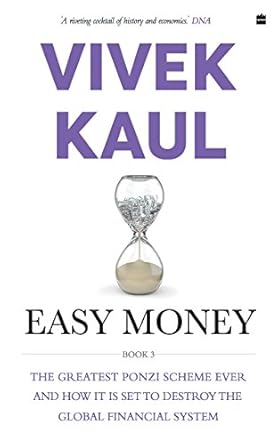

Discover the eye-opening insights of “Easy Money: The Greatest Ponzi Scheme Ever and How It Threatens to Destroy the Global Financial System” by Vivek Kaul. This compelling read delves deep into the aftermath of the 2008 financial crisis, revealing whether banks and financial firms have learned from past mistakes or if they’re still playing with fire. With a warm, conversational style, Kaul engages readers by posing critical questions about the stability of our financial systems, making it feel like an enlightening chat with a knowledgeable friend.

In this third installment of the Easy Money series, Kaul not only highlights the risks that loom over the global economy but also provides readers with a clear understanding of the current financial landscape. Don’t miss this chance to arm yourself with the knowledge needed to navigate the complexities of modern finance. Grab your copy today and stay one step ahead!

Easy Money: The Greatest Ponzi Scheme Ever and How It Threatens to Destr oy the Global Financial System

Why This Book Stands Out?

- Timely and Relevant Analysis: Vivek Kaul dives deep into the ramifications of the 2008 financial crisis, exploring whether banks have truly reformed or if they are merely repeating past mistakes.

- Insightful Questions: The book raises critical questions about the stability of the global financial system and prepares readers for potential future crises.

- Engaging Writing Style: Kaul’s approachable prose makes complex financial concepts accessible to readers of all backgrounds, ensuring an enjoyable reading experience.

- Part of a Comprehensive Series: As the third installment in the Easy Money series, this book builds on previous insights while providing fresh perspectives on ongoing financial issues.

- Actionable Insights: Readers will walk away with a clearer understanding of current financial practices and the potential risks that lie ahead, empowering them to make informed decisions.

Personal Experience

Reading “Easy Money: The Greatest Ponzi Scheme Ever and How It Threatens to Destroy the Global Financial System” was not just an intellectual exercise for me; it was a journey through my own financial experiences and anxieties. The financial crisis of 2008 left many of us grappling with uncertainty, fear, and a deep mistrust of the financial institutions that govern our lives. This book resonates on a deeply personal level, reminding us of the fragility of the systems we often take for granted.

As I turned the pages, I found myself reflecting on moments when I felt the weight of financial insecurity. Whether it was watching friends and family lose their jobs or feeling the stress of my own financial decisions, Kaul’s insights struck a chord. Here are a few thoughts that lingered with me:

- Understanding Risk: The book challenges us to think about the risks we take every day. It made me reconsider my own financial choices and how they are influenced by the larger system.

- Trust Issues: Like many, I have struggled with trusting banks and financial institutions since the crisis. Kaul sheds light on whether we’ve truly learned from past mistakes, prompting me to examine my own skepticism.

- Hope for Change: Reading about the potential for reform and accountability in the financial sector was both reassuring and thought-provoking. It made me question what kind of systemic changes I hope to see in my lifetime.

- Preparing for the Future: The book left me pondering what I can do to safeguard my financial future. It encourages readers to be proactive rather than reactive, which is a valuable mindset in today’s unpredictable economy.

Ultimately, “Easy Money” is not just a commentary on the financial system; it’s a mirror reflecting our own personal experiences and fears. As I closed the book, I felt a mix of anxiety and empowerment, realizing that understanding these complex issues is the first step toward navigating the tumultuous waters of our financial lives.

Who Should Read This Book?

If you’ve ever found yourself puzzled by the complexities of the financial world or anxious about the stability of our economy, then “Easy Money: The Greatest Ponzi Scheme Ever” is a must-read for you. This book is perfect for a diverse audience, including:

- Finance Enthusiasts: Whether you’re a budding investor or someone who loves to stay updated on economic trends, this book breaks down intricate financial concepts into digestible insights.

- Students of Economics: If you’re studying finance or economics, this book offers a real-world perspective on the implications of the 2008 crisis and the current state of the financial system.

- Taxpayers and Citizens: For anyone concerned about how government bailouts impact their taxes and the economy, this book provides clarity on the relationship between taxpayers and financial institutions.

- Policy Makers and Regulators: If you’re involved in shaping financial policies, understanding the lessons from past crises is essential for making informed decisions that can prevent future disasters.

- Curious Minds: Even if you’re not a finance expert, if you have a curiosity about how global systems work and what risks lie ahead, this book serves as an eye-opener.

This book uniquely combines storytelling with analytical insight, making it not only informative but also engaging. Vivek Kaul’s ability to simplify complex topics means you’ll walk away with a clearer understanding of the financial landscape and the potential threats it faces. Don’t miss out on the opportunity to equip yourself with knowledge that could be crucial for navigating the future!

Easy Money: The Greatest Ponzi Scheme Ever and How It Threatens to Destr oy the Global Financial System

Key Takeaways

In “Easy Money: The Greatest Ponzi Scheme Ever and How It Threatens to Destroy the Global Financial System,” Vivek Kaul delves into the intricate workings of the financial landscape post-2008 crisis. Here are the essential insights and lessons that readers can expect from this compelling read:

- Understanding Risk Management: Gain clarity on how banks and financial firms have adapted their risk management strategies since the 2008 crisis.

- Evaluating Post-Crisis Changes: Discover whether the financial institutions are genuinely operating more responsibly or if they continue to engage in high-risk behaviors.

- Anticipating Future Crises: Learn about the potential triggers for the next financial crisis and what signs to watch for.

- Impact of Government Bailouts: Explore the long-term effects of taxpayer-funded bailouts on the financial system and public trust.

- Global Financial System Insights: Understand the interconnectedness of global financial markets and how crises in one region can impact economies worldwide.

- Critical Analysis: Benefit from Kaul’s critical examination of the systemic issues that remain unaddressed since the last financial crisis.

- Practical Lessons: Take away practical lessons for personal finance and investment strategies in an uncertain economic landscape.

Final Thoughts

In “Easy Money: The Greatest Ponzi Scheme Ever and How It Threatens to Destroy the Global Financial System,” Vivek Kaul dives deep into the intricacies of our financial landscape post-2008 crisis. With a keen eye for detail, he explores whether the lessons of the past have truly been learned and questions the accountability of financial institutions in today’s world. This book is not just a retrospective analysis; it’s a critical examination of the risks that still loom large over the global economy.

- Unearths the realities of post-crisis banking practices.

- Offers insights into the potential for future financial disasters.

- Encourages readers to think critically about the systems that govern their financial lives.

This book is a must-read for anyone interested in understanding the forces that shape our financial systems and the implications these have on our future. Whether you’re a seasoned investor, a curious learner, or someone simply seeking to protect your financial well-being, Kaul’s insights are invaluable.

Don’t miss out on this opportunity to arm yourself with knowledge that can help navigate the uncertain waters of the financial world. Purchase “Easy Money” today!