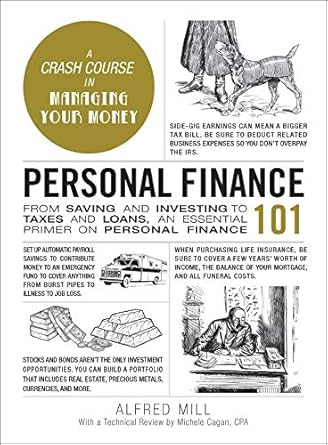

Unlock your financial potential with “Personal Finance 101: From Saving and Investing to Taxes and Loans,” an essential guide designed for anyone looking to master their money management skills. This comprehensive primer simplifies complex financial concepts, offering practical advice on everything from choosing the right bank to building credit responsibly. With clear, accessible information, you’ll learn how to effectively save, invest, and prepare for future financial commitments.

Whether you’re a finance novice or seeking to refresh your knowledge, this book serves as your one-stop resource for personal finance. Discover strategies for building an emergency fund, refinancing student loans, and navigating salary packages, all while gaining the confidence to make informed financial decisions. Equip yourself with the tools you need to grow your wealth, plan for significant purchases, and secure a stable financial future.

Personal Finance 101: From Saving and Investing to Taxes and Loans, an Essential Primer on Personal Finance (Adams 101 Series)

Why This Book Stands Out?

- Comprehensive Coverage: Personal Finance 101 offers an all-encompassing overview of essential financial topics, from saving and investing to understanding taxes and loans.

- Accessible Format: The book is organized in an easy-to-read manner, making complex financial concepts approachable for readers of all levels.

- Practical Advice: Filled with actionable tips, it empowers readers to make informed financial decisions and enhance their personal wealth effectively.

- Key Financial Skills: It teaches crucial skills such as choosing the right bank, building an emergency fund, and managing salary and benefits.

- Focus on Responsibility: Encourages responsible financial behaviors like building credit wisely and planning for future expenses.

- Ideal for Beginners: Perfect for those new to finance or anyone seeking to refresh their understanding of personal finance fundamentals.

Personal Experience

Reading Personal Finance 101 can be a transformative experience for many individuals who find themselves navigating the often confusing waters of finance. Whether you’re just starting out in your career or looking to make more informed decisions about your money, this book serves as a relatable guide that speaks to real-life experiences. Here are some insights that may resonate with readers:

- Feeling Overwhelmed: Many readers may initially feel overwhelmed by financial jargon and complex concepts. This book breaks down those barriers, making finance accessible and manageable.

- Realizing the Importance of Savings: For those who have struggled to save, the section on building an emergency fund provides a wake-up call. Readers may reflect on past financial struggles and see the value in having a safety net.

- Understanding Credit: The book’s focus on building credit responsibly can resonate deeply with anyone who has faced challenges in obtaining loans or credit cards. It offers practical tips that can lead to significant improvements in their credit journey.

- Mapping Out Financial Goals: Readers might find themselves inspired to create a roadmap for their financial future, whether it’s planning for a house, a vacation, or retirement. The actionable advice can spark motivation to take control of their finances.

- Consolidating Student Loans: For many, student loans are a daunting reality. The insights on refinancing and consolidating can bring relief and clarity, helping readers feel empowered to tackle their debt.

By engaging with Personal Finance 101, readers can not only gain knowledge but also find a sense of community in shared financial experiences. This book doesn’t just teach; it resonates, encouraging individuals to reflect on their financial habits and take actionable steps toward a brighter financial future.

Who Should Read This Book?

This book is an essential resource for anyone looking to take control of their financial life. Whether you are starting from scratch or seeking to strengthen your existing knowledge, Personal Finance 101 is designed to meet the needs of a diverse audience:

- Finance Beginners: Individuals who are new to managing finances will find clear explanations of key concepts, making it easy to understand the fundamentals of personal finance.

- Young Professionals: Those entering the workforce can benefit from guidance on salary negotiations, benefit packages, and building credit responsibly.

- Students: College students navigating student loans and budgeting will learn how to manage their finances effectively while planning for the future.

- Parents: Parents looking to teach their children about money management will find valuable insights to share with their families.

- Anyone Seeking Financial Refresh: Individuals who want to brush up on their knowledge of personal finance will appreciate the comprehensive overview of essential topics, from saving to investing.

Overall, Personal Finance 101 offers valuable strategies and practical advice that empower readers to make informed decisions and build a solid financial foundation for their future.

Personal Finance 101: From Saving and Investing to Taxes and Loans, an Essential Primer on Personal Finance (Adams 101 Series)

Key Takeaways

Readers can expect to gain valuable insights into managing their personal finances effectively. Here are the key lessons and benefits from Personal Finance 101:

- Understand the importance of choosing the right bank and how it affects your finances.

- Learn how to build and maintain an emergency fund for financial security.

- Get insights on salary and benefits packages to maximize your earnings.

- Discover effective strategies for tracking your spending and saving more money.

- Explore options for refinancing or consolidating student loans to reduce debt.

- Gain knowledge about different types of health and property insurance.

- Master the art of building credit responsibly to improve your financial standing.

- Understand the mortgage process and how to prepare for purchasing a home.

This guide serves as a comprehensive resource for anyone looking to enhance their financial literacy and make informed decisions about their money.

Final Thoughts

Personal Finance 101 is an invaluable resource for anyone looking to take control of their financial future. This comprehensive guide simplifies complex financial concepts, making them accessible and understandable for readers at any level of expertise. With practical advice and actionable insights, this book empowers you to make informed decisions about saving, investing, and managing debt.

Here are some key reasons why Personal Finance 101 is worth purchasing:

- Easy-to-read format that breaks down essential financial topics.

- Practical tips on building credit, managing loans, and choosing banking options.

- Guidance on saving for emergencies and planning for future purchases.

- Ideal for beginners and anyone looking to refresh their financial knowledge.

Don’t miss out on the opportunity to enhance your financial literacy and secure your financial future. Buy Personal Finance 101 today and start your journey toward financial empowerment!