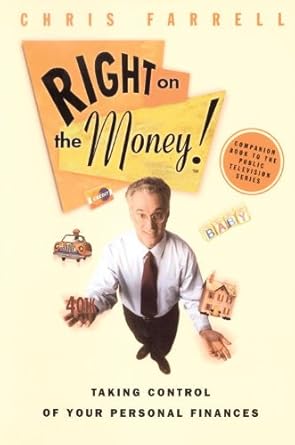

If you’re ready to take charge of your financial future, look no further than “Right on the Money!: Taking Control of Your Personal Finances” by Chris Farrell. This insightful guide offers a practical and hands-on approach to navigating today’s complex financial landscape. Whether you’re setting up a budget, saving for retirement, or tackling debt, Farrell equips you with the essential knowledge and tools you need to make informed decisions. Each chapter features real-life stories of individuals and families at financial crossroads, supported by expert advice that makes personal finance accessible and engaging.

From mastering the stock market to managing credit cards, “Right on the Money!” covers a wide range of crucial topics in a fun and relatable way. With its “roll up your sleeves and solve the problem” attitude, this book is destined to become your go-to resource for achieving financial stability and success. Don’t just manage your money—master it!

Right on the Money!: Taking Control of Your Personal Finances

Why This Book Stands Out?

- Practical Approach: Chris Farrell delivers hands-on strategies that empower readers to take control of their finances with actionable advice.

- Real-Life Examples: Each chapter showcases individuals and families at financial crossroads, making the lessons relatable and applicable.

- Expert Guidance: The book features insights from a team of street-smart experts, providing diverse perspectives on financial challenges.

- Comprehensive Topics: From budgeting and debt management to investing and retirement planning, it covers a wide array of essential personal finance subjects.

- Engaging Style: With a fun and informative tone, Farrell makes learning about money management enjoyable rather than daunting.

- Informed Decision-Making: Readers are equipped with the knowledge to navigate complex financial options confidently.

Personal Experience

As I delved into Right on the Money!: Taking Control of Your Personal Finances, I couldn’t help but reflect on my own financial journey. Like many, I’ve faced moments where the weight of financial decisions felt overwhelming, and I yearned for a guiding hand. Chris Farrell’s approach in this book resonated deeply with me, making me realize that I’m not alone in navigating the twists and turns of personal finance.

Each chapter, with its relatable stories and practical advice, brought to mind my own experiences:

- Budgeting struggles: I remember the anxiety of trying to create a budget that worked for my lifestyle. Farrell’s tips on setting up a household budget felt like a comforting nudge, reminding me that it’s okay to start small and adjust as needed.

- Debt challenges: The discussions on credit cards and getting out of debt hit close to home. I found myself reflecting on times when I felt trapped by my spending habits. The actionable strategies provided were like a lifeline, offering hope and a clear path forward.

- Investments and savings: Saving for retirement always seemed like a distant goal. Farrell’s insights made it feel more attainable, encouraging me to view it as an ongoing journey rather than a daunting destination.

- Life’s crossroads: The real-life stories of individuals and families facing financial decisions mirrored my own crossroads. Whether it was buying a home or paying for college, I felt a sense of camaraderie with these narratives, knowing that many of us share similar challenges.

Reading this book was not just about gaining knowledge; it was a reminder that personal finance is a shared experience. The engaging, hands-on approach makes the daunting world of money management feel approachable and even enjoyable. I found myself nodding along, inspired to take control of my own financial future with newfound confidence.

Who Should Read This Book?

If you’ve ever felt overwhelmed by your finances or unsure where to start when it comes to managing your money, then Right on the Money! is the book for you. This practical guide is perfect for a wide range of readers, including:

- Young Adults: If you’re just starting out in your financial journey—whether you’re a recent grad entering the workforce or someone navigating life changes—this book will equip you with the essential tools to build a solid financial foundation.

- Families: Balancing a household budget can be daunting, especially when kids and various expenses come into play. This book provides relatable scenarios and actionable advice to help families manage their finances more effectively.

- Individuals Facing Financial Challenges: Whether you’re struggling with debt, trying to save for a big purchase, or planning for retirement, the real-life stories and expert insights in this book will guide you through your financial crossroads.

- Anyone Looking to Improve Financial Literacy: If you want to feel more confident in making financial decisions—like investing, buying a home, or understanding credit cards—this book breaks down complex topics into easy-to-understand language.

What makes Right on the Money! truly unique is its hands-on, relatable approach. Chris Farrell doesn’t just throw out theories; he walks you through real-life situations, providing practical solutions that you can apply to your own life. It’s like having a personal finance coach right at your fingertips!

Right on the Money!: Taking Control of Your Personal Finances

Key Takeaways

In “Right on the Money!: Taking Control of Your Personal Finances,” Chris Farrell delivers essential insights and practical advice for anyone looking to improve their financial situation. Here are the key points that make this book a valuable read:

- Practical Guidance: The book offers a hands-on approach to personal finance, providing actionable steps readers can implement immediately.

- Real-Life Scenarios: Each chapter features individuals or families facing financial challenges, illustrating how to navigate common crossroads effectively.

- Comprehensive Topics: Topics covered include budgeting, debt management, investments, credit cards, buying a home or car, and saving for retirement.

- Expert Insights: Chris Farrell collaborates with a team of financial experts, ensuring readers benefit from diverse perspectives and strategies.

- Empowerment through Knowledge: The book emphasizes making informed decisions, helping readers understand their options and the implications of their choices.

- Engaging and Fun: With an approachable tone, the book keeps readers engaged while tackling serious financial matters.

- Long-Term Financial Health: Readers will learn not just to solve immediate problems but also to build a foundation for future financial stability.

Final Thoughts

If you’re looking to take control of your personal finances, Right on the Money!: Taking Control of Your Personal Finances by Chris Farrell is an invaluable resource. This book stands out for its practical, hands-on approach that guides readers through the often-overwhelming world of money management with clarity and confidence.

Farrell’s engaging storytelling and expert advice tackle essential financial topics, making it accessible for anyone—from those just starting their financial journey to those seeking to refine their strategies. Each chapter presents relatable scenarios, helping readers understand how to navigate their own financial crossroads effectively. Here are some key takeaways:

- Learn to set up a realistic budget that works for your lifestyle.

- Gain insights on saving for retirement and investing wisely.

- Understand how to balance love and money in relationships.

- Discover practical tips for managing debt and improving credit scores.

- Get guidance on significant purchases like cars and homes.

- Find strategies for paying for college without breaking the bank.

With its informative yet enjoyable approach, Right on the Money! is destined to be a classic in personal finance literature. It empowers you to make informed decisions and equips you with the tools necessary to achieve financial stability and success.

Don’t miss out on the opportunity to enhance your financial literacy and secure your future. Purchase your copy of Right on the Money! today and start your journey towards financial empowerment!