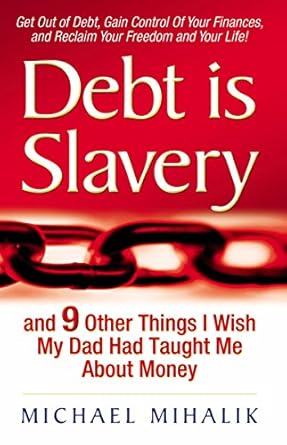

Are you tired of feeling trapped by debt? In “Debt is Slavery: and 9 Other Things I Wish My Dad Had Taught Me About Money,” Michael Mihalik offers a refreshing, no-nonsense approach to personal finance that can help you break free from financial burdens. This concise guide is packed with ten transformative steps that challenge your perceptions of money, empowering you to take control of your finances and eliminate debt for good. With straightforward advice and actionable strategies, Mihalik’s book is like having a financial mentor by your side, guiding you every step of the way.

What sets “Debt is Slavery” apart is its focus on real change. Mihalik equates debt with slavery, a powerful analogy that resonates deeply with anyone struggling financially. The book is lean, effective, and filled with practical insights that are easy to implement, making it a must-read for anyone ready to reclaim their financial freedom. Don’t let debt control your life—discover the tools you need to thrive today!

Debt is Slavery: and 9 Other Things I Wish My Dad Had Taught Me About Money

Why This Book Stands Out?

- No-Nonsense Approach: Michael Mihalik delivers straightforward, actionable advice without any fluff, making it easy for readers to grasp and implement his money management strategies.

- Transformative Perspective: The book’s core message equates debt with slavery, prompting readers to rethink their relationship with money and understand the gravity of financial servitude.

- 10 Practical Steps: Mihalik outlines ten essential steps that he personally used to conquer debt, providing a clear roadmap to financial freedom.

- Focus on Mindset: The emphasis on changing perceptions about money helps readers cultivate healthier financial habits and make lasting changes in their lives.

- Concise and Accessible: At just 128 pages, this book is perfect for busy individuals, ensuring that every page is packed with valuable insights that can be absorbed quickly.

- Real-Life Impact: Readers have shared transformative experiences, highlighting how the book has prompted them to take action and reassess their financial priorities.

Personal Experience

As I delved into Debt is Slavery by Michael Mihalik, I couldn’t help but reflect on my own journey with money and debt. Like many, I found myself in a cycle of borrowing that felt overwhelming, and the analogy of debt as slavery resonated deeply with me. It was a wake-up call, forcing me to reconsider my relationship with money and the choices I was making.

Each chapter was like peeling back layers of my financial habits. Mihalik’s straightforward approach cut through the noise and provided clarity. It reminded me of those late-night conversations with friends, where we share our struggles and celebrate small victories. I could almost hear their voices in the anecdotes he shared, urging me to take control of my financial destiny.

- Shifting Mindset: The idea that I needed to change my perception of money struck a chord. I realized that every dollar I spent was a choice, a representation of my values and priorities.

- Time vs. Money: Equating money with time made me rethink my spending habits. Suddenly, that impulsive purchase didn’t feel worth the hours I had to work to pay for it.

- Facing the Truth: Mihalik’s candid discussion about the hidden costs of possessions made me confront the clutter in my life—both physical and financial. I began to see how much I had been held captive by my belongings.

- Empowerment: By the time I reached the chapter about saving 50 percent of my salary, I felt empowered. It was as if Mihalik was handing me the keys to unlock a future free from financial burdens.

Reading this book wasn’t just an academic exercise; it was a transformative experience. It sparked a sense of urgency in me to take actionable steps towards financial freedom. I found myself jotting down notes and reflecting on my spending patterns, much like I would after a motivational talk. If you’ve ever felt weighed down by debt, or if money has been a source of stress in your life, this book might just be the compass you need to navigate your financial journey.

Who Should Read This Book?

