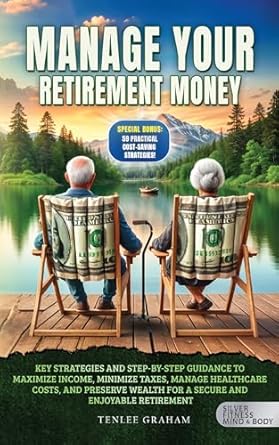

Are you anxious about outliving your savings or confused by complex financial products? Introducing Manage Your Retirement Money, the essential guide that empowers you to secure your retirement income and achieve financial freedom. This comprehensive roadmap provides you with key strategies and step-by-step guidance to maximize your income, minimize taxes, and manage healthcare costs, all while preserving your wealth for a secure and enjoyable retirement.

Inside this invaluable resource, you’ll discover seven proven strategies to generate a steady income, the best income-generating investments tailored to your unique needs, and practical techniques to protect your savings from market volatility. With easy-to-understand content designed for everyone—regardless of financial expertise—you’ll gain the confidence to navigate your retirement planning effectively. Don’t let uncertainty hold you back; take charge of your financial future today!

Manage Your Retirement Money: Key Strategies and Step-by-Step Guidance to Maximize Income, Minimize Taxes, Manage Healthcare Costs, and Preserve Wealth For a Secure and Enjoyable Retirement

Why This Book Stands Out?

- Comprehensive Strategies: Offers 7 proven strategies to generate steady income without depleting savings.

- Tailored Investment Insights: Discusses the best income-generating investments specifically for retirees.

- Clear Guidance on Complex Topics: Simplifies complex subjects like Closed-End Funds (CEFs) and Roth conversions.

- Focus on Risk Management: Provides smart, diversified investment choices to protect savings from market volatility.

- Tax Minimization Techniques: Details essential tax strategies for IRAs and 401(k)s to reduce tax burdens effectively.

- Healthcare Cost Management: Offers practical techniques for managing healthcare costs and exploring insurance options.

- Real-Life Case Studies: Includes real-life examples showcasing successful retirement strategies for relatable learning.

- Psychological Insights: Addresses the emotional aspects of retirement, helping to foster a positive mindset.

- User-Friendly Language: Designed for all readers, avoiding overwhelming jargon for easy comprehension.

- Actionable Steps: Provides simple, actionable steps tailored to individual financial situations.

Personal Experience

As you dive into Manage Your Retirement Money, you may find yourself reflecting on your own journey towards retirement. Perhaps you’ve experienced moments of uncertainty or anxiety about your financial future, and this book resonates with those feelings. Many readers might relate to the following insights and experiences:

- Feeling Overwhelmed: You might recall times when financial jargon felt like a foreign language, leaving you anxious about making the right decisions for your retirement.

- Concerns About Savings: The fear of outliving your savings is common, and this guide addresses that worry with practical strategies that you can easily implement.

- Market Volatility: You may have seen your investments fluctuate wildly, and the book’s insights on protecting your savings and managing risk could provide the reassurance you need.

- Unique Financial Situation: Everyone’s financial journey is different; you might appreciate the book’s tailored advice that acknowledges your unique circumstances rather than offering a one-size-fits-all solution.

- Desire for Clarity: If you’ve been burned by complicated financial guides in the past, you’ll likely find comfort in the straightforward and engaging content that this book promises.

- Need for Practical Tools: The inclusion of real-life case studies and recommended financial planning tools can help you visualize and apply the strategies to your own life.

- Emotional Aspects of Retirement: The exploration of psychological factors related to retirement might resonate deeply with you, offering insights into managing stress and fostering a positive outlook.

This book not only provides actionable advice but also connects with your personal experiences, making the journey toward a secure and enjoyable retirement feel achievable and less daunting. As you navigate these complex topics, you’ll find that you’re not alone on this path.

Who Should Read This Book?

This book is ideal for anyone looking to secure their financial future during retirement. It is particularly suitable for:

- Upcoming retirees: Those nearing retirement age who want to ensure their savings last and provide a comfortable lifestyle.

- New retirees: Individuals who have recently retired and need guidance on managing their finances effectively.

- Financial novices: Readers who find financial products and investment strategies overwhelming and seek straightforward advice.

- Concerned savers: People worried about outliving their savings or facing financial hardships due to market volatility.

- Individuals facing tax complexities: Those looking to minimize their tax burden on retirement accounts and understand tax implications.

- Healthcare planners: Retirees wanting to manage healthcare costs and explore insurance options effectively.

- Anyone seeking financial peace of mind: Individuals who desire actionable steps to secure their financial future without extensive prior knowledge.

With clear, engaging content and practical strategies, this book empowers readers to take control of their retirement finances and enjoy a secure, worry-free retirement.

Manage Your Retirement Money: Key Strategies and Step-by-Step Guidance to Maximize Income, Minimize Taxes, Manage Healthcare Costs, and Preserve Wealth For a Secure and Enjoyable Retirement

Key Takeaways

Readers can expect to gain valuable insights and practical strategies from Manage Your Retirement Money that will empower them to take control of their financial future. Here are the most important lessons and benefits:

- Discover 7 proven strategies to generate a steady income without depleting savings.

- Learn about the best income-generating investments tailored for retirees’ unique needs.

- Understand how Closed-End Funds (CEFs) work and assess their suitability for your portfolio.

- Protect your savings from market volatility with smart, diversified investment choices.

- Implement essential tax strategies for IRAs and 401(k)s to minimize your tax burden.

- Evaluate the benefits and drawbacks of Roth conversions to make informed decisions.

- Follow detailed steps for transitioning from traditional to income-focused investment portfolios.

- Explore practical techniques for managing healthcare costs and insurance options.

- Gain easy-to-understand guidance on balancing risk and return in your retirement portfolio.

- Ensure your financial advisor understands your unique retirement needs.

- Stay informed about up-to-date legal considerations to protect your retirement funds.

- Learn creative ways to hedge against inflation and maintain your purchasing power.

- Review real-life case studies showcasing successful retirement strategies.

- Address the psychological aspects of retirement, managing emotional stress, and fostering a positive outlook.

- Access recommended financial planning tools and software to simplify money management.

Final Thoughts

Manage Your Retirement Money is an invaluable resource for anyone looking to take control of their financial future as they approach retirement. This comprehensive guide demystifies complex financial concepts and presents them in an easy-to-understand manner, making it accessible for readers at any level of financial knowledge. Whether you’re concerned about outliving your savings or navigating the intricacies of tax strategies, this book equips you with the tools you need to maximize your income and minimize your financial worries.

- 7 proven strategies for steady income generation.

- Insights into the best income-generating investments for retirees.

- Guidance on protecting your savings from market volatility.

- Essential tax strategies to minimize your tax burden.

- Practical techniques for managing healthcare costs.

- Real-life case studies showcasing successful retirement strategies.

Don’t let uncertainty cloud your retirement years. With Manage Your Retirement Money, you can navigate the complexities of financial planning with confidence and ease. If you’re ready to eliminate financial stress and secure your retirement with certainty, click here to purchase the book now and take the first step toward a secure and enjoyable retirement!