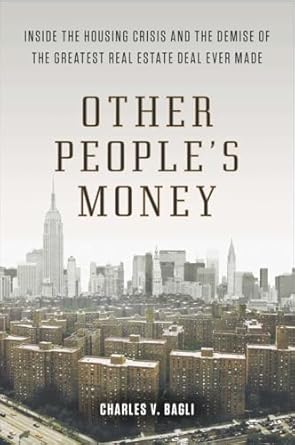

Discover the riveting story behind one of the most spectacular failures in real estate history with “Other People’s Money: Inside the Housing Crisis and the Demise of the Greatest Real Estate Deal Ever Made.” Authored by a veteran New York Times reporter, this compelling narrative delves into the ill-fated acquisition of Stuyvesant Town-Peter Cooper Village by real estate titan Tishman Speyer and its partner BlackRock. As billions were lost, readers will uncover how Tishman Speyer emerged relatively unscathed while others faced devastating financial repercussions.

Illuminating the intricate world of high finance, politics, and the unchecked hubris that led to the nationwide real estate meltdown, “Other People’s Money” offers an insider’s perspective akin to “Too Big to Fail.” This book is a must-read for anyone interested in understanding the complexities of real estate investments and the factors that can lead to monumental failures.

Other People’s Money: Inside the Housing Crisis and the Demise of the Greatest Real Estate Deal Ever M ade

Why This Book Stands Out?

- Expert Insight: Authored by a veteran New York Times reporter, the book offers a deep dive into the complexities of the real estate industry, specifically the monumental failure of Tishman Speyer and BlackRock.

- Compelling Narrative: The book tells a riveting story that parallels the financial crisis of 2008, shedding light on the intricate interplay between politics and high finance.

- Detailed Analysis: It provides an in-depth examination of how one of the largest real estate deals in history collapsed, highlighting the factors that contributed to the failure and the surprising outcomes for various stakeholders.

- Lessons Learned: The book not only recounts events but also offers critical insights into the hubris and decision-making processes that led to the nationwide real estate meltdown, making it a valuable resource for investors and policymakers alike.

- Comparative Context: By drawing parallels to ‘Too Big to Fail,’ it situates the housing crisis within a broader financial narrative, making it relatable and informative for readers interested in economic history.

- Engaging Style: The author’s journalistic background ensures a gripping and accessible writing style that keeps readers engaged while educating them on complex financial concepts.

Personal Experience

Reading “Other People’s Money: Inside the Housing Crisis and the Demise of the Greatest Real Estate Deal Ever Made” offers a unique lens through which to view not just the world of finance, but also our individual relationships with money, property, and investment. As you delve into this gripping narrative, you might find several relatable insights and experiences that resonate on a personal level.

- Reflections on Financial Choices: The book prompts readers to consider their own financial decisions, particularly in real estate. Have you ever felt the pressure to invest in a property? Did you weigh the risks and rewards carefully, or were you swept up in the excitement?

- Understanding Market Vulnerability: The story of Tishman Speyer and BlackRock serves as a stark reminder of how fragile the real estate market can be. Readers may relate this to their own experiences of market fluctuations, perhaps recalling a time when they witnessed a friend’s or family member’s investment crumble.

- Lessons in Hubris: The narrative illustrates the dangers of overconfidence in investment strategies. Many readers can likely relate to moments in their lives where they were overly ambitious or underestimated challenges, leading to unexpected outcomes.

- Community Impact: The book highlights how large-scale real estate deals can affect local communities. Many readers may have seen firsthand how housing crises impact their neighborhoods, leading to reflections on community stability and the importance of responsible investment.

- Personal Financial Responsibility: Engaging with the text encourages self-examination regarding one’s financial literacy and responsibility. Readers may find themselves questioning their own understanding of investments and seeking to improve their financial acumen.

Through these relatable insights, “Other People’s Money” becomes more than just a recounting of a financial disaster; it transforms into a mirror reflecting our individual experiences, aspirations, and sometimes, our missteps in the complex world of finance.

Who Should Read This Book?

This book is ideal for a diverse audience interested in understanding the complexities of the real estate market and the factors that led to the housing crisis. Here are some key groups who will find value in reading “Other People’s Money”:

- Real Estate Professionals: Gain insights into the pitfalls of high-stakes real estate deals and learn from one of the biggest failures in the industry.

- Investors: Understand the risks involved in real estate investments and the dynamics between major players like Tishman Speyer and BlackRock.

- Students and Academics: Delve into a detailed analysis of the housing crisis and its implications for economic theory and policy.

- Policy Makers: Explore the political and economic factors that contributed to the real estate meltdown, informing future regulatory decisions.

- General Readers: Anyone interested in true stories of finance and the real estate market will appreciate the narrative style and engaging storytelling.

Other People’s Money: Inside the Housing Crisis and the Demise of the Greatest Real Estate Deal Ever M ade

Key Takeaways

Readers of Other People’s Money can expect to gain valuable insights into the complexities of the real estate market and the critical factors that contributed to one of the most significant financial failures in history. Here are the key takeaways from the book:

- Understanding Market Dynamics: Learn how external economic factors and market conditions can dramatically impact real estate investments.

- The Role of Major Players: Gain insight into how major corporations like Tishman Speyer and BlackRock operate and influence the real estate landscape.

- Lessons from Failures: Examine the consequences of hubris and poor decision-making in high-stakes investments.

- Political Influence: Discover how politics and policies affect real estate markets and the importance of regulatory environments.

- Risk Management: Understand the significance of risk assessment and management strategies in avoiding catastrophic losses.

- Financial Strategies: Explore the financial maneuvers that can lead to profit or loss in large-scale real estate transactions.

- Comparative Analysis: Analyze the contrasting outcomes for different stakeholders involved in the Stuyvesant Town–Peter Cooper Village deal.

Final Thoughts

Other People’s Money offers a compelling exploration of one of the most significant failures in real estate history. Through meticulous reporting, the author sheds light on the intricate dynamics of high finance and the politics that shaped the housing crisis. This book is not just a tale of loss; it is a cautionary narrative about the hubris of major players in the real estate market and the implications of their decisions.

- In-depth analysis of the Stuyvesant Town–Peter Cooper Village deal.

- Insights into the roles of Tishman Speyer, BlackRock, and MetLife.

- Comparative exploration of the financial industry and real estate, akin to “Too Big to Fail.”

- Engaging writing style that makes complex financial concepts accessible.

This book is a must-read for anyone interested in real estate, finance, or the socio-economic factors that contribute to market failures. It provides valuable lessons about risk, accountability, and the intricacies of investment strategies. Don’t miss out on this enlightening read—purchase Other People’s Money today and gain a deeper understanding of the forces that shape our financial landscape.