If you find yourself struggling with debt or feeling overwhelmed by your finances, then Debt is Slavery by Michael Mihalik is the perfect companion for your journey towards financial freedom. This book is tailored for a variety of readers who are ready to take control of their money and make lasting changes in their lives.

- Individuals in Debt: If you’re currently facing the burden of debt, this book offers straightforward, actionable steps that can help you break free from financial servitude.

- Financial Newbies: New to managing your finances? Mihalik explains complex concepts in a simple way, making it easier for you to grasp the fundamentals of personal finance.

- People Seeking Motivation: Sometimes, all you need is a little push to get started on your financial journey. This book is packed with motivating insights that can inspire you to take action.

- Readers Tired of Fluff: If you’re fed up with lengthy financial books that beat around the bush, you’ll appreciate Mihalik’s direct and no-nonsense approach.

- Anyone Looking to Change Their Mindset: Mihalik emphasizes the importance of changing your perception of money. If you’re ready for a mental shift that leads to better financial habits, this book will guide you.

In a world where financial advice can often be overwhelming and complicated, Debt is Slavery stands out as a beacon of clarity. Whether you’re drowning in debt or simply looking to refine your financial literacy, Mihalik’s insights are invaluable. Give it a read—you might just find the answers you’ve been searching for!

Debt is Slavery: and 9 Other Things I Wish My Dad Had Taught Me About Money

Key Takeaways

Reading “Debt is Slavery: and 9 Other Things I Wish My Dad Had Taught Me About Money” by Michael Mihalik offers invaluable insights for anyone looking to take control of their finances and escape the burden of debt. Here are the most important lessons and benefits you can expect from this powerful guide:

- Debt as Slavery: Mihalik compellingly equates debt with slavery, helping readers understand the psychological and financial chains that borrowing creates.

- Transform Your Thinking: The book emphasizes that changing your perception of money is crucial for financial success; actions stem from thought.

- Simple Actionable Steps: Mihalik outlines 10 straightforward steps he used to gain financial control, making it easy for readers to follow along.

- Money Equals Time: Readers learn to equate money with time to curb unnecessary spending and prioritize their financial decisions.

- Evaluate Possessions: The book encourages readers to assess the hidden costs associated with their possessions, fostering a more mindful approach to spending.

- Avoid Marketing Traps: Mihalik discusses the pervasive influence of marketing on consumer behavior and how to protect oneself from its effects.

- Saving Strategies: By the end of the book, readers are empowered with the belief that they can save 50% of their salary through practical techniques.

- Concise and Direct Advice: With only 128 pages, the book is free from fluff, delivering essential information in a clear and direct manner.

- Action-Oriented Approach: Many readers report being motivated to take action in their financial lives after engaging with the content.

Final Thoughts

If you’re feeling overwhelmed by debt and searching for a way out, “Debt is Slavery: and 9 Other Things I Wish My Dad Had Taught Me About Money” by Michael Mihalik is a must-read. This insightful book is not just a guide; it’s a transformative journey that challenges the way we perceive money and debt. Mihalik’s candid approach pairs practical advice with powerful mindset shifts, making it an invaluable resource for anyone looking to reclaim their financial freedom.

Here are a few key takeaways that highlight the book’s overall value:

- Practical Steps: Mihalik outlines 10 actionable steps that he personally used to pay off a significant amount of debt.

- Mindset Shift: The central theme equates debt with slavery, prompting readers to reconsider their relationship with money.

- No Fluff: At just 128 pages, this book gets straight to the point, making it accessible for even the busiest individuals.

- Empowering Insights: Readers will learn to evaluate the true cost of possessions and the influence of marketing on their spending habits.

Whether you’re just starting on your financial journey or looking to refine your existing strategies, “Debt is Slavery” offers a roadmap to success. Don’t let debt dictate your life any longer. Take the first step towards financial empowerment today. Purchase your copy now!