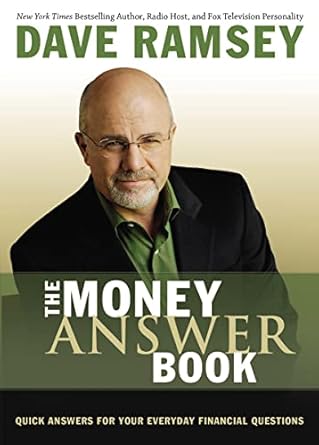

Unlock your financial potential with The Money Answer Book: your go-to resource for tackling everyday money matters with confidence. This comprehensive guide addresses over 100 of the most commonly asked questions from The Dave Ramsey Show, providing clear, concise answers on everything from budget planning to retirement strategies, college savings, and charitable giving.

Designed for individuals seeking quick, actionable advice, this book simplifies complex financial concepts, making it easier for you to make informed decisions. Whether you’re looking to optimize your budget or plan for a secure future, The Money Answer Book delivers invaluable insights in Dave Ramsey’s signature question-and-answer format, ensuring you get the specific guidance you need to thrive financially.

The Money Answer Book: Quick Answers for Your Everyday Financial Questions (Answer Book Series)

Why This Book Stands Out?

- Expert Guidance: Authored by Dave Ramsey, a renowned financial expert, providing trusted advice based on years of experience.

- Comprehensive Coverage: Addresses over 100 of the most frequently asked financial questions, ensuring readers find answers to their pressing money matters.

- Accessible Format: Structured as a question-and-answer guide, allowing for quick reference and easy navigation through various financial topics.

- Real-World Relevance: Draws from the popular Dave Ramsey Show, making it relatable and grounded in everyday financial situations.

- Diverse Topics: Covers a wide range of financial issues, from budgeting and retirement planning to saving for college and charitable giving.

- Practical Solutions: Offers specific, actionable answers to help readers make informed financial decisions with confidence.

Personal Experience

Delving into “The Money Answer Book” by Dave Ramsey can be a transformative experience for many readers. Whether you’re just starting out on your financial journey or looking to refine your existing strategies, this book provides relatable insights and practical advice that resonate on a personal level. Here are some potential experiences readers might encounter:

- Finding Clarity: Readers often find themselves overwhelmed by complex financial jargon. This book breaks down key concepts into digestible answers, making it easier to grasp essential money matters.

- Addressing Real-Life Questions: As you navigate through daily financial decisions, you may encounter specific situations like budgeting for a family vacation or understanding retirement plans. The direct Q&A format allows you to quickly find relevant advice tailored to your needs.

- Building Confidence: Many readers report feeling more empowered after gaining knowledge from the book. Understanding financial principles can boost your confidence in making informed decisions, whether it’s choosing the right insurance or planning for college savings.

- Relating to Personal Stories: Readers often connect with anecdotes and examples shared in the book, allowing them to see their own financial struggles reflected in the stories of others. This connection can be both comforting and motivating.

- Inspiring Action: The actionable tips provided encourage readers to take steps toward improving their financial situations. Whether it’s creating a budget or starting an emergency fund, the book inspires tangible actions that can lead to positive change.

Ultimately, “The Money Answer Book” serves not just as a guide, but as a companion for individuals seeking to navigate their financial lives with greater ease and understanding.

Who Should Read This Book?

The Money Answer Book is an invaluable resource for anyone looking to enhance their understanding of personal finance. It caters to a diverse audience, including:

- Individuals Seeking Financial Guidance: Whether you’re new to budgeting or planning for retirement, this book offers straightforward answers to your most pressing financial questions.

- Students and Young Adults: Those just starting their financial journey will find practical advice on saving for college and managing student loans.

- Families: Parents looking to navigate issues like saving for college, budgeting for family expenses, and charitable giving will benefit from the tailored advice provided.

- Retirees: Individuals planning for retirement will find resources on effective retirement strategies and financial security.

- Fans of The Dave Ramsey Show: Those who appreciate Dave Ramsey’s approach to money management will enjoy this concise format that reflects his most popular insights.

This book is suitable for anyone wanting quick, practical answers to everyday financial concerns, making it a must-read for those striving to improve their financial literacy and decision-making skills.

The Money Answer Book: Quick Answers for Your Everyday Financial Questions (Answer Book Series)

Key Takeaways

The Money Answer Book provides readers with essential insights into managing their finances effectively. Here are the most important lessons and benefits you can expect from this valuable resource:

- Comprehensive Coverage: Addresses over 100 of the most frequently asked financial questions, making it a go-to resource for everyday money matters.

- Expert Guidance: Features advice and answers directly from Dave Ramsey, a trusted figure in personal finance.

- Practical Solutions: Offers specific, actionable answers that can help readers implement effective financial strategies immediately.

- Topics Include: Budget planning, retirement strategies, saving for college, personal buying decisions, and charitable giving.

- Easy-to-Navigate Format: Each question is clearly defined, allowing for quick reference and understanding of complex financial topics.

- Empowerment Through Knowledge: Equips readers with the information they need to make informed financial decisions and enhance their financial literacy.

Final Thoughts

The Money Answer Book by Dave Ramsey is an invaluable resource for anyone looking to navigate the complexities of personal finance. This easy-to-use question and answer format provides readers with direct, actionable insights on a wide range of financial topics. Whether you’re just starting to budget, planning for retirement, or looking for ways to give charitably, this book offers clear guidance.

Here are a few key reasons why this book is worth purchasing:

- Addresses over 100 of the most frequently asked financial questions.

- Provides straightforward answers that are easy to understand and apply.

- Offers practical advice directly from the trusted voice of Dave Ramsey.

- Equips readers with the knowledge to make informed financial decisions.

If you’re ready to take control of your finances and find quick solutions to your everyday money questions, don’t hesitate! Purchase The Money Answer Book today and start your journey towards financial empowerment!