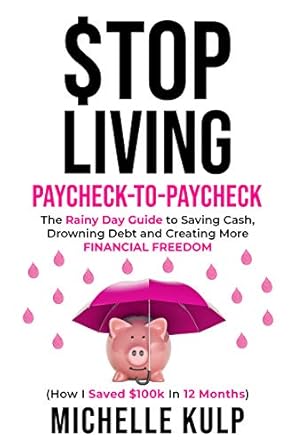

Are you tired of living paycheck-to-paycheck and feeling stressed about your finances? Discover the transformative power of “Stop Living Paycheck-to-Paycheck: The Rainy Day Guide to Saving Cash, Drowning Debt, and Creating More Financial Freedom.” In this eye-opening book, author Michelle Kulp shares her inspiring journey from zero savings to an impressive $100K in just 12 months, providing you with a practical blueprint to achieve your financial goals. With a focus on four essential financial buckets—Debt, Expenses, Income, and Savings—this guide helps you plug the leaks that are draining your financial well-being.

Whether you’re struggling with high-interest debts, limited savings, or simply want to take charge of your financial future, this book offers the strategies you need to reclaim your power. Learn how to shift your money mindset, create multiple income streams, and build a robust emergency fund. Get ready to embrace financial freedom and prepare for those inevitable rainy days—it’s time to take control of your finances!

Stop Living Paycheck-to-Paycheck: The Rainy Day Guide to Saving Cash, Drowning Debt and Creating More Financial Freedom (How I Saved $100k in 12 Months)

Why This Book Stands Out?

- Proven Success Story: Learn from Michelle Kulp, a 6-figure income earner who transformed her financial life, saving $100K in just 12 months and erasing her debt.

- Four Essential Buckets: The book cleverly categorizes finances into four buckets—Debt, Expenses, Income, and Savings—helping you visualize and manage your money effectively.

- Mindset Shift: Address unconscious money blocks and develop a healthier money mindset, ensuring lasting financial change.

- Actionable Strategies: Gain access to specific, practical strategies to overcome underearning, create multiple income streams, and automate your finances.

- Empowerment Tools: Discover manifestation techniques and reclaim your power over your spending habits, fostering a sense of control and freedom.

- Preparedness for Life’s Challenges: Equip yourself for financial rainy days, ensuring you have the savings and strategies in place to weather any storm.

Personal Experience

As I delved into “Stop Living Paycheck-to-Paycheck,” I couldn’t help but feel a sense of connection with Michelle Kulp’s journey. Like many of us, I’ve experienced that familiar anxiety that comes with living on the financial edge, where every month feels like a tightrope walk. The feeling of being one unexpected expense away from chaos is something I know all too well. This book spoke to me not just as a financial guide, but as a companion in my own struggles.

Michelle’s candid sharing of her transformation from zero savings to $100,000 in just a year felt both inspiring and achievable. It was a reminder that change is possible, even when it seems daunting. I found myself nodding along as I read about the four financial buckets—the Debt Bucket, Expenses Bucket, Income Bucket, and Savings Bucket. It was like a light bulb went off; I could see how my own financial habits mirrored those leaking buckets, and it was time to take action.

Some key insights that resonated deeply with me included:

- Identifying unconscious money blocks that hold us back from financial freedom.

- The importance of shifting our money mindset to embrace abundance rather than scarcity.

- Practical strategies to create multiple streams of income and automate savings.

- The empowering realization that we can reclaim control over our spending habits.

Reading this book felt like having a trusted friend guiding me through the murky waters of personal finance. Michelle’s relatable anecdotes and actionable advice made me reflect on my own spending patterns and the emotional triggers that led to impulsive purchases. I realized I wasn’t alone in this struggle and that many readers would find solace in knowing that they too can rewrite their financial stories.

There was something liberating about exploring the concept of financial freedom through the lens of rainy days. It’s not just about saving for a crisis; it’s about building a life filled with choices and opportunities. This book reminded me that every step towards financial stability, no matter how small, is a step towards greater freedom. I could almost feel the weight lifting as I contemplated the possibility of a future where my financial buckets were full instead of empty.

Who Should Read This Book?

