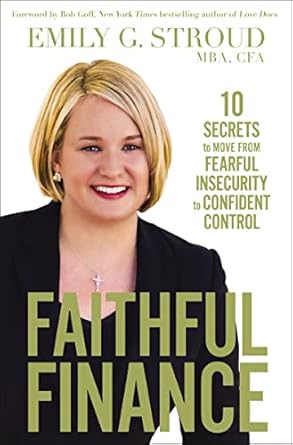

Are you tired of feeling overwhelmed by your finances? Dive into “Faithful Finance: 10 Secrets to Move from Fearful Insecurity to Confident Control” by financial advisor Emily G. Stroud. With two decades of experience, Emily understands that money doesn’t have to be a source of stress but can instead bring joy and security. This practical guide offers ten essential secrets that will empower you to take control of your financial future.

In “Faithful Finance,” you’ll discover how to create a customized savings plan, develop a monthly budget that works for you, reduce debt, and even plan for your children’s education—all while nurturing the importance of generosity. Presented in a warm, conversational style, this book is perfect for anyone, regardless of income level or life stage, looking to achieve financial freedom and peace of mind. Let Emily guide you on the path to confident financial management today!

Faithful Finance: 10 Secrets to Move from Fearful Insecurity to Confident Control

Why This Book Stands Out?

- Expert Insights: Written by financial advisor Emily G. Stroud, who brings two decades of experience helping individuals navigate their finances.

- Practical Secrets: Offers ten actionable secrets that empower readers to shift from financial fear to confident control.

- Relatable Approach: Presented in a conversational style, making complex financial concepts easy to understand and apply.

- Customized Strategies: Guides you in creating a personalized savings plan, a realistic budget, and effective debt reduction tactics.

- Life Stage Relevance: Applicable for all income levels and stages of life, ensuring that everyone can benefit from its teachings.

- Holistic Perspective: Encourages not just financial management but also generosity, legacy planning, and the pursuit of true wealth.

- Engaging Stories: Features real-life examples that illustrate key concepts, making the lessons relatable and memorable.

Personal Experience

As I delved into the pages of Faithful Finance, I couldn’t help but reflect on my own journey with money. Like many, I’ve faced moments of financial uncertainty, times when the weight of bills and obligations felt overwhelming. I remember sitting at the kitchen table, staring at a pile of receipts, feeling lost and anxious about my financial future. It was in those moments that I wished for a guiding hand, someone to help me navigate the intricate world of personal finance.

Emily G. Stroud’s approach resonated deeply with me. Her conversational style made it feel as though I was chatting with a wise friend rather than reading a textbook on finance. She shared stories that mirrored my own experiences—those late-night worries about whether I could save enough for my children’s education or feeling guilty about not giving generously when I truly wanted to. This book felt like a warm embrace, reassuring me that I wasn’t alone in my financial struggles.

Here are a few key insights that really struck a chord with me:

- Setting Unique Goals: Emily encourages readers to develop a savings plan tailored to their individual aspirations. I realized that I had been trying to fit into a mold that didn’t reflect my life or dreams.

- Practical Budgeting: The idea of creating a budget that actually works for me was revolutionary. I found myself nodding along as she outlined steps to make budgeting a tool for empowerment rather than a source of dread.

- Debt Reduction: Her straightforward strategies on reducing debt felt like a lifeline. I could almost envision a path to financial freedom, one step at a time.

- Legacy and Generosity: Emily’s emphasis on leaving a legacy and encouraging generosity reminded me of what truly matters in life—relationships and community. It reignited my desire to give back.

- True Wealth: Perhaps the most profound insight was her exploration of what true wealth means. It’s not just about money; it’s about joy, security, and hope—values I cherish deeply.

Reading Faithful Finance felt like embarking on a journey of self-discovery. It challenged me to rethink my relationship with money and empowered me to take control of my financial destiny. I could see the path laid out before me, a roadmap to not just surviving but thriving financially. If you’ve ever felt the weight of financial stress, this book may just be the companion you need to find your way to confident control.

