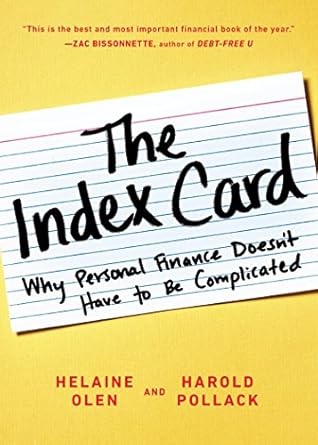

Are you tired of feeling overwhelmed by your finances? Look no further than “The Index Card: Why Personal Finance Doesn’t Have to Be Complicated.” This insightful guide distills essential personal finance wisdom onto a simple index card, proving that managing your money doesn’t have to be a daunting task. Authored by University of Chicago professor Harold Pollack and renowned financial journalist Helaine Olen, this book offers ten straightforward rules that can help you take control of your financial future with confidence.

With endorsements from financial experts like Burton Malkiel, you can trust that this easy-to-follow action plan is designed for everyone—from novice investors to those looking to simplify their financial strategies. Say goodbye to complex jargon and hello to a clear, concise roadmap for your financial success!

The Index Card: Why Personal Finance Doesn’t Have to Be Complicated

Why This Book Stands Out?

- Simplicity at its Best: The Index Card distills personal finance into ten straightforward rules, proving that managing your money doesn’t have to be complicated.

- Expert Endorsements: With praise from financial experts like Burton Malkiel, you can trust that this guide is grounded in credible insights and proven strategies.

- Actionable Advice: The book provides a clear action plan that empowers you to take control of your finances, whether you’re a beginner or looking to refine your approach.

- Viral Inspiration: Originating from a viral post, the concept of summarizing finance on an index card resonates with readers seeking clarity in a cluttered financial world.

- Timeless Wisdom: The principles outlined are designed to work in both prosperous and challenging times, ensuring their relevance regardless of market conditions.

Personal Experience

Reading “The Index Card: Why Personal Finance Doesn’t Have to Be Complicated” felt like a breath of fresh air. As someone who has often felt overwhelmed by the sheer volume of financial advice out there, I found myself nodding along as I turned each page. The idea that everything I needed to know about managing my finances could fit on a simple index card was both liberating and inspiring.

I remember the countless hours spent researching investment strategies and financial plans, only to feel more confused than before. The jargon, the endless charts, the constant updates—it all seemed designed to intimidate rather than educate. But then I stumbled upon this little gem, and it changed everything for me. Suddenly, the daunting task of managing my finances was distilled into ten straightforward rules that I could actually understand and apply.

What really struck me was how relatable the authors made the journey to financial literacy. Here are a few key reflections that resonated deeply with me:

- Simplicity is Key: The book emphasizes that managing your money doesn’t have to be complicated. This was a revelation for me. It reminded me that I could take control of my finances without needing a degree in economics.

- Empowerment Through Knowledge: As I absorbed the lessons from the index card, I felt a newfound sense of empowerment. It was as if I had been handed a toolkit to tackle my financial concerns head-on.

- Real-Life Applications: The practical advice shared throughout the book made it easy to see how I could implement these strategies in my everyday life. It felt less like theory and more like a personal roadmap.

- Connection with Others: I found comfort in knowing that many others share the same struggles with personal finance. The authors’ candid approach made me feel less alone in my quest for financial stability.

Each chapter felt like a conversation with a wise friend who genuinely wanted to help me succeed. As I closed the book, I realized that “The Index Card” was not just a guide; it was a source of motivation that encouraged me to take charge of my financial future. I couldn’t help but wonder how many others would benefit from this straightforward, honest approach to personal finance.

Who Should Read This Book?

If you’ve ever felt overwhelmed by the complexities of personal finance or found yourself drowning in a sea of financial jargon, then The Index Card: Why Personal Finance Doesn’t Have to Be Complicated is just for you! This book is perfect for anyone looking to take control of their financial future without getting lost in complicated strategies or expensive advice.

Here’s why this book is a must-read for specific audiences:

- Newbie Investors: If you’re just starting out on your investment journey and feel intimidated by the financial world, this book breaks everything down into simple, actionable steps. It provides a solid foundation that will boost your confidence as you navigate the market.

- Busy Professionals: For those with packed schedules who don’t have time to sift through lengthy financial guides, this concise read offers quick insights and rules that can easily fit on an index card. You can apply the principles immediately, saving you time and effort.

- Budgeting Beginners: If managing a budget feels like a chore, this book simplifies the process. The ten essential rules make budgeting less daunting and more manageable, giving you a clear path to financial stability.

- Individuals Seeking Financial Independence: Whether you’re aiming for early retirement or simply want to secure your financial future, the strategies outlined in this book empower you to make informed decisions that can lead to lasting financial health.

- Anyone Feeling Overwhelmed: If financial advice from TV analysts and money managers leaves you confused, this book cuts through the noise. It offers straightforward, practical advice that demystifies personal finance, making it accessible and engaging.

In short, The Index Card is perfect for anyone looking to simplify their financial life. It equips you with the tools and knowledge to take charge of your finances confidently, proving that managing money doesn’t have to be complicated at all!

The Index Card: Why Personal Finance Doesn’t Have to Be Complicated

Key Takeaways

“The Index Card: Why Personal Finance Doesn’t Have to Be Complicated” offers valuable insights that simplify managing your finances. Here are the key points that make this book a must-read:

- Simplicity is Key: The book emphasizes that personal finance can be straightforward and doesn’t have to be overwhelming.

- Ten Essential Rules: It distills financial wisdom into ten simple rules that anyone can follow, making it easier to take control of your money.

- Proven Strategies: The index card strategies are shown to outperform complex financial plans, offering a more effective approach to wealth management.

- Actionable Advice: Readers will find an easy-to-follow action plan that can be implemented during both prosperous and challenging financial times.

- Empowerment: The book aims to boost your confidence in managing finances, giving you the tools and knowledge to make informed decisions.

- Expert Insights: Collaborating with financial journalist Helaine Olen, Harold Pollack provides credible insights backed by research and experience.

Final Thoughts

If you’ve ever felt overwhelmed by personal finance advice, “The Index Card: Why Personal Finance Doesn’t Have to Be Complicated” is the refreshing breath of clarity you need. Authors Harold Pollack and Helaine Olen distill complex financial concepts into ten simple rules that can fit on a 4″ x 6″ card, proving that managing your money doesn’t have to be a daunting task.

This book is not just for seasoned investors; it is also an invaluable resource for beginners who want to take charge of their financial future without getting lost in a sea of jargon and intricate strategies. Pollack and Olen offer a straightforward action plan that equips you with the tools, knowledge, and confidence necessary to navigate both good times and bad.

- Simple, actionable rules that outperform complex strategies.

- A focus on practical advice that fits into everyday life.

- Empowering readers to seize control of their financial destiny.

Whether you’re just starting out or looking to refine your financial approach, this book is a worthwhile addition to any reader’s collection. Don’t let the complexities of finance hold you back; embrace simplicity and clarity with “The Index Card.”

Ready to take the first step towards mastering your personal finances? Purchase the book here and discover how easy it can be to manage your money!