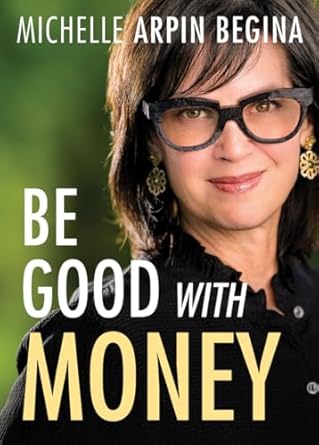

Unlock your financial potential with “Be Good With Money” by Michelle Arpin Begina, a transformative guide that dives deep into the emotional narratives holding you back from financial freedom. Drawing on over 30 years of experience as a financial advisor and her own family’s complex history with money, Michelle reveals the hidden shame and secrecy that often shape our financial behaviors. This book offers a refreshing blend of social psychology and financial therapy, empowering you with six transformative concepts designed to break the cycles of money struggles and self-sabotage.

With a warm and compassionate approach, “Be Good With Money” equips you with practical exercises and insights that inspire you to rethink your relationship with money. Whether you’re just starting out or looking to enhance your financial skills, this book is a must-read. Join the early readers who are raving about its empowering messages and actionable advice, and take the first step toward mastering your financial destiny today!

Be Good With Money

Why This Book Stands Out?

- Expertise Meets Empathy: With over 30 years as a financial advisor, Michelle Arpin Begina combines professional insight with deep understanding of personal struggles around money.

- Transformative Concepts: The book introduces six key ideas that challenge traditional financial wisdom, addressing the root causes of money-related self-sabotage.

- Money Therapy Exercises: Readers engage in practical exercises that foster a healthier relationship with money, moving beyond mere budgeting to emotional healing.

- Compelling Storytelling: Michelle weaves personal narratives and plot twists that reveal the often hidden emotional ties we have with money, making the reading experience relatable and engaging.

- Inspiring Approach: The unique blend of social psychology and financial therapy encourages readers to discuss money openly, breaking down barriers of shame and secrecy.

- Accessible for All: Whether you’re a finance novice or looking to refine your skills, the book is designed to be approachable and actionable for everyone.

- Empowerment Focus: Early readers rave about the empowerment they feel to take charge of their financial futures, thanks to the clear guidance and practical advice provided.

Personal Experience

As I delved into Be Good With Money by Michelle Arpin Begina, I couldn’t help but reflect on my own journey with finances. Like many of us, I’ve navigated the often tumultuous waters of budgeting, saving, and investing, sometimes feeling lost in the overwhelming sea of financial advice and societal expectations. This book felt like a friend sitting down with me to share insights and wisdom, all while gently urging me to confront the stories I’ve told myself about money.

Michelle’s relatable anecdotes about the silent narratives many of us carry struck a chord with me. I realized how often I had avoided talking about money, whether it was out of shame or simply feeling unprepared. The stories she shares reminded me of my own experiences—those moments where I felt embarrassed to admit my financial struggles, and how that silence only deepened my challenges.

- Transformative Concepts: The six transformative concepts presented in the book felt like stepping stones. They not only helped me identify the underlying issues I faced but also provided actionable steps to break free from the cycle of financial self-sabotage.

- Money Therapy Exercises: The in-depth exercises encouraged me to reflect on my past experiences with money. I found myself writing down my financial fears and aspirations, which was both liberating and enlightening.

- Connection to Emotions: I appreciated how Michelle highlighted the emotional aspects of our relationship with money. It made me realize that understanding my feelings towards finances could be just as important as crunching the numbers.

- Community and Conversation: The book emphasizes the importance of discussing money openly, which resonated with me. It inspired me to initiate conversations with friends about our financial journeys, breaking down barriers that I once thought were insurmountable.

Reading Be Good With Money felt like a transformative experience, prompting me to reassess not just my financial habits, but my overall mindset towards money. I could sense the potential for empowerment it offered, and I couldn’t help but think how many others might feel the same way after reading it. Michelle’s compassionate guidance encourages us to embrace our financial reality, not with fear, but with clarity and confidence. It’s a powerful reminder that we all deserve to be good with money, and this book shows us just how to begin that journey.

Who Should Read This Book?

If you’ve ever felt that your relationship with money is complicated or that financial stress keeps you from living your best life, then Be Good With Money is the book for you. This insightful guide is designed for a wide range of readers who are ready to transform their financial mindset and reclaim their financial power. Here’s why you should pick up this book:

- Financial Newbies: If you’re just starting your journey in managing your finances, this book breaks down complex concepts into easy-to-understand advice, making it a perfect companion to help you build a strong financial foundation.

- Those Feeling Stuck: If you find yourself in a cycle of financial booms and busts, Michelle’s six transformative concepts can help you identify and dismantle the barriers that hold you back, leading you towards financial stability.

- Individuals with Financial Anxiety: For anyone who feels shame or fear around money, this book offers compassionate guidance to confront these feelings and turn them into a healthier relationship with your finances.

- Anyone Seeking Clarity and Confidence: If you want to gain control over your financial future, Michelle’s empathetic approach will empower you to make informed decisions and embrace your financial reality with courage.

- Those Interested in Personal Growth: This book isn’t just about numbers; it’s about understanding your emotional connection to money. If you’re on a journey of self-improvement, you’ll find valuable insights that bridge the gap between your financial and personal lives.

Be Good With Money is more than just a financial guide—it’s a comprehensive resource that encourages open conversations about money and helps you make peace with your financial past. Whether you’re looking to level up your money management skills or simply want to feel more empowered, this book is your perfect partner on the path to financial freedom.

Be Good With Money

Key Takeaways

Be Good With Money offers transformative insights that can change your relationship with finances. Here are the most important lessons and benefits you can expect from the book:

- Understanding Financial Self-Sabotage: Discover the hidden narratives of shame and secrecy that affect your financial decisions.

- Six Transformative Concepts: Learn six key ideas that can help dismantle the cycles of financial booms and busts.

- In-Depth Money Therapy Exercises: Engage in practical exercises designed to enhance your money management skills.

- Compassionate Guidance: Benefit from Michelle’s empathetic approach that encourages you to make peace with your financial past.

- Empowerment Through Conversation: Understand how discussing money can lead to significant personal transformation and financial clarity.

- Real-Life Stories: Enjoy relatable anecdotes that illustrate the complex, often secretive relationships we have with money.

- Actionable Advice: Gain practical tips and strategies that are easy to understand and implement, regardless of your financial background.

Final Thoughts

“Be Good With Money” by Michelle Arpin Begina is not just another financial self-help book; it’s a transformative journey into understanding our complex relationship with money. With over 30 years of experience as a financial advisor, Michelle draws from her personal and professional insights to address the silent narratives of shame and secrecy that often hinder our financial growth.

This book offers:

- Six transformative concepts to break free from financial self-sabotage.

- In-depth money therapy exercises to change your mindset about finances.

- A blend of social psychology and financial therapy that resonates deeply with readers.

- Empowering stories that reveal the truth about our often hidden struggles with money.

Readers have praised “Be Good With Money” as a powerful and informative guide that leaves them feeling empowered to take charge of their financial futures. If you’re ready to make peace with your past and embrace your financial reality, this book is a must-read!

Don’t miss out on the opportunity to transform your relationship with money. Purchase your copy of “Be Good With Money” today! Get it here!