If you’ve ever felt overwhelmed by your finances or found yourself living paycheck-to-paycheck, then this book is absolutely for you! Whether you’re struggling to make ends meet, drowning in debt, or simply want to build a better financial future, “Stop Living Paycheck-to-Paycheck” is the guide you’ve been waiting for. Here’s why this book is perfect for you:

- Individuals with Little to No Savings: If you find yourself constantly worrying about how to pay your bills or cover unexpected expenses, this book will teach you practical strategies to start saving and ensure you have a financial cushion for those rainy days.

- Debt-Burdened Readers: For anyone feeling crushed under the weight of credit card debt or loans, Michelle Kulp shares her personal journey of erasing debt and increasing her credit score. You’ll learn effective methods to tackle your debt head-on.

- Those Seeking Financial Freedom: If you dream of living a life free from financial stress, this book provides a blueprint for achieving that. It’s not just about getting by; it’s about thriving and making empowered financial choices.

- People Who Want to Improve Their Money Mindset: Michelle emphasizes the importance of addressing unconscious money blocks. If you’re ready to shift your perspective and reclaim your financial power, this book offers the tools you need.

- Anyone Interested in Multiple Streams of Income: If you’re looking to diversify your income and create financial security, Michelle’s strategies for generating additional revenue will inspire and guide you.

In short, if you’re ready to take control of your financial future and start living life on your own terms, “Stop Living Paycheck-to-Paycheck” is your go-to resource. Michelle Kulp’s friendly and relatable approach makes this journey not only achievable but enjoyable!

Stop Living Paycheck-to-Paycheck: The Rainy Day Guide to Saving Cash, Drowning Debt and Creating More Financial Freedom (How I Saved $100k in 12 Months)

Key Takeaways

If you’re looking to transform your financial situation, “Stop Living Paycheck-to-Paycheck” by Michelle Kulp offers invaluable insights and practical strategies. Here are the key points that make this book a must-read:

- Identify and Fix Financial Leaks: Learn how to assess and plug the leaks in your financial buckets – Debt, Expenses, Income, and Savings.

- Proven Success Blueprint: Follow Michelle’s step-by-step blueprint that helped her save $100K in just 12 months and eliminate debt.

- Enhance Your Money Mindset: Overcome unconscious money blocks and develop a healthier relationship with your finances.

- Create Multiple Income Streams: Discover effective strategies to increase your income and boost your financial stability.

- Automate Your Finances: Learn how to automate your money management to ensure consistent savings and reduced stress.

- Build Emergency Cash: Gain insights into building a substantial emergency fund for those inevitable rainy days.

- Increase Your Credit Score: Understand the steps to improve your credit score, just like Michelle increased hers by 300 points.

- Empower Your Financial Decisions: Reclaim control over your spending and empower yourself with effective purchasing strategies.

By reading this book, you can take meaningful steps towards achieving financial freedom and security.

Final Thoughts

If you find yourself living paycheck-to-paycheck, constantly stressed about money, and unsure of how to improve your financial situation, then “Stop Living Paycheck-to-Paycheck” is the perfect guide for you. Authored by Michelle Kulp, a successful entrepreneur who transformed her financial life, this book provides a practical roadmap to financial freedom. By focusing on the four crucial financial buckets—Debt, Expenses, Income, and Savings—Michelle helps you identify and plug the leaks that are keeping you from achieving your financial goals.

Here are a few key takeaways from the book:

- Learn to recognize and address unconscious money blocks that hinder your financial progress.

- Explore strategies to eliminate debt, reduce expenses, and increase your income.

- Discover how to automate your finances and build a strong emergency fund.

- Gain insights into creating multiple streams of income for greater financial stability.

By the end of this engaging read, you’ll be equipped with the knowledge and tools to reclaim control over your finances, paving the way for a more secure and fulfilling life. Stop waiting for a financial rainy day—prepare for it! This book is a valuable addition to anyone’s collection who seeks to elevate their financial health and overall well-being.

Are you ready to transform your financial future? Don’t hesitate—click the link to purchase your copy of Stop Living Paycheck-to-Paycheck today and embark on your journey toward financial freedom!