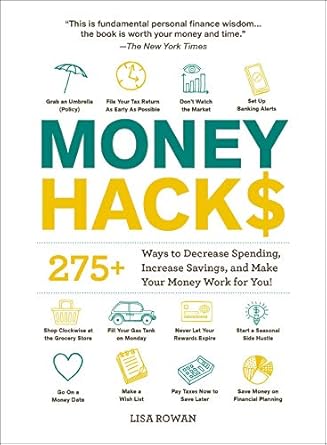

Unlock your financial potential with “Money Hacks: 275+ Ways to Decrease Spending, Increase Savings, and Make Your Money Work for You!” This essential guide offers over 300 practical solutions to tackle your personal finance challenges, from crushing student loan debt to savvy investment strategies. Whether you’re just starting your financial journey or looking to refine your approach, this book is designed to empower you with the knowledge and tools needed to achieve your financial goals.

Say goodbye to confusing jargon and overwhelming financial concepts! “Money Hacks” simplifies money management with easy-to-follow advice that helps you decrease spending and maximize savings. Learn how to build an emergency fund, make informed purchases, and plan for a secure retirement—all while making every penny count. With this comprehensive resource at your fingertips, you can transform your financial habits and create a brighter, more stable future.

Money Hacks: 275+ Ways to Decrease Spending, Increase Savings, and Make Your Money Work for You! (Life Hacks Series)

Why This Book Stands Out?

- Comprehensive Solutions: Offers over 275 practical strategies to tackle a wide range of personal finance challenges, from debt management to investment optimization.

- User-Friendly Approach: Designed for everyone, regardless of financial expertise, making complex financial concepts accessible and actionable.

- Focus on Financial Empowerment: Encourages readers to take charge of their finances by providing the tools to make informed decisions and maximize savings.

- Variety of Topics Covered: Addresses essential financial questions, including budgeting, saving for retirement, and managing student loans, ensuring a holistic approach to personal finance.

- Stress-Free Money Management: Simplifies the process of achieving financial goals, helping readers feel more confident and less overwhelmed by their financial situations.

- Engaging and Practical Hacks: Features easy-to-implement hacks that can be integrated into daily life, enabling readers to see immediate results in their financial well-being.

Personal Experience

Reading Money Hacks can be a transformative journey for anyone looking to take control of their financial life. As you delve into its pages, you might find yourself reflecting on your own relationship with money and how it has shaped your decisions over the years. Each hack presented in the book could resonate with a different aspect of your financial situation, making it both relatable and practical.

Many readers may recall moments when financial stress felt overwhelming—perhaps after receiving a student loan bill or realizing how much they spend on daily coffee runs. This book addresses those exact concerns with straightforward solutions that feel achievable and empowering.

- Realizing Spending Patterns: You may find yourself identifying habits that drain your finances, such as impulsive purchases or frequent dining out. The book encourages you to take a step back and analyze these patterns, fostering a sense of accountability.

- Finding Simple Savings Tips: As you explore various hacks, you can relate to the excitement of discovering easy ways to cut costs—like meal prepping to reduce food expenses or using cashback apps for online shopping.

- Setting Financial Goals: You might have experienced the frustration of not knowing where to start with saving for retirement or paying off debt. The book provides clear steps that transform these daunting tasks into manageable goals, allowing you to envision a more secure financial future.

- Gaining Confidence: The encouragement offered throughout the book can boost your confidence in making financial decisions. Readers often share a renewed sense of empowerment after applying the hacks, feeling more in control of their finances.

- Sharing Insights: Engaging with friends or family about the money-saving strategies you learn can foster meaningful conversations. You may find yourself sharing these insights, starting discussions that help others in their financial journeys.

Ultimately, Money Hacks serves as a relatable guide that speaks to the everyday challenges and victories in managing personal finances. With each page, you are not just learning; you are also connecting your experiences to the broader landscape of financial wellness.

Who Should Read This Book?

This book is ideal for anyone looking to take control of their finances and make informed decisions about their money. It offers valuable insights and practical hacks for a wide range of readers, including:

- Students: Those looking to manage student loans and budget effectively.

- Young Professionals: Individuals starting their careers who want to build savings and plan for the future.

- Families: Parents seeking ways to reduce expenses and save for their children’s education.

- Retirees: Those planning for retirement who need guidance on investments and savings strategies.

- Anyone in Debt: Individuals looking for actionable steps to pay down debt and improve their financial situation.

This book provides practical solutions that are easy to implement, making it suitable for readers at any financial stage. With over 300 hacks, it empowers readers to make every penny count and achieve their financial goals.

Money Hacks: 275+ Ways to Decrease Spending, Increase Savings, and Make Your Money Work for You! (Life Hacks Series)

Key Takeaways

Readers of Money Hacks: 275+ Ways to Decrease Spending, Increase Savings, and Make Your Money Work for You! can expect to gain valuable insights and practical strategies for improving their financial situation. Here are the key takeaways:

- Learn over 300 actionable solutions to common personal finance challenges.

- Discover effective methods to decrease spending and increase savings.

- Gain confidence in discussing money and financial planning.

- Find simple advice for managing investments and making informed financial decisions.

- Understand the basics of personal finance to make every penny count.

- Receive guidance on paying off debt and starting an emergency fund.

- Explore tips for making smart choices on major purchases.

- Start planning for retirement with easy-to-follow strategies.

Final Thoughts

Money Hacks: 275+ Ways to Decrease Spending, Increase Savings, and Make Your Money Work for You! is an invaluable resource for anyone looking to take control of their personal finances. With over 300 practical solutions, this book demystifies the often daunting world of money management. Whether you’re aiming to reduce debt, boost your savings, or make informed investment decisions, the straightforward advice provided will empower you to achieve your financial goals.

- Comprehensive guide covering a wide range of financial topics.

- Easy-to-implement hacks that fit into any lifestyle.

- Encourages a proactive approach to personal finance.

- Suitable for readers of all financial backgrounds.

Investing in Money Hacks is a step towards financial literacy and empowerment. Don’t miss out on the chance to transform your financial future—get your copy today and start making your money work for you!