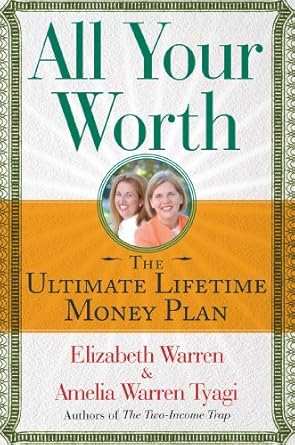

Are you tired of feeling like you work hard but never quite have enough to cover your bills, save for your child’s education, or enjoy some well-deserved fun? If so, All Your Worth: The Ultimate Lifetime Money Plan by Elizabeth Warren and Amelia Warren Tyagi is the essential guide you’ve been searching for. This New York Times bestseller offers a refreshing perspective on personal finance that goes beyond traditional budgeting—helping you create a balanced approach to your money that promotes emotional peace and lasting financial well-being.

With over twenty years of research behind it, this transformative book introduces a simple yet powerful strategy: divide your finances into three key categories—Must-Haves, Wants, and Savings. Forget the complicated spreadsheets and penny-pinching; Warren and Tyagi provide a straightforward plan that empowers you to take control of your finances and build the life you’ve always dreamed of. Embrace a new way of thinking about money and start enjoying the freedom that comes with financial balance!

All Your Worth: The Ultimate Lifetime Money Plan (A Guide to Personal Finances)

Why This Book Stands Out?

- Groundbreaking Approach: Elizabeth Warren and Amelia Warren Tyagi introduce a refreshing perspective on personal finance, emphasizing balance over complexity.

- Simple Framework: The book breaks finances down into three essential components: Must-Haves, Wants, and Savings, making it easy to manage your money effectively.

- Research-Backed Insights: With over twenty years of intensive research, the authors provide practical strategies that are both realistic and achievable.

- Emotional Peace: This guide not only focuses on financial stability but also aims to foster lifelong emotional well-being.

- No Complicated Budgets: Say goodbye to tracking every penny; this book teaches you how to enjoy life while still managing your finances wisely.

- Proven Track Record: As a New York Times bestseller, “All Your Worth” has garnered praise for its straightforward, effective approach to personal finance.

Personal Experience

As I dove into All Your Worth: The Ultimate Lifetime Money Plan, I found myself reflecting on my own relationship with money. Like many, I’ve felt the weight of financial stress creeping in, especially when it comes to balancing bills, saving for the future, and still finding room for a little joy in my life. Elizabeth Warren and Amelia Warren Tyagi’s approach resonated deeply with me, providing not just a framework, but a sense of hope.

One of the most relatable insights I encountered was their emphasis on the importance of categorizing expenses into Must-Haves, Wants, and Savings. This concept struck a chord with me. I realized how often I had been tangled in the web of guilt over spending—whether it was a small treat for myself or a spontaneous outing with friends. The idea that it’s okay to enjoy life while still being responsible with finances was liberating.

- Must-Haves: I could finally see my essential bills as a priority without the anxiety of feeling like I was neglecting my dreams.

- Wants: Allocating a portion of my budget for fun gave me permission to enjoy the fruits of my labor, something I had often denied myself.

- Savings: The structured yet flexible savings plan inspired me to think long-term, allowing for a more secure future.

Reading this book was like having a candid conversation with a wise friend who truly understands the struggles of managing finances. The authors’ relatable anecdotes and practical advice made me feel seen and validated. It was comforting to know that I wasn’t alone in my financial journey. The real-life examples they shared highlighted how many of us grapple with these same challenges, making the lessons feel even more applicable to my own life.

With each chapter, I couldn’t help but feel a shift in my mindset. The stress that had once loomed over me started to fade, replaced by a newfound clarity and optimism. This book isn’t just a guide; it’s a roadmap to reclaiming financial control and finding peace in the process. I found myself eager to implement their strategies, excited about the prospect of not just surviving financially, but thriving.

Who Should Read This Book?

If you’ve ever felt overwhelmed by your finances or wondered where all your hard-earned money goes each month, then All Your Worth: The Ultimate Lifetime Money Plan is just the book for you! This guide is tailored for anyone who wants to take control of their financial future without getting lost in complicated budgets and endless spreadsheets. Here’s why this book is perfect for you:

- Busy Parents: If you’re juggling work, family, and endless bills, this book offers a straightforward approach to managing your money, helping you find balance without adding to your stress.

- Recent Graduates: Just starting out in the real world? Learn the foundational principles of personal finance that will set you up for success in your career and life.

- Debt Holders: If credit card debt has you feeling trapped, this book provides actionable strategies to help you regain control and plan for a debt-free future.

- Anyone Feeling Financially Stressed: Whether it’s worries about saving for a home, college, or retirement, this book will give you practical tools to ease those worries and create a clear path forward.

- Financial Beginners: If you’re new to personal finance and don’t know where to start, Elizabeth Warren and Amelia Warren Tyagi break down complex concepts into easy-to-understand steps.

This book goes beyond traditional budgeting. It offers a refreshing perspective that encourages you to view your finances in a balanced way, allowing you to enjoy life while also planning for the future. It’s time to stop stressing about money and start living life on your terms!

All Your Worth: The Ultimate Lifetime Money Plan (A Guide to Personal Finances)

Key Takeaways

If you’re looking to take control of your finances and achieve lasting peace of mind, “All Your Worth: The Ultimate Lifetime Money Plan” offers invaluable insights and practical strategies. Here are the key takeaways that make this book a must-read:

- Balanced Approach to Finances: Learn to divide your money into three essential categories: Must-Haves, Wants, and Savings, allowing for a more manageable and realistic approach to budgeting.

- Emotional Well-Being: Discover how achieving financial balance can lead to lifelong emotional peace and reduce stress related to money management.

- Simple Strategies: No need for complicated budgets—Warren and Tyagi provide straightforward methods to help you gain control over your finances without tracking every penny.

- Research-Backed Insights: Benefit from over twenty years of extensive research that underpin the authors’ strategies and recommendations.

- Long-Term Financial Health: Equip yourself with a step-by-step plan designed for lasting success, enabling you to build the life you’ve always wanted.

- Focus on Growth: Understand how prioritizing savings can set you up for a better tomorrow while still allowing for enjoyment today.

Final Thoughts

If you’re feeling overwhelmed by your finances and unsure how to regain control, All Your Worth: The Ultimate Lifetime Money Plan is a must-read. Authored by the mother-daughter duo Elizabeth Warren and Amelia Warren Tyagi, this personal finance guide presents a refreshing perspective on money management that prioritizes emotional peace alongside financial stability. With over twenty years of research backing it, the book introduces a practical, straightforward approach to budgeting that focuses on balancing three essential components: Must-Haves, Wants, and Savings.

Here’s why this book is invaluable for anyone looking to improve their financial situation:

- Offers a simple and effective method to manage your money without complicated budgets.

- Helps you understand your spending habits and align them with your life goals.

- Encourages a healthier relationship with money, allowing you to enjoy life while saving for the future.

Don’t let financial stress hold you back from achieving your dreams. All Your Worth will guide you toward a balanced, fulfilling financial life. Take the first step towards financial well-being by adding this transformative book to your collection. Purchase your copy today!