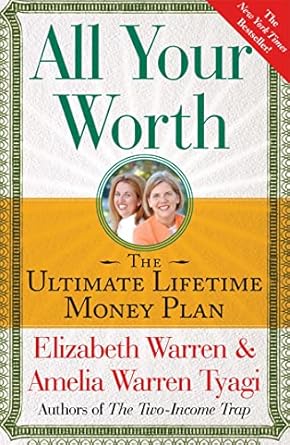

Unlock the secrets to financial peace with “All Your Worth: The Ultimate Lifetime Money Plan,” a transformative guide authored by Elizabeth Warren and Amelia Warren Tyagi. This New York Times bestseller presents a revolutionary approach to personal finance that empowers you to take control of your money like never before. Discover how to balance your Must-Haves, Wants, and Savings to create a sustainable financial future, all while fostering emotional well-being.

With over twenty years of research backing their insights, Warren and Tyagi offer a straightforward, step-by-step plan designed to simplify your budgeting process. Say goodbye to complicated spreadsheets and endless tracking; this guide will help you understand your relationship with money, enabling you to build the life you’ve always dreamed of. Dive into “All Your Worth” today and take the first step towards lifelong financial security and satisfaction.

All Your Worth: The Ultimate Lifetime Money Plan (A Guide to Personal Finances)

Why This Book Stands Out?

- Innovative Framework: Introduces a unique three-part money management system focusing on Must-Haves, Wants, and Savings, allowing for a balanced financial life.

- Research-Driven Insights: Based on over twenty years of extensive research, ensuring the strategies are grounded in real-world data and experiences.

- Accessible Guidance: Offers a straightforward, step-by-step plan that eliminates the need for complicated budgets or meticulous tracking of every expense.

- Emotional Well-Being: Emphasizes the connection between financial management and emotional peace, providing a holistic approach to personal finance.

- Expert Authors: Written by Elizabeth Warren, a prominent political figure and financial expert, alongside her daughter Amelia Warren Tyagi, lending credibility and authority to the content.

- Transformative Perspective: Encourages readers to rethink their relationship with money, promoting a healthier mindset towards personal finances.

- New York Times Bestseller: Recognized as a bestseller, highlighting its popularity and trust among readers seeking financial guidance.

Personal Experience

Reading “All Your Worth: The Ultimate Lifetime Money Plan” can be a transformative journey for anyone grappling with their financial situation. As you delve into the insights provided by Elizabeth Warren and Amelia Warren Tyagi, you may find yourself reflecting on your own habits and choices regarding money. This book resonates on a personal level, as it addresses common struggles many face, such as balancing bills, Savings, and the desire for occasional indulgences.

Here are some relatable insights and potential experiences you might encounter as you engage with this book:

- Understanding Your Financial Stress: You may recognize the familiar feeling of financial anxiety, realizing that you’re not alone in feeling overwhelmed by bills and expenses.

- Reevaluating Your Spending Habits: The book encourages you to take a hard look at your Must-Haves and Wants, prompting you to assess where your money really goes each month.

- Finding Balance: The authors’ approach to dividing your finances into three parts allows you to visualize a healthier relationship with money, making it easier to prioritize your needs without sacrificing your happiness.

- Encouraging Open Conversations: The insights from Warren and Tyagi may inspire you to discuss financial topics with family and friends, breaking the stigma around money management and fostering a supportive environment.

- Building a Future: The concept of Savings for a better tomorrow might motivate you to start thinking about long-term goals, such as retirement or your child’s education, fostering a sense of hope and direction.

Ultimately, “All Your Worth” serves as a guide that not only provides practical strategies but also encourages self-reflection and personal growth. Through its relatable lessons, you may find yourself empowered to take control of your finances in a way that brings peace of mind and fulfillment.

Who Should Read This Book?

All Your Worth: The Ultimate Lifetime Money Plan is ideal for a diverse audience seeking to gain control over their finances and achieve long-term financial well-being. This book is particularly suitable for:

- Young Professionals: Those starting their careers and looking to establish sound financial habits early on.

- Parents: Individuals managing family budgets and saving for their children’s education or future needs.

- Debt-burdened Individuals: Readers struggling with credit card debt or living paycheck to paycheck, seeking practical solutions.

- Financial Beginners: Anyone unfamiliar with budgeting concepts who desires a straightforward approach to managing money.

- Individuals Seeking Peace of Mind: Those wanting to reduce financial stress and achieve emotional well-being through better money management.

By presenting a simple, balanced approach to finances, this book empowers readers to take charge of their money, making it a valuable resource for anyone looking to improve their financial literacy and security.

All Your Worth: The Ultimate Lifetime Money Plan (A Guide to Personal Finances)

Key Takeaways

All Your Worth: The Ultimate Lifetime Money Plan provides readers with essential insights into managing personal finances effectively. Here are the key takeaways from the book:

- Balanced Approach: The authors emphasize the importance of balancing your finances across three essential categories: Must-Haves, Wants, and Savings.

- Must-Haves: Identify and prioritize your necessary expenses to ensure that you cover all essential bills every month.

- Wants: Allocate a portion of your budget for enjoyment and discretionary spending, promoting a healthy relationship with money.

- Savings: Focus on building savings for future goals, including emergencies and long-term investments, to secure financial stability.

- Simplicity Over Complexity: The book offers a straightforward system that eliminates the need for complicated budgets or meticulous tracking of every expense.

- Emotional Peace: By adopting this balanced approach, readers can achieve lifelong emotional peace and financial well-being.

- Research-Backed Strategies: The insights are grounded in over twenty years of research, providing credibility and effectiveness to the proposed methods.

- Empowerment: Readers will gain a new perspective on money management that empowers them to take control of their financial future.

Final Thoughts

All Your Worth: The Ultimate Lifetime Money Plan by Elizabeth Warren and Amelia Warren Tyagi is an invaluable resource for anyone looking to take control of their finances. With a fresh perspective on managing money, the authors provide a simple yet effective strategy that prioritizes balance across essential financial categories. This book is not just about budgeting; it’s about creating a sustainable financial future that aligns with your values and goals.

- Groundbreaking approach to personal finance

- Focuses on three essential parts: Must-Haves, Wants, and Savings

- Based on over twenty years of research

- Aims to provide lifelong emotional peace and financial well-being

Investing in All Your Worth means equipping yourself with the knowledge and tools to transform your financial life. Don’t miss out on the opportunity to learn how to achieve balance and peace of mind in your financial journey. Buy your copy today!