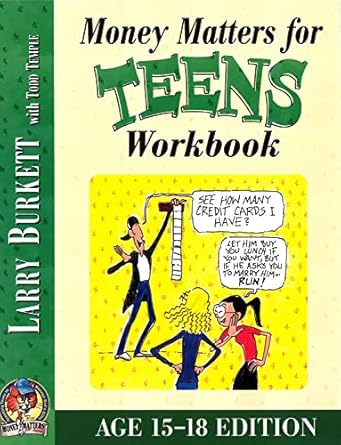

Introducing the *Money Matters Workbook for Teens*, the essential guide for young adults aged 15-18 to master the art of financial management. Designed by financial experts Larry Burkett and Todd Temple, this interactive workbook equips teenagers with crucial skills to take control of their money. With the average American teen spending $3,000 a year, understanding how to budget, save, and invest is more important than ever.

Through engaging activities and practical advice, teens will learn to avoid common financial pitfalls, make informed purchasing decisions, and even save for future goals like college or a first car. Empower your teen to build a solid financial foundation and make a positive impact with their money. The *Money Matters Workbook for Teens* is not just a book—it’s a stepping stone to a financially savvy future!

Money Matters Workbook for Teens (ages 15-18)

Why This Book Stands Out?

- Targeted Audience: Specifically designed for teenagers aged 15-18, addressing their unique financial challenges and perspectives.

- Practical Insights: Offers real-world examples of teenage spending habits, emphasizing the importance of financial awareness and management.

- Empowerment through Knowledge: Teaches essential skills to help teens make informed decisions, avoid common pitfalls, and take control of their finances.

- Future-Oriented: Prepares teens for significant financial milestones, such as saving for college, a car, or even starting a business.

- Impactful Giving: Encourages a mindset of generosity, teaching teens how to allocate funds meaningfully to make a difference in the world.

- Engaging Format: The workbook style promotes active participation, making learning about money management interactive and enjoyable.

Personal Experience

As a teenager, managing money can often feel overwhelming. You might find yourself wondering why you should even care about budgeting or saving when your income is limited. However, diving into the Money Matters Workbook for Teens can transform your perspective on personal finance. Here are some relatable insights and experiences that might resonate with you:

- Understanding Spending Habits: You may have never tracked where your money goes each month. This workbook encourages you to reflect on your spending habits, helping you realize just how much those daily snacks and online purchases add up.

- Avoiding Common Pitfalls: Have you ever felt pressured to buy something just because it was on sale? This book will teach you how to identify misleading ads and avoid being swayed by salespeople, empowering you to make informed decisions.

- Setting Financial Goals: Whether it’s saving for a car, college, or even a new video game console, this workbook guides you through setting achievable financial goals, making the process feel less daunting and more exciting.

- Learning the Value of Saving: You might think saving is for adults, but this workbook shows you how even small amounts can grow over time. Imagine the satisfaction of watching your savings grow and knowing you’re working toward something meaningful.

- Giving Back: It’s inspiring to learn how your money can make a difference. The workbook encourages you to think about charitable giving, helping you realize that even as a teen, you have the power to contribute positively to your community.

- Having Fun with Friends: Managing your money wisely doesn’t mean sacrificing fun. This resource helps you plan out how to enjoy outings with friends while staying within your budget, ensuring you can have a good time without financial stress.

By engaging with the Money Matters Workbook for Teens, you’ll not only gain valuable financial skills but also build confidence in your ability to manage money wisely. It’s more than just a workbook; it’s a tool that can lead to a brighter financial future.

Who Should Read This Book?

This workbook is designed for teenagers aged 15-18 who are eager to take control of their finances and build a solid foundation for their financial future. It is particularly beneficial for:

- High School Students: Those looking to understand the basics of money management while balancing school and extracurricular activities.

- Future College Students: Teens preparing for college expenses and wanting to budget for tuition, books, and living costs.

- Young Entrepreneurs: Aspiring business owners wanting to learn how to save, invest, and manage their money effectively.

- Socially Conscious Teens: Those interested in making a difference by learning how to give back and manage charitable contributions.

- Parents and Educators: Adults who want to guide teens in developing financial literacy skills that will last a lifetime.

By engaging with this workbook, readers will gain practical skills and knowledge to navigate their financial decisions, avoid common pitfalls, and make informed choices that will benefit them now and in the future.

Money Matters Workbook for Teens (ages 15-18)

Key Takeaways

The “Money Matters Workbook for Teens” provides essential insights and practical skills for managing money effectively. Here are the key takeaways:

- Understand the true cost of teenage spending, averaging $3,000 per year.

- Learn to track and analyze your spending habits to make informed financial decisions.

- Gain skills to pay fair prices for quality items and avoid scams.

- Master strategies to stay out of debt and manage financial obligations responsibly.

- Develop savings plans for significant future expenses, such as a car or college.

- Discover the impact of giving back to the community and financial stewardship.

- Enjoy a balanced approach to spending that allows for fun with friends while managing finances wisely.

Final Thoughts

The “Money Matters Workbook for Teens” is an invaluable resource for young individuals aged 15-18 who want to take charge of their financial future. This engaging workbook, authored by Larry Burkett and Todd Temple, equips teens with essential money management skills that are often overlooked in traditional education. By understanding how to budget, save, and spend wisely, teenagers can avoid common financial pitfalls and make informed decisions that will benefit them throughout their lives.

- Learn to manage your money effectively.

- Avoid being misled by ads and sales tactics.

- Prepare for significant expenses like college or a car.

- Empower yourself to help others through charitable giving.

- Enjoy leisure activities without financial stress.

Don’t let your teenage years be a time of financial uncertainty. Start building a solid foundation for your future today! Invest in your financial education by purchasing the Money Matters Workbook for Teens and take the first step towards financial independence!