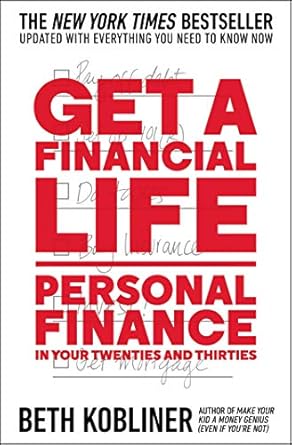

Are you navigating the tricky waters of personal finance in your twenties or thirties? Look no further than the newly revised edition of “Get a Financial Life: Personal Finance in Your Twenties and Thirties” by Beth Kobliner. This trusted New York Times bestseller has been a financial lifeline for a generation, offering down-to-earth advice tailored to the unique challenges young adults face today. With skyrocketing student loan debt and high living costs, it’s essential to get your financial life in order, and Kobliner’s fresh insights will empower you to do just that.

This updated edition is packed with actionable tips that help you tackle everything from budgeting and saving to understanding credit scores and taxes. Whether you’re looking to escape debt or build a solid financial foundation, “Get a Financial Life” is your go-to guide for creating healthy financial habits that last a lifetime. Start your journey toward financial freedom today!

Get a Financial Life: Personal Finance in Your Twenties and Thirties

Why This Book Stands Out?

- Timely and Relevant: Tailored specifically for millennials navigating the post-economic crisis landscape, this book addresses the unique financial challenges faced by today’s young adults.

- Proven Expertise: Authored by Beth Kobliner, a trusted voice in personal finance, whose insights have guided readers for over two decades.

- Actionable Advice: Offers clear, step-by-step strategies for managing debt, saving, and investing, making financial concepts accessible and achievable.

- Updated Content: The fourth edition includes fresh insights and modern tools reflecting current trends in digital finance, ensuring relevance in a fast-changing world.

- Comprehensive Coverage: From understanding taxes to improving credit scores, the book covers a wide range of topics essential for building a solid financial foundation.

- Engaging Style: Kobliner’s down-to-earth approach makes even the most complex financial topics relatable and easy to understand.

Personal Experience

As I flipped through the pages of Get a Financial Life: Personal Finance in Your Twenties and Thirties, I couldn’t help but feel a wave of nostalgia wash over me. I remember the confusion and anxiety that came with stepping into adulthood, especially when it came to managing my finances. This book felt like a friend reaching out, offering guidance in a world that often seems overwhelming.

Beth Kobliner’s down-to-earth style resonates deeply with anyone who has ever felt lost in a sea of bills, student loans, and the pressure to save for the future. The relatable anecdotes and practical advice made me reflect on my own journey, and I found myself nodding in agreement as I read about the struggles of budgeting and the importance of building a solid financial foundation.

- Understanding Debt: I remember the weight of my student loans, feeling like I was carrying a heavy backpack everywhere I went. Kobliner’s insights on tackling debt made me realize I wasn’t alone in this struggle.

- Learning to Save: The concept of saving seemed daunting at first, but this book broke it down into manageable steps. It encouraged me to set aside even a small amount regularly, which slowly transformed my mindset.

- Investing for the Future: The section on investing felt like a light bulb moment. It opened my eyes to the possibilities that lay ahead, making me excited about the prospect of growing my money rather than just watching it dwindle.

- Facing Financial Realities: The discussions around budgeting and financial planning felt like a wake-up call. They reminded me that understanding my finances is not just a skill, but a necessity in today’s economy.

Reading Get a Financial Life is not just about learning facts; it’s about connecting with the experiences of others who have walked the same path. It’s a reminder that financial literacy is a journey, one that can be navigated with the right tools and a little bit of encouragement. I found Kobliner’s voice to be both comforting and empowering, making me feel like I had a trusted advisor by my side as I faced my own financial challenges.

Who Should Read This Book?

If you’re in your twenties or thirties and feeling overwhelmed by the complexities of personal finance, then Get a Financial Life: Personal Finance in Your Twenties and Thirties is the perfect book for you! This essential guide is tailored specifically for young adults who are navigating the often confusing financial landscape of today’s world.

Here’s why this book is a must-read for you:

- Recent Graduates: If you’ve just walked across the stage with your diploma, you might be wondering how to tackle your student loans, set a budget, and start saving. This book offers practical advice that’s easy to understand.

- Young Professionals: As you begin your career, understanding how to manage your income, invest for the future, and build a solid credit score is crucial. Kobliner’s insights will help you make informed financial decisions.

- Budgeting Beginners: If you’ve never had to manage your own finances before, the step-by-step guidance provided in this book will help you create a budget that works for you and stick to it!

- Those Struggling with Debt: If student loans, credit card debt, or other financial burdens are weighing you down, this book provides actionable strategies to help you get back on track and regain control over your finances.

- Tech-Savvy Millennials: With the changing digital world, it’s important to understand the latest tools and apps for managing finances. This book includes fresh material that speaks to the tech-savvy generation.

In short, whether you’re just starting your financial journey or looking to refine your money management skills, Get a Financial Life is here to guide you with its friendly tone and practical wisdom. Don’t miss out on the opportunity to take charge of your financial future!

Get a Financial Life: Personal Finance in Your Twenties and Thirties

Key Takeaways

If you’re looking for a comprehensive guide to managing your finances in your twenties and thirties, “Get a Financial Life” by Beth Kobliner is a must-read. Here are the most important insights and benefits you can expect from this updated edition:

- Debt Management: Learn effective strategies to reduce and eliminate student loans and other debts, paving the way for financial freedom.

- Budgeting Basics: Discover practical tips for creating and sticking to a budget that accommodates your lifestyle while promoting savings.

- Saving Strategies: Understand how to build an emergency fund and save for future goals, ensuring a more secure financial foundation.

- Investing Insights: Get introduced to the basics of investing, helping you to grow your wealth over time with confidence.

- Credit Score Improvement: Gain actionable advice on how to boost and maintain a healthy credit score, which is vital for major life purchases.

- Tax Tips: Navigate the complexities of filing taxes and learn to maximize your refunds while minimizing liabilities.

- Digital Age Awareness: Benefit from fresh insights that reflect the changing financial landscape, including tips for managing finances in the digital world.

- Common Mistakes to Avoid: Identify and steer clear of typical pitfalls that young adults face, ensuring a smoother financial journey.

Final Thoughts

In “Get a Financial Life: Personal Finance in Your Twenties and Thirties,” Beth Kobliner delivers a practical and comprehensive guide tailored for young adults navigating the complexities of personal finance. Drawing on her extensive experience and updated insights, Kobliner addresses the unique challenges faced by millennials today, from crippling student debt to the pressures of a volatile economy. This book is not just about managing money; it’s about empowering a generation to take control of their financial futures.

Here are some key takeaways that make this book a must-have:

- Offers actionable advice on budgeting, saving, and investing.

- Addresses modern financial concerns, including navigating the digital landscape.

- Equips readers with strategies to tackle debt and improve credit scores.

- Encourages the formation of healthy financial habits for a lifetime.

If you’re looking to demystify your finances and build a solid foundation for your future, “Get a Financial Life” is an essential resource that should be in your collection. Don’t miss the opportunity to transform your financial understanding and secure your path to financial independence. Purchase your copy today!