Who Should Read This Book?

If you’re feeling overwhelmed by your finances or just want to take control of your money, then Faithful Finance is the perfect book for you! Whether you’re a busy parent, a young professional, or someone looking to build a secure financial future, Emily G. Stroud’s guidance is tailored to meet your needs. Here’s why this book is a must-read:

- Parents Seeking Financial Stability: If you want to create a solid financial foundation for your family, this book provides actionable steps to develop a savings plan and plan for your children’s college years.

- Young Professionals: Just starting out in your career and feeling unsure about managing your finances? Emily’s friendly approach will help you set up a budget that really works for you.

- Individuals Struggling with Debt: If reducing your debt burden feels like an uphill battle, you’ll find practical strategies in this book to help you tackle it head-on.

- Those Wanting to Leave a Legacy: If you’re interested in estate planning and ensuring your loved ones are taken care of, Emily offers insightful advice on how to leave a meaningful legacy.

- Anyone Looking to Give Back: If generosity is important to you, this book encourages you to give with confidence and joy, highlighting the profound impact of charitable giving.

With its engaging stories and practical examples, Faithful Finance empowers readers from all walks of life to make informed decisions about their finances. You’ll not only learn to manage your money, but also discover how it can be a source of joy and hope!

Faithful Finance: 10 Secrets to Move from Fearful Insecurity to Confident Control

Key Takeaways

In “Faithful Finance: 10 Secrets to Move from Fearful Insecurity to Confident Control,” Emily G. Stroud provides valuable insights and practical strategies for achieving financial freedom. Here are the key points that make this book a must-read:

- Transformative Mindset: Learn how to shift your perspective on money from one of fear and stress to one of joy and security.

- Personalized Savings Plans: Develop a savings strategy tailored to your unique life goals, ensuring your financial choices align with your values.

- Effective Budgeting: Create a monthly budget that is realistic and works for your lifestyle, helping you manage your expenses with confidence.

- Debt Reduction Techniques: Discover methods to reduce and manage debt, allowing you to achieve financial stability more quickly.

- College Planning: Gain insights on how to effectively plan for your children’s education without compromising your financial health.

- Life Insurance Simplified: Understand the importance of life insurance and learn how to secure it without fear.

- Estate Planning Essentials: Explore the key components of estate planning to leave a legacy that reflects your values and supports your loved ones.

- Generosity Encouraged: Find encouragement to give generously and understand how it contributes to true wealth.

- Universal Applicability: Benefit from practical advice that applies to various income levels and stages of life, making it accessible to everyone.

- Empowering Stories: Engage with relatable stories and examples that illustrate financial concepts in a clear and engaging manner.

Final Thoughts

If you’re feeling overwhelmed by your finances and searching for a path to financial freedom, “Faithful Finance: 10 Secrets to Move from Fearful Insecurity to Confident Control” by Emily G. Stroud is a must-read. This insightful guide offers ten transformative secrets that empower you to take control of your financial life with confidence.

Emily draws on her two decades of experience as a financial advisor to present practical strategies that resonate with readers from all walks of life. Whether you’re a busy mom, an entrepreneur, or someone simply looking to make wiser financial choices, this book provides:

- A personalized savings plan tailored to your unique goals

- A functional monthly budget that fits your lifestyle

- Effective strategies to reduce debt and plan for the future

- Guidance on life insurance and estate planning

- Encouragement to give generously and build a legacy

Through engaging stories and relatable examples, Emily inspires readers to see money not as a source of stress but as a tool for joy, security, and hope. This book is not just about managing money; it’s about transforming your mindset and embracing the freedom that comes with financial control.

Don’t let fear hold you back from achieving your financial goals. Invest in your future and equip yourself with the knowledge and strategies you need. Purchase “Faithful Finance” today and take the first step towards a more secure and fulfilling financial life!