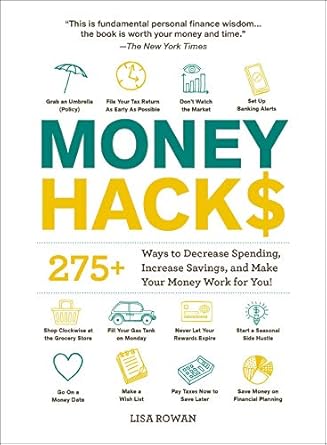

Are you ready to transform your finances and achieve your financial goals? Look no further than Money Hacks: 275+ Ways to Decrease Spending, Increase Savings, and Make Your Money Work for You! This essential guide offers over 300 practical solutions tailored to help you cut costs, boost your savings, and navigate the often-daunting world of personal finance with ease. From tackling student loans to smart investment strategies, this book is your go-to resource for making your money work harder for you.

What sets Money Hacks apart is its friendly and approachable style, making money management feel less intimidating. Whether you’re focused on reducing debt, building an emergency fund, or making informed decisions on significant purchases, this book is packed with invaluable tips and insights that will empower you to take control of your financial future. Say goodbye to financial stress and hello to a more secure, savvy you!

Money Hacks: 275+ Ways to Decrease Spending, Increase Savings, and Make Your Money Work for You! (Life Hacks Series)

Why This Book Stands Out?

- Comprehensive Solutions: With over 275 practical tips, this book covers everything from reducing expenses to boosting savings, catering to a wide range of financial needs.

- Easy-to-Implement Hacks: The straightforward advice makes it easy for readers to apply the tips immediately, ensuring that financial empowerment is just a page away.

- Focus on Real-Life Challenges: Addressing common financial hurdles like student loans and retirement planning, it provides relatable solutions that resonate with everyday readers.

- Encourages Financial Literacy: By breaking down complex topics, it demystifies personal finance and encourages open conversations about money management.

- Life Hacks Series: As part of the popular Life Hacks series, it aligns with a fun, practical approach to everyday challenges, making learning about finances enjoyable.

Personal Experience

When I first stumbled upon “Money Hacks,” I was in a bit of a financial rut. Like many, I had dreams of traveling, owning a home, and enjoying life without the constant stress of money weighing me down. Yet, every month felt like a battle against my bank account, and the thought of saving seemed almost impossible. That’s when I decided to give this book a shot.

The moment I opened its pages, I felt a sense of relief wash over me. The approachable language and practical advice made it easy to digest, even for someone who wasn’t particularly financially savvy. It was as if the author was sitting right there with me, sharing secrets to financial freedom that I had never considered before.

As I read through the various hacks, a few key points really resonated with me:

- Finding Small Savings: The idea that even minor changes could lead to significant savings was eye-opening. I started cutting out unnecessary subscriptions and brewing my own coffee instead of buying it daily, and it felt empowering to see my savings grow each month.

- Debt Management: The chapter on paying off student loans provided a clear, actionable plan that I could follow. I realized I wasn’t alone in my struggles and found motivation from the success stories shared within the book.

- Investment Basics: For the first time, I felt confident about investing. The straightforward explanations demystified the process, making it less intimidating and more approachable.

- Retirement Planning: It’s something I had always pushed to the back of my mind, but the book made me see its importance. It encouraged me to start a retirement fund, and I’m grateful I took that step early on.

What struck me the most was the book’s emphasis on mindset. It wasn’t just about the hacks themselves; it was about fostering a positive relationship with money. I began to see budgeting not as a restriction but as a pathway to my dreams. Each tip felt like a small victory, and I found myself excited to implement them in my daily life.

In sharing my journey with “Money Hacks,” I hope to inspire others who might feel overwhelmed by their finances. This book truly has the potential to change your perspective on money and inspire you to take control of your financial future. I know it did for me!

Who Should Read This Book?

If you’ve ever felt overwhelmed by your finances or unsure about how to manage your money effectively, then Money Hacks: 275+ Ways to Decrease Spending, Increase Savings, and Make Your Money Work for You! is the perfect companion for you. This book is designed for a diverse audience, including:

- Students and Recent Graduates: If you’re navigating student loans and trying to establish a budget for the first time, this book will provide you with practical tips to manage your money wisely.

- Young Professionals: Whether you’re starting your career or looking to save for a big purchase, you’ll find actionable strategies to help you maximize your income and minimize expenses.

- Families: For parents juggling multiple financial responsibilities, this book offers insights into managing household expenses while still saving for the future.

- Anyone Looking to Get Out of Debt: If you’re struggling with credit card debt or loans, the easy-to-follow hacks will empower you to take control of your finances and pay off your obligations faster.

- Investors at Any Level: Whether you’re just starting to think about investing or looking to optimize your current portfolio, the advice in this book will help you make informed decisions.

- Retirement Planners: If you want to start planning for retirement but don’t know where to begin, this book breaks down the essentials in a clear and concise manner.

With its friendly tone and practical approach, Money Hacks demystifies personal finance and equips you with the tools you need to make every penny count. It’s not just about saving money; it’s about building a more secure financial future for yourself and your loved ones. Dive in and discover how easy it can be to take charge of your finances today!

Money Hacks: 275+ Ways to Decrease Spending, Increase Savings, and Make Your Money Work for You! (Life Hacks Series)

Key Takeaways

Money Hacks offers a wealth of practical advice and actionable strategies to help you take control of your finances. Here are some of the most valuable insights you’ll gain from this book:

- Over 275 Money-Saving Strategies: Discover a comprehensive collection of tips that can help you decrease spending and increase savings effortlessly.

- Debt Management Techniques: Learn effective methods to pay off student loans and other debts, allowing you to regain financial freedom.

- Investment Insights: Gain simple yet powerful advice for maximizing your investments and making your money work harder for you.

- Retirement Planning Guidance: Find clear steps to start planning for your future, regardless of your current financial situation.

- Practical Financial Skills: Develop essential money management skills that can lead to improved financial literacy and confidence.

- Real-Life Applications: Explore how to apply these hacks in everyday situations, from major purchases to building an emergency fund.

- Breaking the Money Taboo: Understand the importance of discussing financial matters and learning from others to enhance your money-saving skills.

Final Thoughts

If you’re looking to take control of your finances and achieve your financial goals, Money Hacks: 275+ Ways to Decrease Spending, Increase Savings, and Make Your Money Work for You! is an indispensable resource. This book provides over 300 practical solutions to tackle your most pressing personal finance questions, from paying off student loans to investing wisely for the future.

Here are a few reasons why this book deserves a spot on your bookshelf:

- Learn how to decrease your spending and increase your savings effectively.

- Discover simple tips for maximizing your investments and planning for retirement.

- Gain confidence in discussing money matters and implementing money-saving strategies.

- Find actionable advice tailored to various financial situations, whether you’re in debt or saving for a major purchase.

Don’t let fear or uncertainty hold you back from mastering your finances. With Money Hacks, you’ll gain the knowledge and tools necessary to make every penny count. So why wait? Start your journey toward financial freedom today!

Purchase your copy of Money Hacks now!